Asia Goes Its Own Way: Why Global Investors Are Following

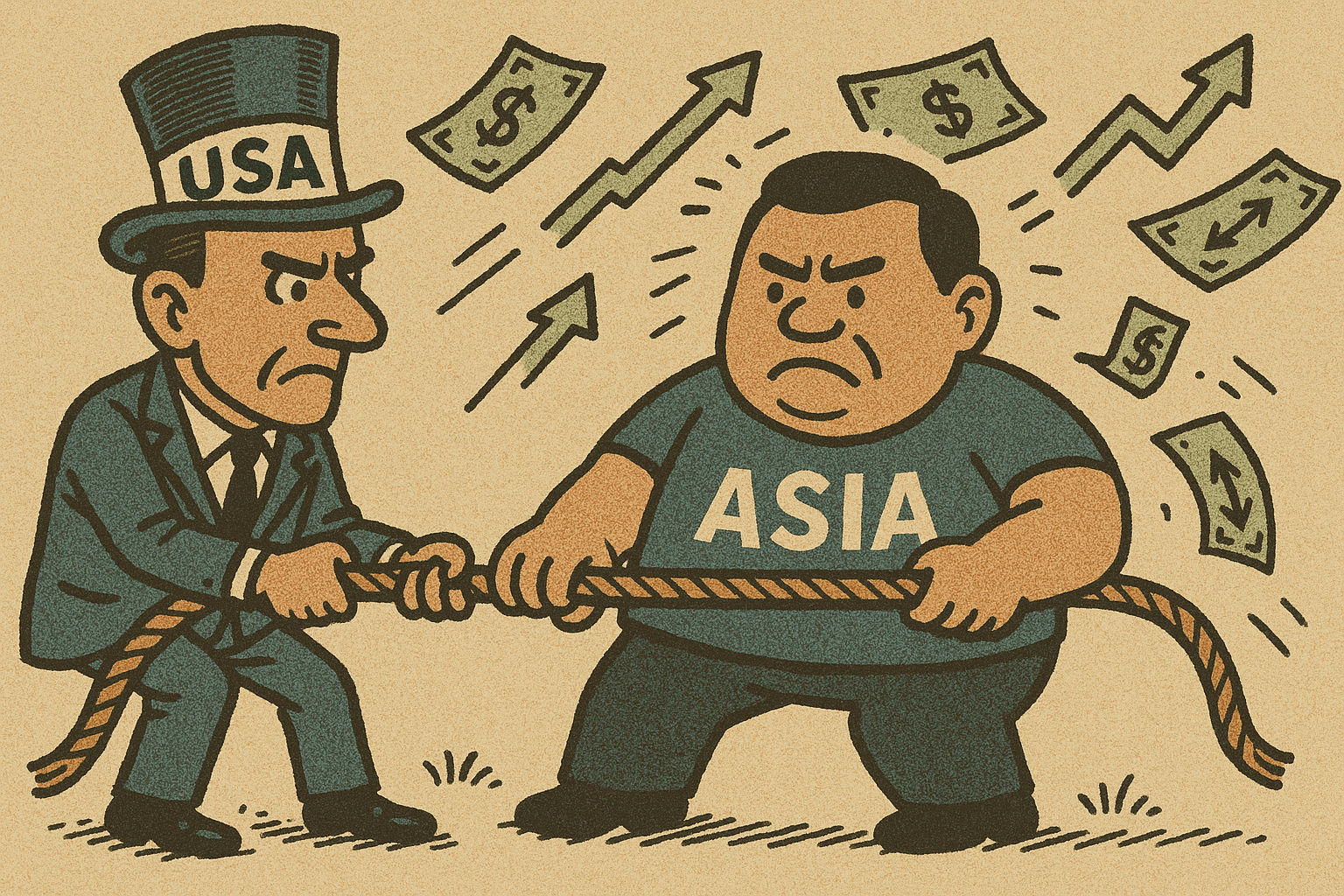

Asia's growing monetary independence in 2025 is reshaping global capital flows—marking a shift from Fed-centric policies to a multipolar financial order driven by regional priorities.

In the first quarter of 2025, a new wave of monetary policy divergence is redrawing the global financial map. While the U.S. Federal Reserve adopts a cautious stance with only modest easing on the horizon, Asian economies are forging distinct paths—some easing to stimulate growth, others holding firm. These diverging trajectories are reshaping capital flows, disrupting carry trades, and creating new opportunities in bond and currency markets.

