Bitcoin and the Dollar: A Shifting Correlation in a Changing Global Order

Bitcoin’s inverse link to the US dollar is breaking down in 2025, signaling a potential shift in its market identity—from speculative asset to macro hedge—amid structural dollar weakness and global economic shifts.

The financial world may be witnessing the unraveling of one of its most observed correlations: the inverse relationship between Bitcoin and the US Dollar Index (DXY). For years, this negative correlation served as a dependable framework for traders, but 2025 has brought with it a new market narrative, one in which this relationship appears to be fraying.

A Historical Inverse Relationship

Traditionally, when the dollar strengthens, Bitcoin tends to decline, and vice versa. Over the past five years, the correlation coefficient between Bitcoin and the DXY ranged from -0.4 to -0.8, driven by macroeconomic channels like interest rate shifts and investor risk sentiment.

This relationship was especially pronounced in 2022. The Fed’s aggressive rate hikes sent the DXY to a 20-year high (114), and Bitcoin tumbled from $47,000 to under $16,000. Conversely, when the dollar weakened—especially during multi-day plunges of 2% or more—Bitcoin often surged 94–100% of the time over the following 90 days.

Yet, this bond has not been absolute. During crypto-specific crises like the FTX collapse, the correlation temporarily broke down. Still, the persistent negative trend has historically guided market expectations.

The 2025 Divergence

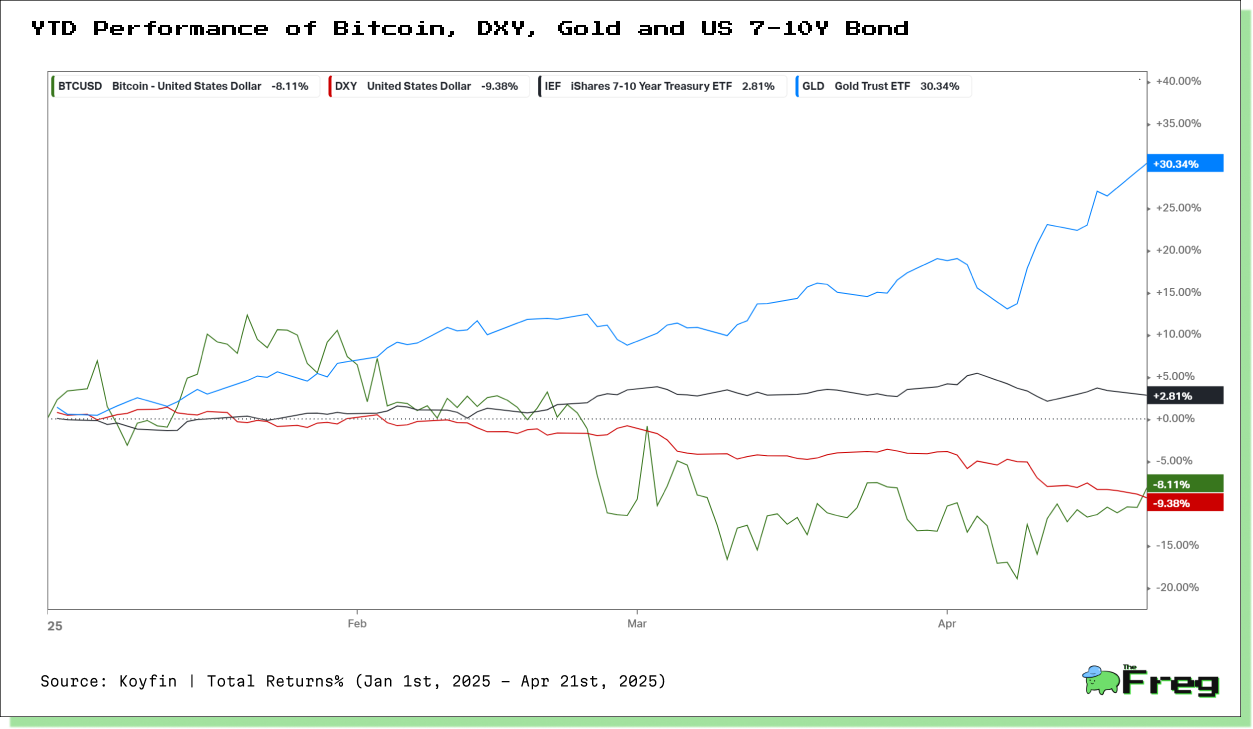

This year, however, a striking decoupling has emerged. Despite the DXY falling nearly 10% year-to-date and dropping below the psychological threshold of 100, Bitcoin has not rallied. Instead, it has declined 6% year-to-date.

