Are Value Funds True to Their Label?

While many funds claim to focus on value investing, they often fail to consistently provide exposure to undervalued stocks. As a result, investors may experience unintended risks and mismatched performance.

Value investing has long been a cornerstone of portfolio construction, championed by legendary investors like Benjamin Graham and Warren Buffett. The strategy is based on the idea that undervalued stocks—those with low price-to-earnings (P/E), price-to-book (P/B), or other valuation ratios—will outperform over time as the market corrects its mispricing.

To capitalize on this philosophy, many investors turn to value-based funds, which aim to systematically invest in these undervalued stocks. However, an important question remains:

Do these funds actually provide exposure to the value factor, or do their holdings deviate from the classical definition of value?

While factor investing research has shown that value stocks tend to outperform over long horizons, not all funds marketed as “value” exhibit strong exposure to the value factor. Some may unintentionally blend in elements of other factors, diluting their intended tilt toward undervalued stocks.

Why Does Factor Exposure Matter?

Factor-based investing has become a central framework in portfolio construction, with investors increasingly using factors like value, momentum, size, quality, and low volatility to explain stock returns. For those investing in value funds, ensuring that these funds genuinely exhibit a value tilt is critical for several reasons:

Ensuring Alignment with Investment Goals

Investors choose value funds expecting exposure to undervalued stocks that historically deliver excess returns over the long run. If a fund marketed as “value” does not have a strong value tilt, it may not meet investors' expectations or deliver the performance associated with value investing.

Avoiding Style Drift

Many funds deviate from their stated value mandate over time by incorporating stocks with characteristics of growth, quality, or momentum. This phenomenon, known as style drift, can result in unintended risk exposures and inconsistent performance.

Understanding Performance Attribution

If a value fund underperforms or outperforms, is it due to genuine value exposure, or are other factors at play? By analyzing factor loadings, investors can determine whether returns are truly driven by the value factor or if the fund’s performance is being influenced by other market dynamics.

Portfolio Construction & Diversification

Investors often strategically combine factor exposures to diversify risk. A fund that does not strongly load on value but instead has exposure to quality or low volatility may not provide the expected diversification benefits when combined with other funds.

Evaluating Fund Selection & Benchmarking

Many investors compare value funds against benchmarks like the Russell 1000 Value or S&P 500 Value. If a fund has weak exposure to the value factor, it may not be a suitable proxy for value investing, and investors should consider alternative funds that better align with their strategy.

Factor Exposure Analysis

To assess whether value-focused funds truly provide exposure to the value factor, we analysed the top value-oriented funds in the U.S. (based on Market Capitalisation) by measuring how frequently the value factor had the highest exposure (compared to other factors) throughout each fund’s history.

This percentage represents how often value was the dominant factor in the fund’s performance, providing a direct measure of its consistency in delivering value exposure.

- Most funds marketed as value funds do not consistently have high exposure to the value factor.

- Only two funds (VTV and JAVA) had significant value exposure over time. These funds appear to stay truer to their value mandate.

- Many funds had minimal or near-zero exposure to value, suggesting their factor loadings may be influenced by other characteristics or broad market exposure.

- Style drift is evident in several funds, where value exposure is not the dominant factor over time.

