AI Bubble: CoreWeave's Lifeline

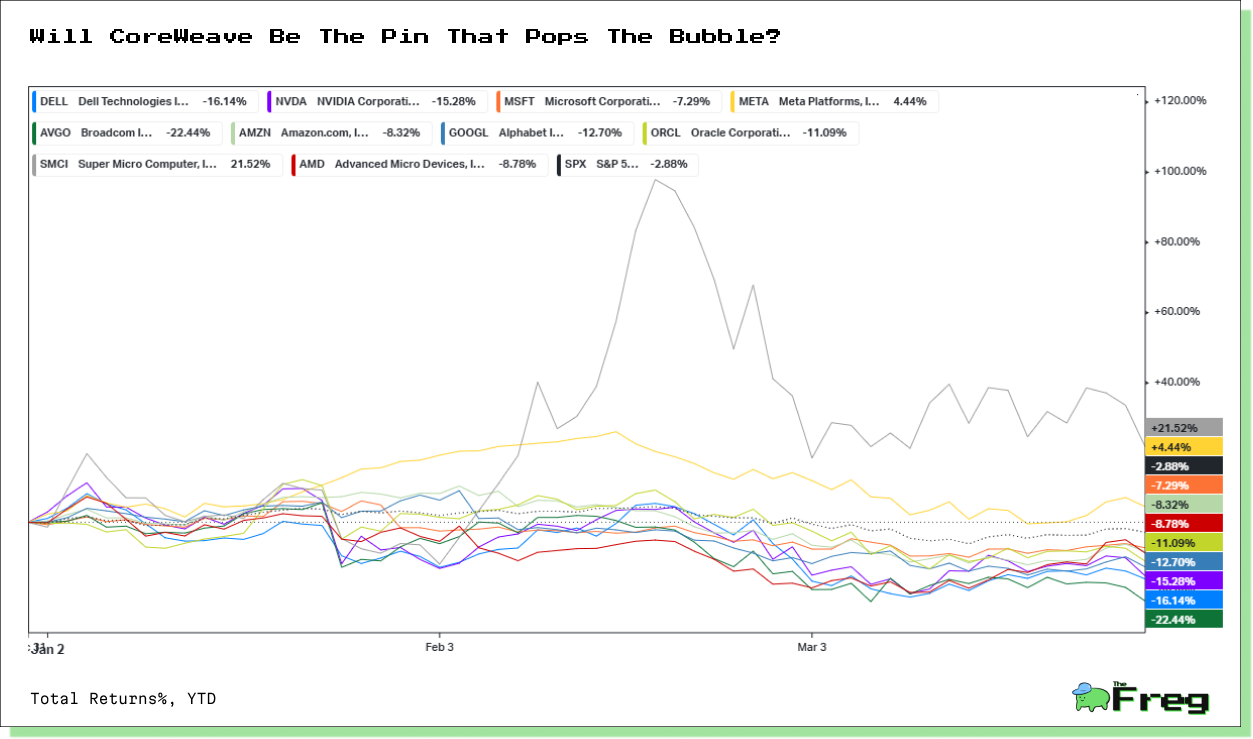

CoreWeave's IPO struggles highlight broader concerns about the AI industry's rapid expansion.

