ARCs Seek Market Access

Will it ever happen?

Asset Reconstruction Companies (ARCs) in India are seeking permission from the Reserve Bank of India to raise equity capital from the market, as reported by The Economic Times. This move aims to enhance their liquidity and net worth, enabling them to compete more effectively with government-backed entities like the National Asset Reconstruction Company (NARCL) and meet the RBI's increased minimum capital requirements.

Impact of Capital Market Entry

The entry of Asset Reconstruction Companies (ARCs) into capital markets could reshape India's bad loans market. With access to public equity, ARCs can raise significant funds to acquire larger non-performing assets (NPAs) at better prices. This liquidity boosts their ability to wait for asset values to rise, improving recovery rates. On the flip side, it may lead to riskier investments and financial instability. ARCs will also face stricter regulations and public scrutiny, pushing them to adopt stronger governance and transparency. While this shift could enhance their role in tackling NPAs, it demands careful management to balance growth with risks.

Challenges in Meeting ₹300 Crore Norm

Asset Reconstruction Companies (ARCs) face significant challenges in meeting the Reserve Bank of India's (RBI) new minimum net owned fund (NOF) requirement of ₹300 crore. The RBI has provided a glide path for existing ARCs to achieve this target, with ₹200 crore required by March 31, 2024, and ₹300 crore by March 31, 2026. However, only about a third of the 27 ARCs currently meet this threshold. The increased capital requirement poses several difficulties:

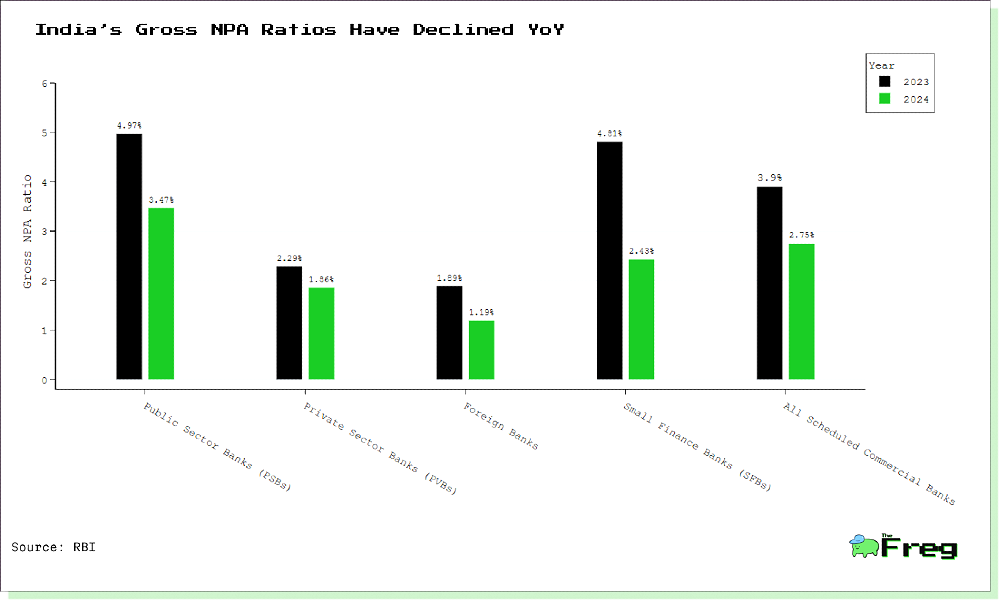

- Limited business potential due to decreasing non-performing assets (NPAs) in the banking sector, with NPAs falling to a 12-year low of 2.8% as of March 2024.

- Intense competition from the government-backed National Asset Reconstruction Company Ltd (NARCL), which offers more attractive government-guaranteed security receipts.

- Regulatory constraints, including the need for independent advisory committee approvals for settlements, which slow down processes and impact profitability.

- Pressure to merge or exit the market for ARCs struggling to meet the new capital requirements.

These challenges are compelling ARCs to seek alternative funding sources and explore strategic adjustments to remain viable in the evolving financial landscape.

Competition with National ARC

The National Asset Reconstruction Company Limited (NARCL), backed by the government, has emerged as a formidable competitor to private Asset Reconstruction Companies (ARCs) in India. NARCL's unique advantage lies in its ability to offer security receipts guaranteed by the government, making it more attractive to financial institutions. This has led to a significant shift in the market, with NARCL acquiring 18 accounts with outstanding loans totaling ₹92,500 crore as of March 31, 2024. Private ARCs are struggling to compete with NARCL despite the sizeable opportunity in existing stressed corporate assets. Banks have written off over ₹13 lakh crore of NPAs between fiscals 2018 and 2024. To remain competitive, private ARCs are focusing on lower vintage NPAs and retail assets, which offer faster resolution and turnover. However, this shift has resulted in a projected contraction of 7-10% in ARC assets under management for fiscal year 2024-25, highlighting the need for strategic adjustments and potential diversification to maintain market relevance.