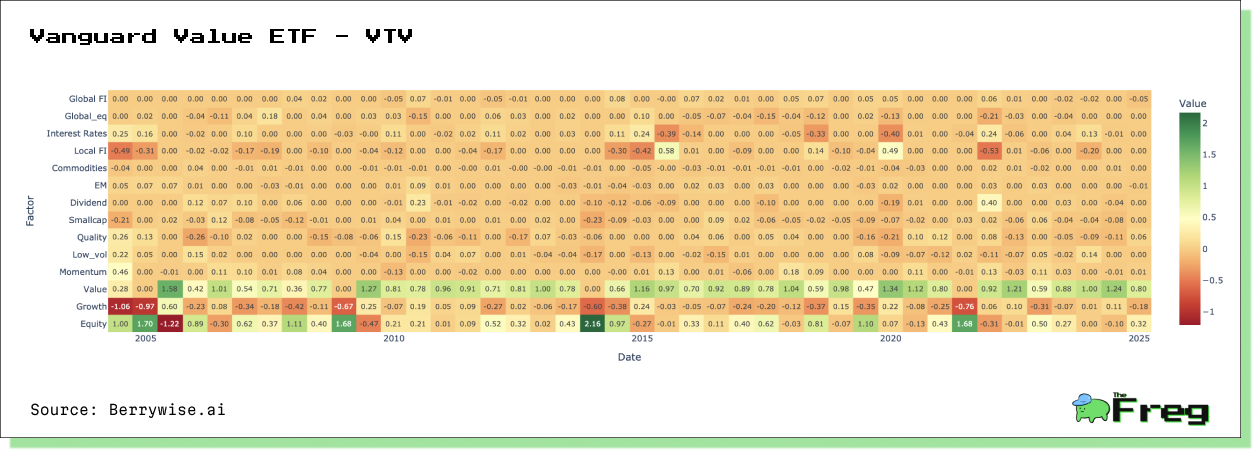

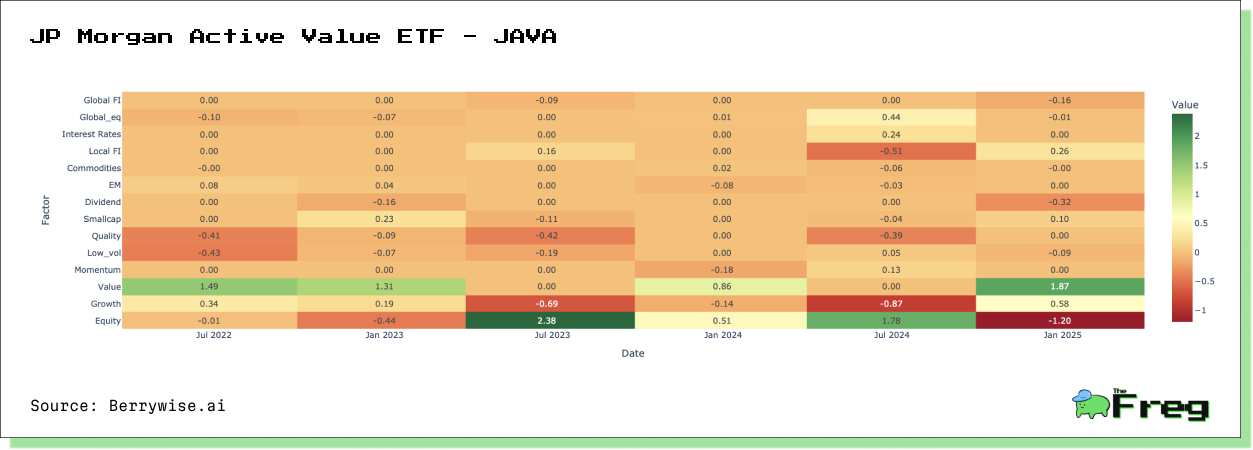

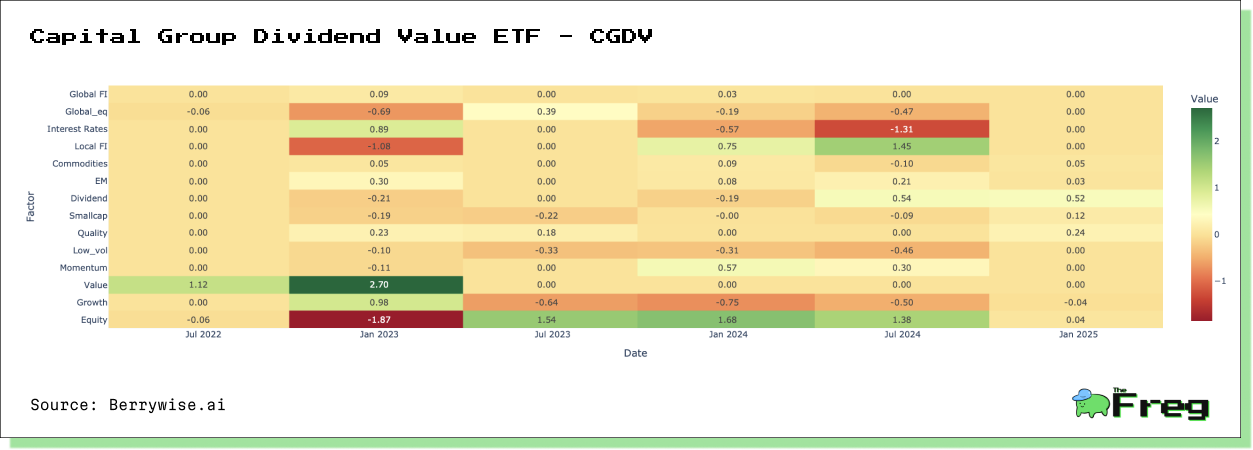

By analyzing factor exposure graphs for the top three funds (VTV, JAVA, and CGDV), we found interesting trends:

- Equity exposure tends to be significant across these funds, meaning their returns often track the broader market rather than purely value-driven movements.

- When value exposure increases, equity exposure decreases—and vice versa. This suggests that as these funds tilt more towards deep-value stocks, their correlation with the broader market weakens.

- The growth factor generally has a negative beta, which aligns with expectations, as value and growth tend to be inversely related.