The Fed's Measured Course

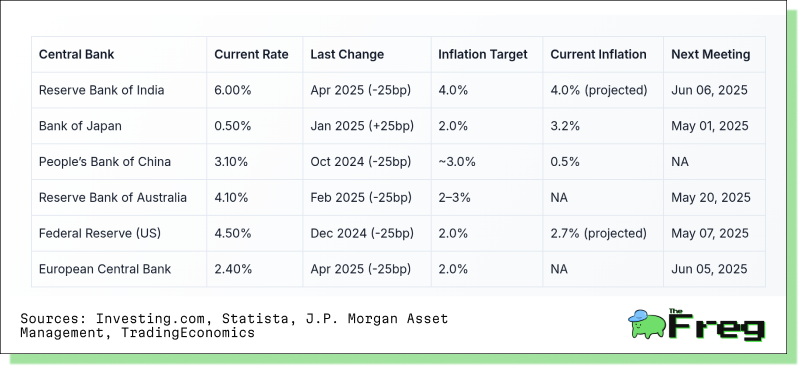

The U.S. Federal Reserve’s March 2025 meeting reaffirmed its restrained approach: the federal funds rate remains at 4.25%-4.5%, with only two quarter-point cuts forecasted this year. Projections also paint a slower-growth, higher-inflation landscape—GDP revised down to 1.7%, and inflation estimates nudging up to 2.7%. Fed officials are divided: while some foresee rates falling to 3.75%–4.00%, others advocate no change at all.

This moderation contrasts starkly with the Fed’s earlier pivot in late 2024, which saw 100 basis points of cuts. Markets have now recalibrated expectations, pushing anticipated rate cuts to mid-2025.

Diverging Monetary Paths in Asia-Pacific

While the Fed treads lightly, Asia’s central banks are taking bolder steps based on domestic priorities. Here’s how the landscape looks:

- China: Continuing its easing cycle, with another 50–60bps of cuts likely in 2025 as the PBOC supports a struggling property sector.

- Japan: Exited negative rates in 2024, with the BOJ poised to raise its benchmark rate to 0.5%, aiming for 1.0% by 2026.

- Australia: Cautiously hawkish, the RBA may not cut until Q2 2025, awaiting inflation clarity.

- Philippines: Eyes 75bps in cuts amid slowing growth.

- Malaysia: Holding rates steady thanks to solid growth and benign inflation.

Rate Snapshot: Asia-Pacific at a Glance

Carry Trade Unwinds: Yen and Franc Surge

Low-yield currencies like the Japanese yen and Swiss franc had long been favorites for carry trades. But that dynamic is reversing fast. In 2025, the JPY surged over 4.5% and the CHF over 7% against the USD. This triggered a rapid unwind of leveraged trades, amplifying volatility across equities and bonds—Japan’s Nikkei swung wildly, while U.S. tech stocks faced outflows.

Analysts estimate that only 50–60% of the unwind is complete. USD/JPY and USD/CHF may briefly rebound to resistance levels of 148 and 0.862 respectively, but the longer-term bias favors yen and franc strength.

Asia’s Yield Advantage

Asian high yield (HY) credit stands out in 2025. With spreads at 521bps—well above long-term averages—and a duration of just 2.4 years, Asia HY offers compelling risk-adjusted returns. Ex-China property, the region’s corporate defaults remain low, often below U.S. equivalents. BBB- and BB-rated credits in the 200bps range are particularly attractive.

This resilience and recovery make Asia HY an appealing play for income-focused investors.

Carry Trades: High Rewards, High Risk

The allure of yield has reignited carry trades in 2025. Borrowing in JPY or CHF and deploying into Indian, Indonesian, or Philippine debt—offering 6–7% yields—seems like a no-brainer. But the game is far riskier now.

Currency volatility is the Achilles’ heel. A sudden appreciation of the yen, for instance, can obliterate months of gains. As a result, investors are hedging more, diversifying funding sources, and targeting economies with consistent policy and strong fundamentals.

Bond Allocations Shift Toward Asia

With U.S. Treasuries offering less appeal and rate risks rising, global investors are rotating into Asian bonds. Corporate and sovereign paper across the region benefit from:

- Higher yields

- Improved credit profiles

- Supportive technicals (negative net supply)

Surveys show a 46% allocation toward fixed income by APAC investors, with 28% specifically targeted at Asia ex-Japan bonds—up from 26% a year ago.

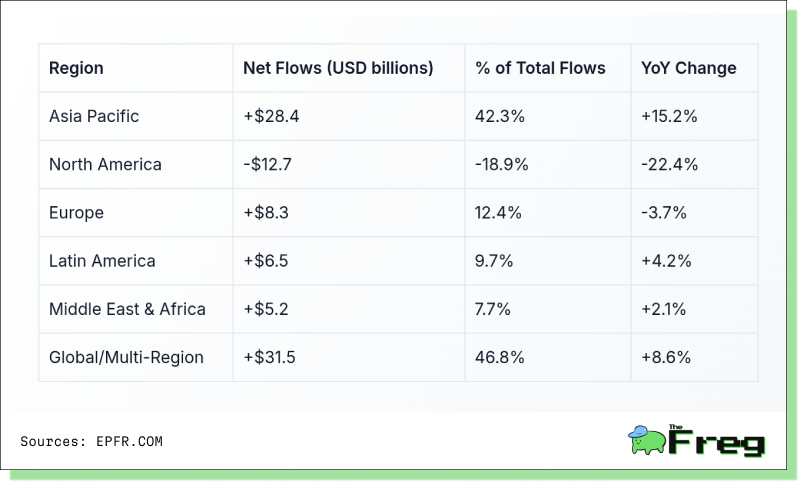

Fund Flow Trends: Asia Leads the Pack

China, in particular, is drawing strong inflows across equity, money market, and bond funds—despite global uncertainty. Gold-focused vehicles are also gaining ground as investors search for hedges beyond U.S. Treasuries.