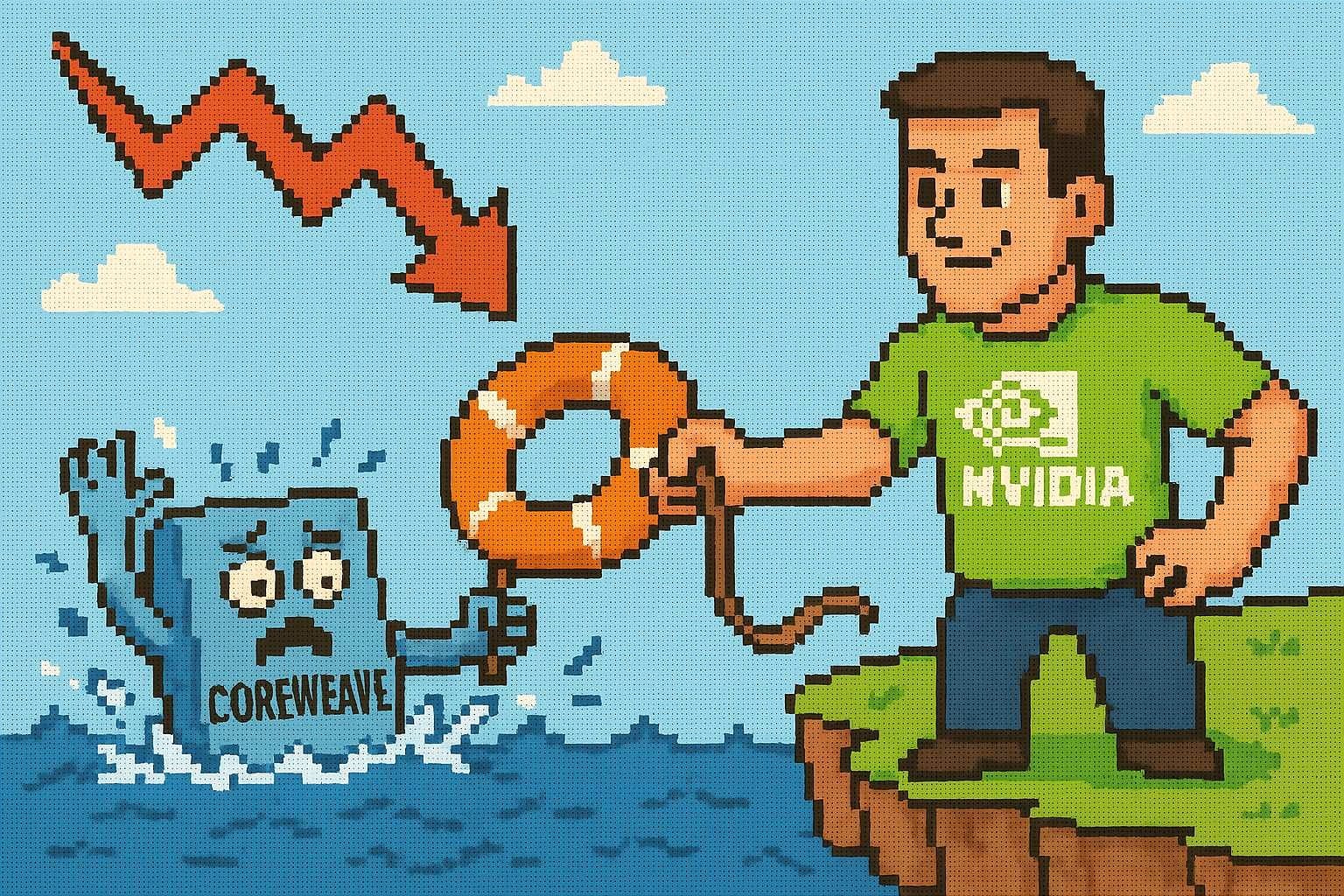

As CoreWeave's much-anticipated IPO faces a drastic valuation cut, NVIDIA steps in to save the day, raising questions about the stability of the AI boom. This turn of events, coupled with recent warnings from industry leaders about potential overinvestment in AI infrastructure, has many wondering: Are we witnessing the first cracks in the AI bubble?

CoreWeave's Financial Struggles Unveiled

CoreWeave's financial struggles have come to light as the company prepares for its IPO. The AI infrastructure firm, which made $1.9 billion in revenue last year, is heavily reliant on a few major customers, with 77% of its revenue coming from just two clients, believed to be Microsoft and NVIDIA. This dependency raises concerns about the company's long-term stability and growth prospects.

Despite its impressive revenue, CoreWeave is grappling with significant debt and cash flow issues. The company has raised $14.5 billion in equity and debt financing, with much of its loans collateralized by its GPU assets. CoreWeave's capital expenditures reached a staggering $8.5 billion in 2024, and it faces nearly $7.5 billion in debt payments by the end of the year. These financial challenges, coupled with reported "material weaknesses" in internal controls, cast doubt on CoreWeave's ability to sustain its operations and meet investor expectations in the competitive AI infrastructure market.

NVIDIA's Role in CoreWeave's Survival

NVIDIA's involvement in CoreWeave's IPO goes beyond mere investment, highlighting the complex relationship between the two companies. As CoreWeave's primary supplier of GPUs, NVIDIA has committed to a $250 million purchase order, effectively anchoring the IPO at $40 per share. This move not only provides crucial financial support but also demonstrates NVIDIA's vested interest in CoreWeave's success.

The partnership between NVIDIA and CoreWeave is symbiotic, with CoreWeave serving as a showcase for NVIDIA's GPU capabilities in real-world AI applications. However, this relationship also exposes CoreWeave to potential risks, as the rapid evolution of AI hardware could render its current GPU inventory obsolete more quickly than anticipated. As NVIDIA continues to innovate with newer, more powerful chips like the Blackwell generation, CoreWeave faces the challenge of maintaining its competitive edge while managing the depreciation of its existing infrastructure.

AI Data Center Overbuild Concerns

As we had covered here previously and now Alibaba Group chairman Joe Tsai has raised concerns about a potential bubble forming in AI data center construction, warning that the current pace of buildout may outstrip initial demand for AI services. This sentiment echoes broader industry worries about overinvestment in AI infrastructure:

- Massive investments: Hyperscalers are planning unprecedented capex investments in AI data center infrastructure for 2025, with Microsoft pledging $80 billion, Amazon $100 billion, and Google $75 billion.

- Speculative building: Tsai expressed worry about data centers being built "on spec" without secured uptake agreements, potentially leading to overcapacity.

- Energy and resource challenges: The rapid expansion of AI data centers is straining existing electrical grids and competing with other urban development needs, prompting regulatory interventions in some areas.

- Depreciation risks: The short lifecycle of specialized AI hardware like GPUs could lead to faster-than-expected depreciation, potentially leaving operators with stranded or underutilized assets.

Despite these concerns, major tech companies continue to invest heavily in AI infrastructure, driven by the fear of being left behind in the AI race. This tension between potential overinvestment and the perceived necessity to stay competitive highlights the complex dynamics shaping the future of AI and data center development.

AI Market Litmus Test

The market's response to CoreWeave's public debut will likely influence investor sentiment towards other AI infrastructure providers and may signal a shift in how the market values companies in this sector. With major tech giants like Microsoft, Amazon, and Google investing heavily in AI capabilities, smaller players like CoreWeave face intense competition for both customers and resources, particularly Nvidia's coveted GPUs. As the AI infrastructure market is projected to grow from $46.15 billion in 2024 to $356.14 billion by 2032, CoreWeave's performance post-IPO could provide valuable insights into whether investors believe the sector can sustain its rapid growth trajectory or if concerns about an AI bubble are beginning to materialize.