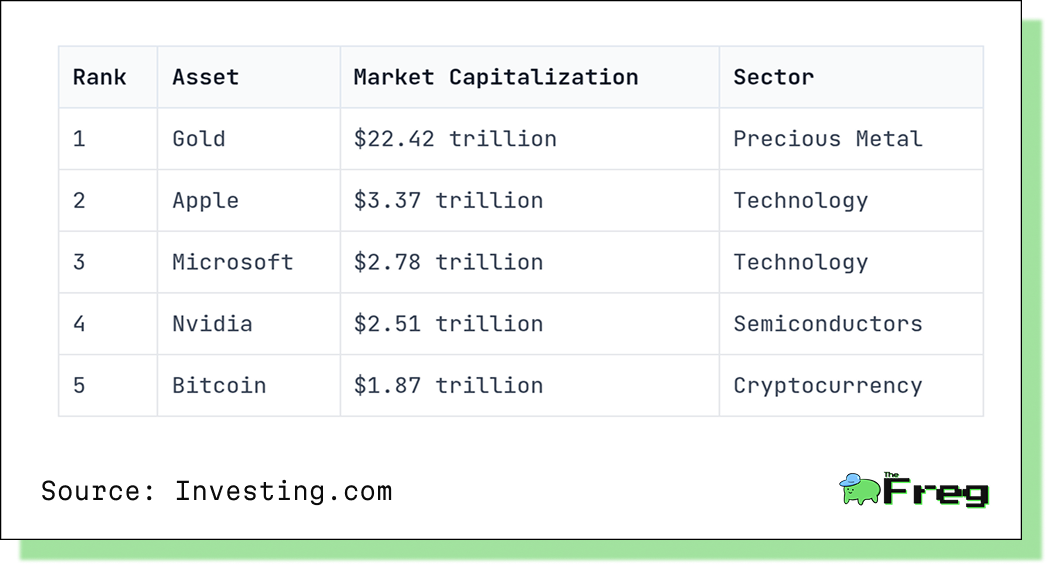

Bitcoin Breaks Into the Top 5: A New Era for Digital Assets

Bitcoin’s rise to a $1.87 trillion market cap positions it as the fifth-largest global asset, surpassing Alphabet.

In April 2025, Bitcoin reached a new pinnacle by overtaking Alphabet (Google) in market capitalization. Now valued at $1.87 trillion, Bitcoin ranks as the fifth-largest asset in the world, trailing only Gold, Apple, Microsoft, and Nvidia. This development marks a pivotal moment in Bitcoin’s evolution from a disruptive technology to a globally recognized financial asset.

Top 5 Global Assets by Market Capitalization

Bitcoin now stands above traditional giants like Amazon, Alphabet, and silver—assets that have dominated the financial landscape for decades.

Key Drivers Behind Bitcoin’s Rise

Several factors fueled Bitcoin’s latest ascent:

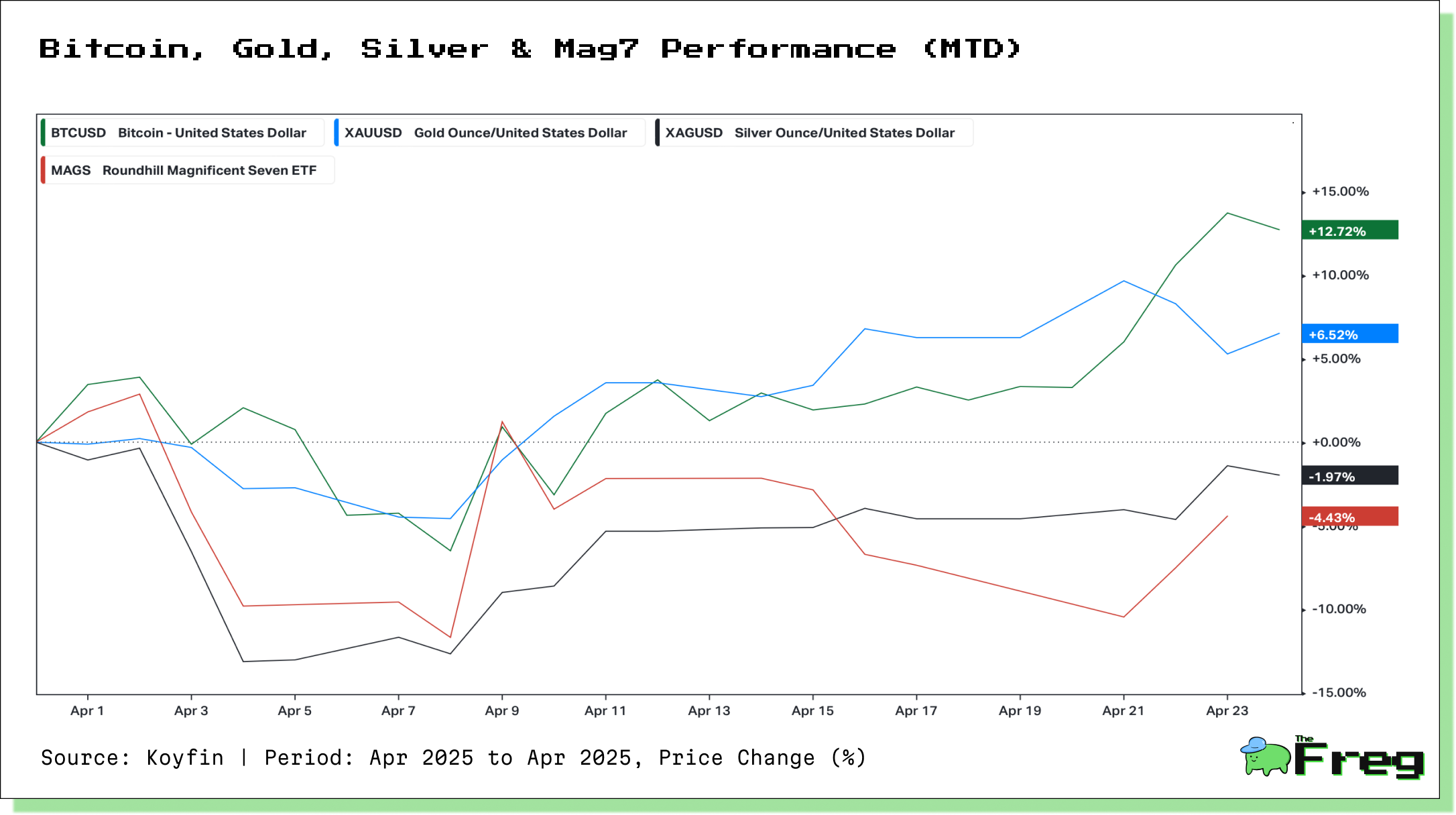

- April Rally: Bitcoin surged 15% in April, far outperforming the Nasdaq 100’s 4.5%, signaling growing divergence from traditional equities.

- ETF Inflows: Nearly $936 million poured into U.S.-listed Bitcoin ETFs in a single day—setting a new 2025 record.

- Improved Macro Environment: Reduced U.S.–China trade tensions and dovish rhetoric from central banks helped reignite risk appetite.

- Recovery from Pullback: BTC rebounded strongly after falling more than 30% from its January all-time high of ~$109,000.

Institutional Adoption: Bitcoin Goes Mainstream

Institutional adoption has shifted Bitcoin from a speculative asset to a strategic allocation:

- Big-Name Entrants: BlackRock, Fidelity, Ark & 21Shares, and others have poured capital into Bitcoin ETFs.

- Growing AUM: BlackRock’s iShares Bitcoin Trust (IBIT) now manages over $18 billion, while Fidelity added $253.8 million in a single day.

- Wider Ownership: Nearly 15% of total BTC supply is now held by institutional entities, governments, or public corporations.

- Infrastructure Maturation: Enhanced custody services, declining volatility (down 75% since 2021), and streamlined on-ramps have made institutional entry smoother than ever.

The broader financial industry is adapting accordingly. Banks are offering crypto custody, asset managers are launching blended portfolios with BTC exposure, and even conservative pension funds are testing the waters.

Bitcoin’s Growing Independence from Tech Stocks

Bitcoin’s price trajectory in 2025 is decoupling from tech stocks:

- As Apple, Microsoft, and Nvidia struggled amid trade tensions and slowing earnings growth, Bitcoin surged.

- Institutional investors are viewing BTC less as a speculative tech play and more as a macro hedge—similar to gold.

- Fixed supply, decentralization, and freedom from central bank policy have enhanced Bitcoin’s “digital gold” narrative.

As Bitwise CIO Matt Hougan put it:

“Bitcoin is rallying because they broke the economy, and the way they'll 'fix' the economy will make Bitcoin rally harder.”

- Bitcoin (BTCUSD): 12.72%

- Gold (XAUUSD): 6.52%

- Silver (XAGUSD): -1.97%

- Magnificent 7 ETF (MAGS): -4.43%

Correlations and Macro Dynamics

Bitcoin’s correlation to traditional assets is dynamic:

- In risk-on environments (low interest rates, QE), BTC and equities often move together.

- In macro stress events, Bitcoin can break away—acting as a hedge against fiat instability or geopolitical risk.

- Institutional behavior influences this: as more institutions hold BTC, its short-term movements may mirror equities. But in periods of crisis or monetary uncertainty, its non-correlated behavior re-emerges.

This evolving pattern underscores Bitcoin’s dual identity—as both a risk asset and a macro hedge, depending on the context.

Risks That Could Stall Bitcoin’s Momentum

Despite the bullish case, headwinds remain:

- Regulatory Risks: Tighter oversight from global regulators could restrict ETF flows or institutional participation.

- Custodial Centralization: Heavy reliance on Coinbase (a single custodian with a BB– rating) poses concentration risks.

- Technological Threats: Advancements in quantum computing could undermine Bitcoin’s cryptographic security in the long run.

- Environmental Concerns: Bitcoin’s energy consumption remains a key criticism, though efforts to shift to greener mining practices are ongoing.

Volatility also hasn’t disappeared entirely—Bitcoin dropped more than 20% YTD earlier this year, shaking retail and institutional confidence alike.

Bitcoin’s rise to the top five global assets cements its evolution from an outsider to a core macro asset. No longer dismissed as a speculative bubble, Bitcoin is increasingly treated as a legitimate hedge, a store of value, and even a strategic reserve asset by institutions.

The road ahead won’t be without turbulence. But the structural shifts driving Bitcoin's adoption—especially its role in a world of inflation, fiat instability, and geopolitical risk—suggest its presence in global portfolios is not just a phase, but a new financial reality.