Currency Realignment: The Asian Edge

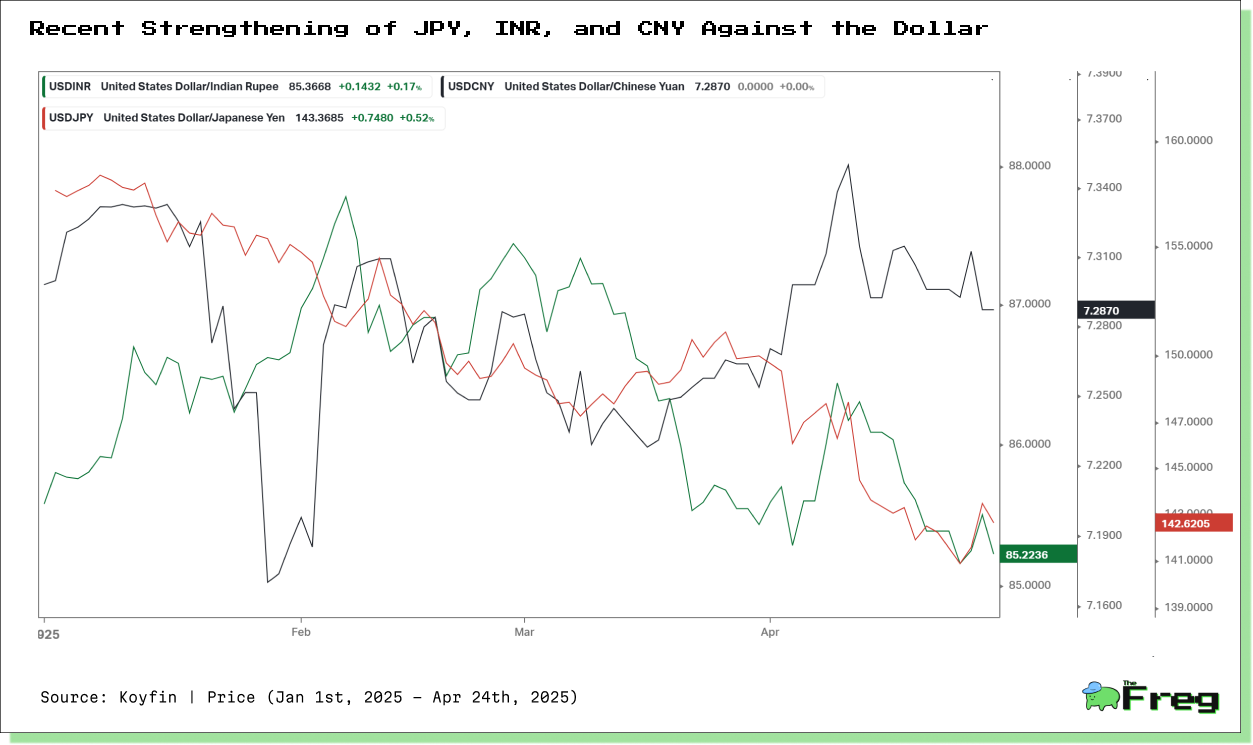

Asian currencies are staging a comeback. The Japanese yen rallied post-BoJ tightening, while the Indian rupee is anchored by solid growth forecasts (6.5% in FY26). China’s yuan remains stable despite easing, as the PBOC actively curbs volatility.

This realignment underscores a broader trend: as capital floods into emerging Asia, the dollar faces increasing depreciation pressure. Regional policymakers are responding by loosening restrictions on portfolio inflows and boosting forex market resilience.

Global Implications: A New Investment Map

The U.S.-Asia rate divergence is not just a subplot—it’s the main narrative of 2025.

- Portfolio rebalancing: More capital is shifting into Asia’s fixed income and equity markets.

- Currency strategies: Hedging FX risk is now non-negotiable.

- Inflation-proofing: Investors are leaning into real assets like commodities and real estate.

- Geographic selectivity: Malaysia’s current account surplus offers a cushion; Indonesia, with fiscal vulnerabilities, may face more pressure.

Final Word

Asia’s growing monetary independence signals more than just a cyclical divergence—it marks a structural realignment of global finance. Unlike in previous cycles, where the Fed’s actions dictated emerging market policy, 2025 reveals a maturing Asia prioritizing domestic objectives. This evolution is supported by flexible exchange regimes, stronger policy frameworks, and demographic tailwinds.

The result? A multipolar monetary world that reshapes how capital flows, how currencies behave, and how portfolios are built. For investors, the challenge is twofold: capturing emerging opportunities while managing heightened FX risk and regional complexity. Success in this environment will depend not just on rate forecasts, but on a deeper understanding of Asia’s evolving economic narrat