This allows us to compare how well these funds align with traditional definitions of value investing. Despite being marketed as value funds, many do not consistently provide strong exposure to the value factor.

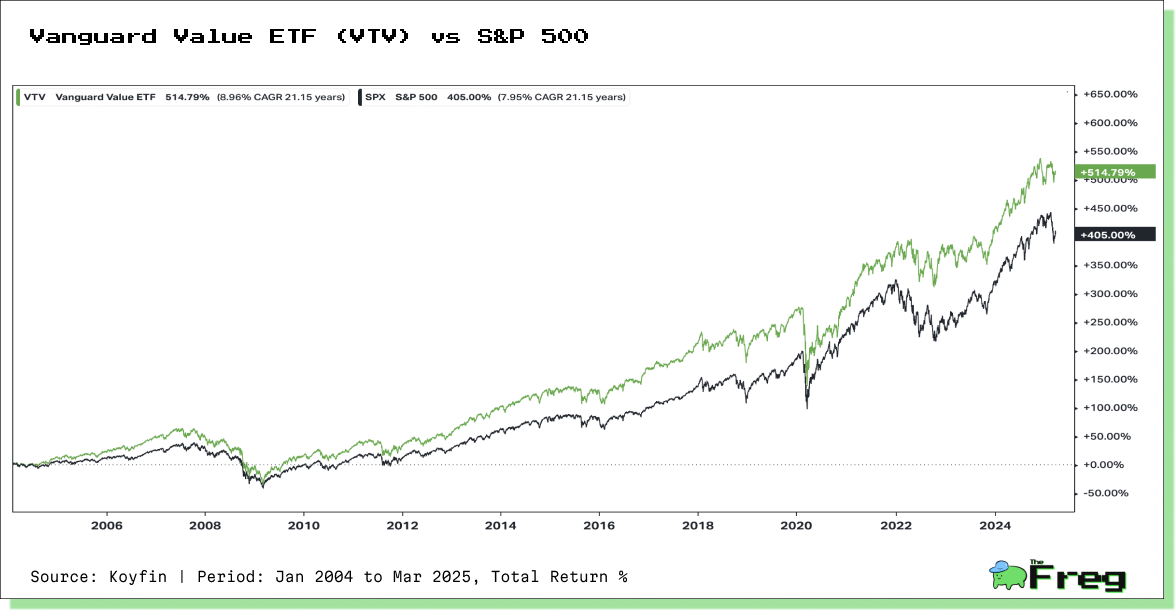

Among the analyzed funds, the Vanguard Value ETF (VTV), which demonstrated the highest and most consistent exposure to the value factor, has outperformed the S&P 500, aligning with its objective of capturing long-term excess returns

For investors seeking pure value exposure, it is critical to analyse factor loadings rather than relying solely on fund marketing descriptions or benchmark labels. Its imperative to audit these funds or investments first-hand using portfolio or investment analytics and get a more transparent assessment.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.