Asia Leads Crypto Adoption

The region is flexing its muscles in terms of innovation and market influence too.

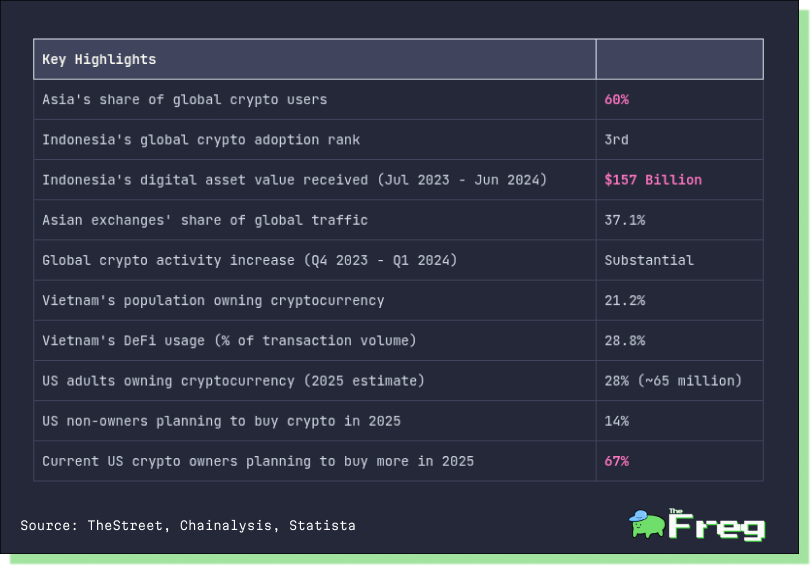

Asia has solidified its position as the global leader in cryptocurrency adoption, with 60% of the world's crypto users and remarkable contributions from countries like India, Vietnam, and the Philippines. The region showcases unparalleled diversity and growth in digital asset engagement despite regulatory challenges and market volatility.

India's Leadership in Crypto Adoption

India has emerged as a global leader in cryptocurrency adoption, maintaining its top position for the second consecutive year despite regulatory challenges. The country's crypto market has shown remarkable resilience, with over 100 million crypto owners by 2024, driven by its tech-savvy youth population. Key factors contributing to India's crypto leadership include:

- High engagement with centralized exchanges and decentralized finance (DeFi) assets.

- Expansion of crypto adoption beyond major metros to Tier-2 and Tier-3 cities.

- Diverse investment portfolio, including Layer-1 tokens, DeFi tokens, and meme coins.

- Strong interest from younger investors, with 75% of crypto investors under the age of 35.

Despite the government's imposition of a 30% tax on crypto gains and a 1% tax deducted at source, the Indian crypto community has demonstrated adaptability and continued growth. This resilience highlights the potential for India to position itself as a future crypto hub, leveraging its thriving startup ecosystem and increasing smartphone and internet penetration.

GameFi Development in Vietnam

Vietnam has emerged as a hotbed for GameFi development, positioning itself as a key player in the global blockchain gaming landscape. The country's rapid adoption of blockchain technology, coupled with its strong gaming culture, has created a fertile ground for innovative GameFi projects.

- Ancient8, a Vietnamese GameFi infrastructure company, secured $6 million in funding to develop software and grow its community of 200,000 members.

- The success of Axie Infinity, based in Ho Chi Minh City, has inspired thousands of new blockchain games in Vietnam.

- Vietnam's government actively supports blockchain technology applications in non-financial sectors, issuing a National Strategy for Blockchain Application and Development to foster growth in this area.

- Emerging trends in Vietnam's GameFi scene include tap-to-earn and click-to-earn games on the TON platform, signaling a shift beyond traditional mobile games.

The Web3+2024 Global Summit in Ho Chi Minh City, co-hosted by ABGA, highlights Vietnam's growing importance in the GameFi ecosystem, bringing together industry experts, investors, and blockchain platforms to discuss the future of GameFi.

Philippines' Play-to-Earn Revolution

The Philippines has emerged as a global leader in the play-to-earn (P2E) gaming revolution, with its young, tech-savvy population embracing blockchain-based games as a means of income generation. This trend gained significant momentum during the COVID-19 lockdowns, as exemplified by the viral success story of

John Aaron Ramos, a 22-year-old Filipino who purchased two houses from his earnings in Axie Infinity. The Philippines' adoption of P2E games is driven by several factors:

- A young median age of 25 years, contributing to rapid technology adoption.

- High unemployment rates, making P2E an attractive alternative income source.

- Strong gaming culture and adaptability to new technologies.

- Government openness to blockchain and crypto initiatives.

Despite a slight decline in overall crypto adoption rankings, the Philippines remains in the top 10 countries for crypto adoption in central and southern Asia and Oceania. The impact of P2E gaming extends beyond individual earnings, with some in-game currencies like Smooth Love Potion (SLP) being accepted as payment in local shops across the Philippines. This phenomenon has not only provided economic opportunities but also introduced many Filipinos to digital financial services, potentially bridging the gap for the unbanked population.

Economic conditions, such as inflation rates or recessions, could also play a big role in shaping adoption trends. While the numbers paint an optimistic picture of growth, particularly in regions like Asia where innovation and adoption are surging, it's worth remembering that the future is far from set in stone. Factors like advancements in blockchain technology, government policies, and even public sentiment toward digital assets will all influence how things unfold. So while there's plenty of reason to be hopeful about where things are headed, it's wise to stay prepared for unexpected twists and turns along the way.