A Short-Term Volatility Hedge Amid Uncertainty

Going long volatility can serve as an effective short-term hedge during periods of market uncertainty. While potentially costly, this strategy offers protection against sudden market downturns.

As reported by Reuters, global markets have been plunged into turmoil following President Trump's sweeping tariff announcements, with volatility spiking and investors scrambling for hedging strategies amid growing economic uncertainty.

We had previously covered potential heightened uncertainty due to Trump tariffs and going 'long vol' as portfolio hedge.

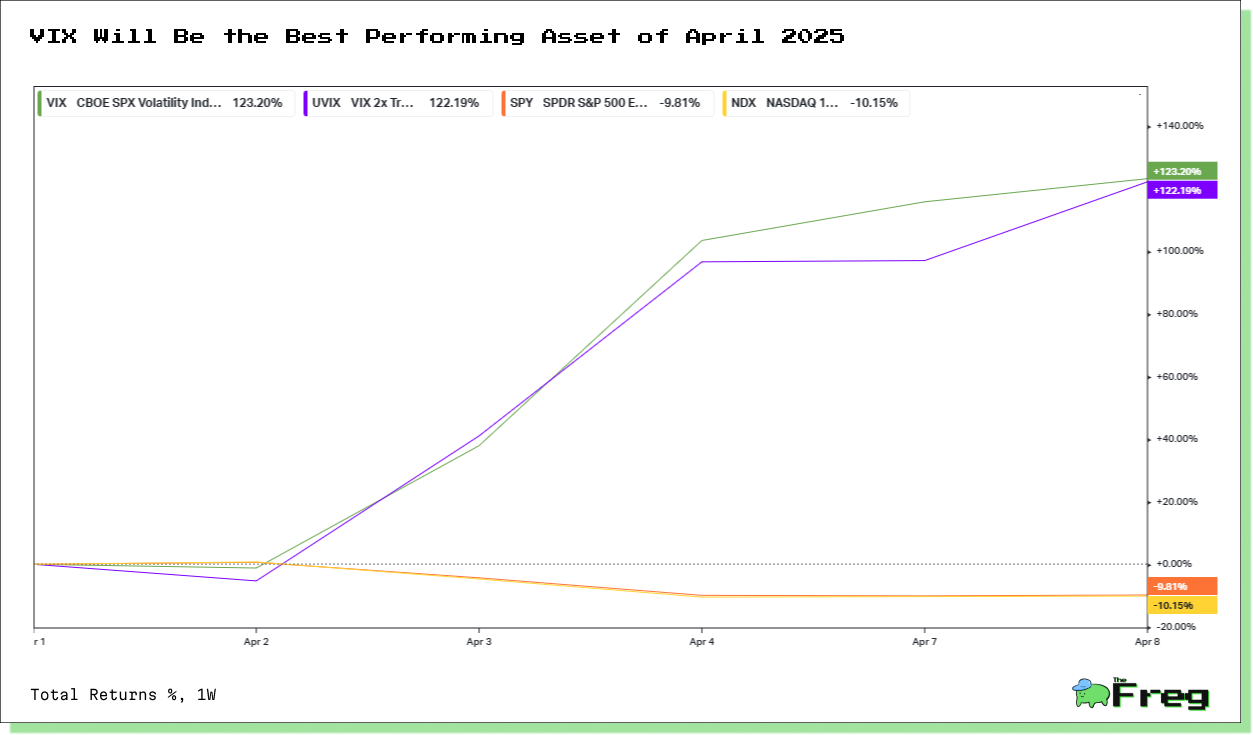

Impact of Trump's Tariffs on VIX

The Volatility Index (VIX), often referred to as Wall Street's fear gauge, experienced a dramatic surge following President Trump's announcement of sweeping tariffs. The VIX skyrocketed by 118% between April 4 and April 7, 2025, marking its largest three-day spike of the year. This sharp increase reflects heightened investor anxiety and market uncertainty triggered by the new trade policies.

- The VIX surge coincided with significant market turbulence, as the S&P 500 plummeted nearly 11% over two trading days, its worst performance since March 2020.

- Despite the alarming spike, historical data suggests that extreme VIX levels often precede positive long-term stock market performance, with an average 10.2% return for the S&P 500 over the following five years.

Leveraged Volatility ETFs for Hedging

Leveraged volatility ETFs offer investors a powerful tool for hedging against market uncertainty and potentially amplifying returns during periods of heightened volatility. These instruments typically provide 1.5x to 2x exposure to VIX futures contracts, allowing traders to capitalize on short-term spikes in market fear. However, they come with significant risks and are

not suitable for long-term holding due to daily rebalancing and potential value erosion.

- Popular leveraged volatility ETFs include ProShares Ultra VIX Short-Term Futures ETF (UVXY) and Volatility Shares 2x Long VIX Futures ETF (UVIX).

- These products can serve as tactical hedges, with some investors allocating 2-5% of their portfolio to volatility ETFs as protection against tail risks.

- It's crucial to monitor VIX futures curves and rebalance positions after major volatility spikes to manage risk effectively.

Volatility Spikes in Crises

Volatility spikes during previous financial crises provide valuable insights into market behavior and investor sentiment. Two notable examples illustrate this phenomenon:

- Global Financial Crisis (2008): The VIX reached an unprecedented peak of 80.86 during the 2008 financial crisis, reflecting extreme market fear and uncertainty. This period saw a five-fold increase in idiosyncratic risk across all industries, demonstrating how economic downturns can amplify individual stock volatility.

- COVID-19 Pandemic (2020): The onset of the pandemic triggered another significant VIX spike, with the index soaring to 82.69 on March 16, 2020. This surge coincided with a rapid 27% decline in the S&P 500 over just five weeks, highlighting the intense market reaction to the global health crisis.

These historical crises underscore how volatility can serve as a crucial indicator of market stress, often spiking dramatically during periods of economic uncertainty and financial instability. Going 'long vol' using volatility ETFs for short-term can act as extremely effective hedge to a portfolio at times of uncertainty.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.