AI Disruption Imminent Says Abu Dhabi's Sovereign Wealth Fund

Mubadala is navigating the transformative potential of artificial intelligence with a blend of optimism and caution.

Khaldoon Al Mubarak, CEO of Abu Dhabi's $330 billion sovereign wealth fund Mubadala, has highlighted the transformative potential of artificial intelligence, emphasizing its rapid advancements and profound implications for personal lives, business operations, and workforce dynamics. Mubadala is actively shaping the global AI landscape through strategic investments, partnerships with entities like OpenAI and G42, and the integration of AI into its operations, reflecting its commitment to innovation and the evolving role of AI in reshaping industries and workforce dynamics.

Mubadala's Role in AI Investments

Mubadala, Abu Dhabi's sovereign wealth fund, is positioning itself as a key player in the global AI landscape through strategic investments and partnerships. The fund participated in OpenAI's recent funding round, which raised $6 billion, and is a founding investor in MGX, Abu Dhabi's AI-focused investment vehicle. Mubadala's collaboration with G42, its dedicated AI enterprise, aims to advance AI technology in the UAE and surrounding regions.

The fund's commitment to AI extends beyond financial investments. Mubadala plans to incorporate AI into its operational model, including corporate, administration, and accounting functions. In a bold move, the fund announced that by 2025, it will have an AI member on its investment committee, serving in a consultative role to support decision-making processes. This integration of AI into Mubadala's core operations reflects its ambition to be at the forefront of AI-enabled business practices and its willingness to embrace innovative approaches in the rapidly evolving technological landscape.

DeepSeek's Market Impact

DeepSeek's emergence as a cost-effective AI solution could potentially disrupt Mubadala's investment in OpenAI, but the impact remains uncertain. DeepSeek's AI models, particularly DeepSeek-V3 and DeepSeek-R1, have been praised for their performance comparable to industry leaders like OpenAI, while requiring significantly less investment. This cost-effectiveness has caught the attention of European and Middle Eastern companies seeking affordable AI solutions. However, Mubadala's strategic investment in OpenAI and its commitment to advancing AI technology in the UAE and surrounding regions may not be immediately threatened. While DeepSeek's affordability is attractive, factors such as long-term reliability, scalability, and ecosystem integration will play crucial roles in determining its impact on established players like OpenAI. Additionally, OpenAI's recent efforts to secure $40 billion in fresh funding, potentially valuing the company at $340 billion, suggest that it is actively working to maintain its competitive edge in the face of new challengers like DeepSeek.

AI Theme Still Good?

The AI theme in stocks and ETFs remains strong, but recent market developments suggest a potential shift in investor sentiment and valuation dynamics. While AI-focused funds continue to attract significant inflows, with US-domiciled AI and big data funds seeing net inflows of $430 million in late January 2025, there are signs of increased volatility and divergence in performance among AI-related stocks and ETFs. Recent events have highlighted the dynamic nature of the AI sector:

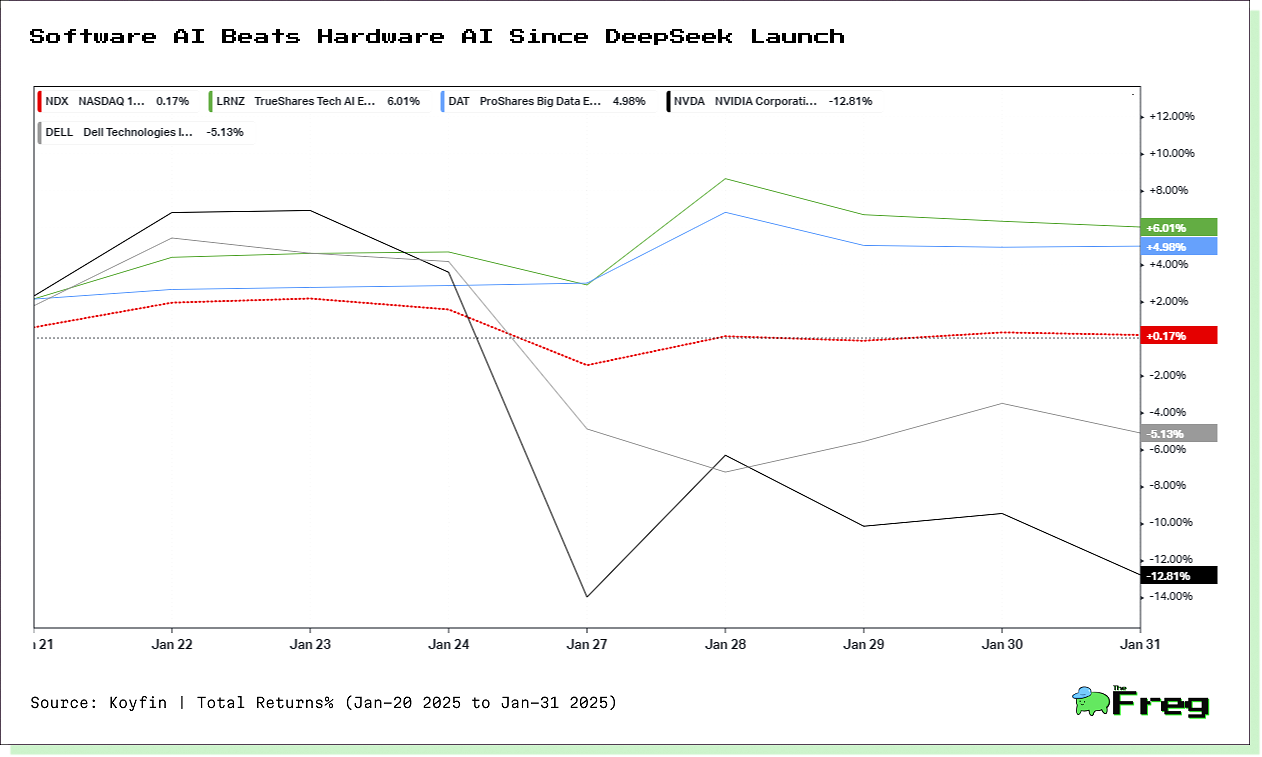

- DeepSeek's breakthrough in efficient AI models triggered a selloff in high-profile AI stocks, challenging assumptions about the necessity of vast computational resources.

- Funds favoring software providers outperformed those heavily invested in hardware companies, with ProShares Big Data Refiners ETF (DAT) and TrueShares Tech, AI, and Deep Learning ETF (LRNZ) returning 4.9% and 6% respectively in a week.

- Analysts suggest that AI stocks are generally fairly valued to overvalued, recommending investors consider paring down positions in growth and core stocks in favor of value stocks.