Gold, by contrast, has rallied to its 55th all-time high in just 12 months, buoyed by central bank accumulation, macro uncertainty, and its role as a centuries-old safe haven. Bitcoin’s failure to mimic this move challenges assumptions of it being “digital gold.”

Gold’s Resurgence vs Bitcoin

Between November 2022 and November 2024, Bitcoin and gold rose in tandem—Bitcoin by nearly 400%, gold by 67%. But by March 2025, this relationship fractured. Gold is up 16% YTD while Bitcoin has slipped.

Why? Central banks, particularly in China, India, and Russia, are purchasing gold in record quantities (over 1,000 metric tons annually). Gold remains a tangible store of value, while Bitcoin—despite growing institutional adoption—still contends with volatility (42% annualized in 2023) and speculative perception.

Economic Shocks and the Dollar Slide

A 3.4% drop in the DXY this year—the sharpest two-month decline since 2002—has triggered broader market turbulence. Behind the slide:

- The Fed’s pivot toward rate cuts amid a weakening labor market

- Unwinding of carry trades, especially favoring the yen

- Recession fears and poor labor data

- Escalating US-China trade tensions, with tariffs as high as 145%

This macro mix has intensified investor search for alternatives to fiat currencies, with gold surging past $3,000 per ounce. Surprisingly, US Treasuries have seen sell-offs, even as markets lean risk-off.

Bitcoin’s Changing Identity

Bitcoin’s character in global markets is transforming. While still volatile, its recent performance amid dollar weakness and equity sell-offs hints at a more nuanced market role.

Institutions are increasingly involved. BlackRock added 2,660 BTC in Q1 2025. Large holders now control nearly 15% of total supply. Futures markets show a falling wedge pattern, typically signaling potential price reversals.

Some argue Bitcoin is evolving beyond its “tech-aligned risk asset” persona. It could soon resemble a new macro hedge—similar to commodities—especially if decoupling from Nasdaq trends continues.

Institutional vs Retail: Diverging Views

Retail and institutional behavior diverge sharply in 2025. On-chain data show long-term holders accumulating 500,000 BTC since February—absorbing more than short-term holders have shed. Short-term holder MVRV has dropped to 0.82, suggesting average losses of 18%—a level historically tied to market bottoms.

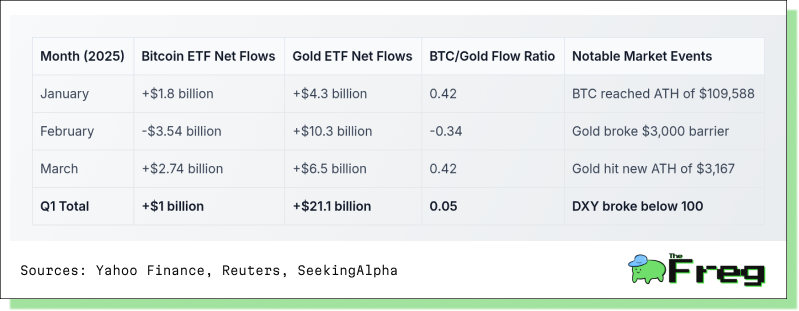

ETF flows, meanwhile, reflect mixed sentiment. After record inflows in late 2024, February 2025 saw $3.54 billion in net outflows. Yet, retail interest is growing: Google searches for Bitcoin jumped 26% in March, hitting yearly highs.

A Structural Shift in the Making?

Could this be more than a temporary anomaly? Evidence is mounting that the Bitcoin-DXY decoupling is structural.

- Bitcoin held steady as the S&P 500 and Nasdaq dropped 2.24% and 3.04% respectively after recent tariff announcements.

- Bitcoin dominance rose to 62.2% in Q1—its highest since February 2021.

- Analysts now consider Bitcoin a potential macro hedge or even a separate asset class altogether.

Three scenarios are emerging:

- Bitcoin as a hedge against macro shocks and inflation

- Bitcoin tracking gold more than equities

- Bitcoin as a distinct financial category, uncorrelated to traditional frameworks

What to Watch Next

Key indicators to monitor in this evolving dynamic include:

- Bitcoin dominance, which surpassed 60% for the first time since April 2021

- ETF flows, particularly relative to Ethereum ETFs (which saw $228 million in outflows in Q1)

- Regulatory action, especially around tariffs, which have wiped out over $1 trillion in crypto market cap

- Liquidity trends and inflation data, which influence Fed policy and risk appetite

As 2025 unfolds, Bitcoin may be carving out a role distinct from both speculative tech assets and traditional safe havens. Whether this shift holds will depend on macro policy, institutional behavior, and global market confidence. It seems, the Bitcoin-dollar correlation is no longer a reliable compass. A new map is being drawn.