Big Tech’s Decline: Market Shift or Prime Buying Opportunity?

The Magnificent 7 stocks - Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla - have reshaped the investment landscape in recent years, but their grip on market dominance appears to be loosening in 2025.

The Magnificent 7 stocks—Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla—have reshaped the investment landscape over the past decade. However, as 2025 unfolds, their grip on market dominance appears to be loosening.

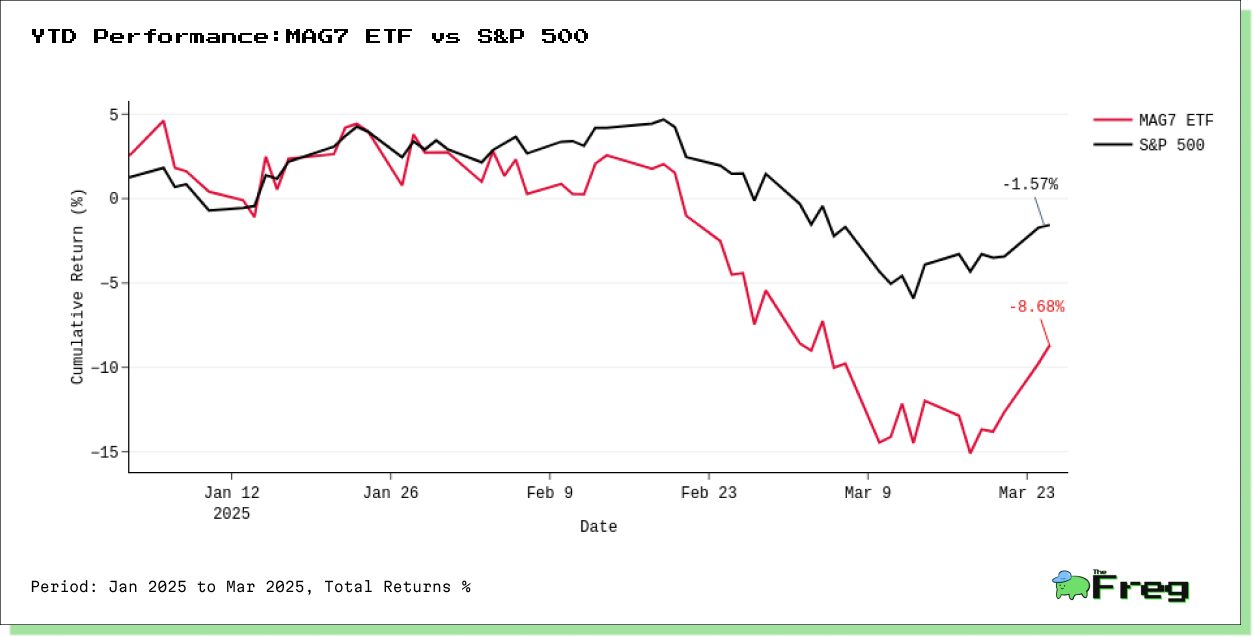

As of March 2025, the performance of the Magnificent 7 has sharply diverged from past trends. While the S&P 500 has declined -1.57% year-to-date, the Magnificent 7 index has declined by -8.68%. This significant underperformance marks a departure from their market-leading status in previous years.

Market Concentration Historically

Despite their recent struggles, the Magnificent 7 still command a significant portion of the S&P 500, representing approximately 33-34.6% of the index’s weight as of early 2025. Their growing influence over the years has contributed to a highly concentrated market:

- 2014: 9.8% of S&P 500

- 2016: 12.5%

- 2018: 16.6%

- 2020: 26.9%

- 2022: 21.6%

- 2023: 30.1%

- 2024: 34.6%

This concentration has sparked concerns about the sustainability of their dominance and the broader implications for market stability.

Shifting Earnings Growth Dynamics

A key indicator suggesting weakening dominance is the shifting earnings growth pattern. Charles Schwab research indicates that earnings growth for the Magnificent 7 in 2025 is expected to be lower than in 2024, while the opposite is true for the rest of the S&P 500. This convergence in growth rates represents a fundamental shift in market dynamics.

- Magnificent 7: Q4 2024 growth of 24% is expected to slow to 18% by Q4 2025.

- S&P 500 (excluding Magnificent 7): Q4 2024 growth of 4% is projected to rise to 14% by Q4 2025.

This reversal suggests a broader market participation beyond mega-cap tech, marking a shift in investment dynamics.

Macroeconomic and Market Rotation Factors

Interest Rate Environment

The Federal Reserve is maintaining interest rates at 4.25%-4.5%, with potential cuts later in 2025. A higher-rate environment typically disadvantages growth stocks in favor of value stocks.

Sector Rotation Signals

Investment strategists are increasingly emphasizing opportunities beyond technology.

Several firms are optimistic about previously overlooked sectors:

- WisdomTree: Bullish on small-cap stocks in 2025.

- Macquarie: Favoring value stocks and real assets.

- Goldman Sachs: Highlighting opportunities in financials, healthcare, and clean energy.

- RBC Wealth Management: Advising investors to remain patient for better entry points into structural growth sectors

Individual Company Outlooks

Each of the Magnificent 7 faces unique challenges and opportunities in 2025:

Tesla (TSLA)

- Facing headwinds from increased EV competition, regulatory challenges, and political controversy surrounding Elon Musk’s government role.

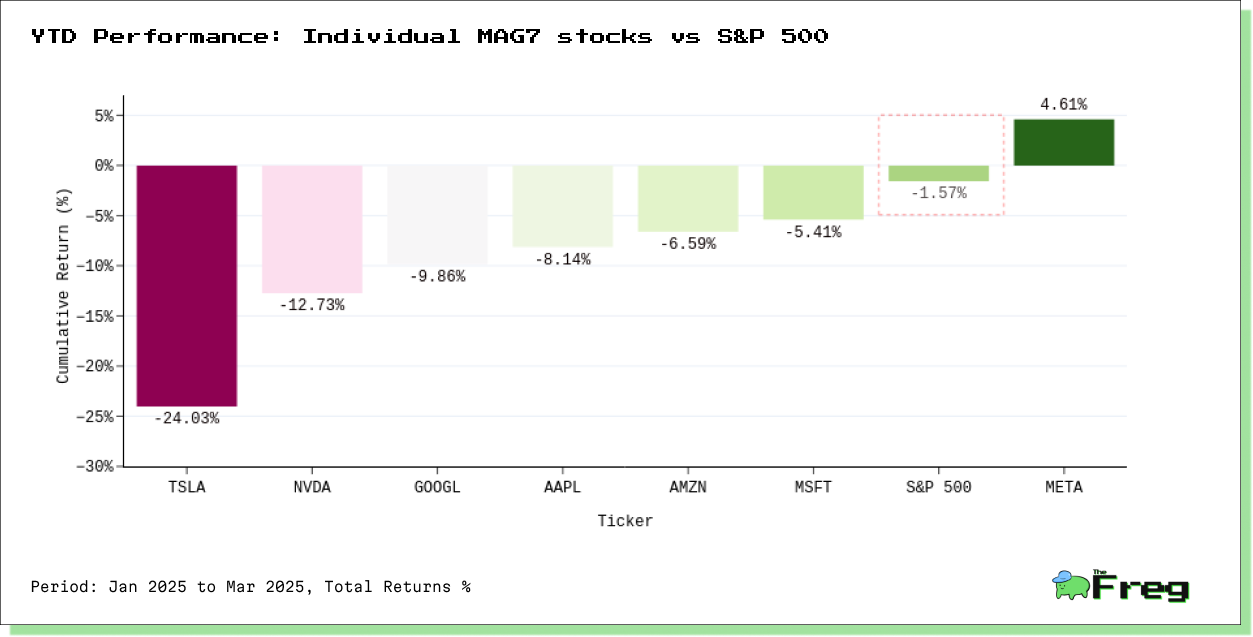

- Stock has plummeted 24.o3% year-to-date due to concerns over potential tax credit losses and declining EV demand.

Nvidia (NVDA)

- Remains the AI chip leader, but stock is down 12.73% YTD.

- Supply constraints and the risk of an AI “digestion phase” pose challenges to growth.

Alphabet (GOOGL)

- DOJ antitrust trial over search dominance (20% revenue at risk), stock declined by 9.86% YTD

- YouTube Shorts monetization: $15B annual run rate

Apple (AAPL)

- Declined 8.14% YTD, though analysts project 7% revenue growth in 2025.

- Future performance hinges on AI initiatives and premium pricing strategy.

Amazon (AMZN)

- AWS growth slows to 12% in 2024 (vs. 20% in 2023), declined by 6.59%

- Logistics-as-a-Service: $95B revenue potential

Microsoft (MSFT)

- Azure cloud platform grew 34% in 2024, with successful AI integration across its software suite.

- Despite strong fundamentals, the stock has fallen 5.41% YTD, raising concerns about valuation sustainability.

Meta (META)

- WhatsApp monetization: $3B/year in emerging markets

- Stock up 4.61% YTD

The Magnificent 7’s absolute dominance of the S&P 500 is likely to decline through 2025, though they will remain influential market leaders. A shift toward broader market participation, rising earnings in non-tech sectors, and sector rotations indicate a changing investment landscape.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.