Bitcoin’s Breakaway: Zero Correlation with the S&P 500

Bitcoin’s zero correlation with the S&P 500 signals a shift in its market role, offering diversification but requiring strategic portfolio adjustments.

Bitcoin's correlation with the S&P 500 has recently dropped to zero, marking a potential shift in its relationship with traditional financial markets. This raises critical questions about Bitcoin’s role as an independent asset and its implications for investors.

Analyzing Bitcoin-S&P 500 Correlation Trends

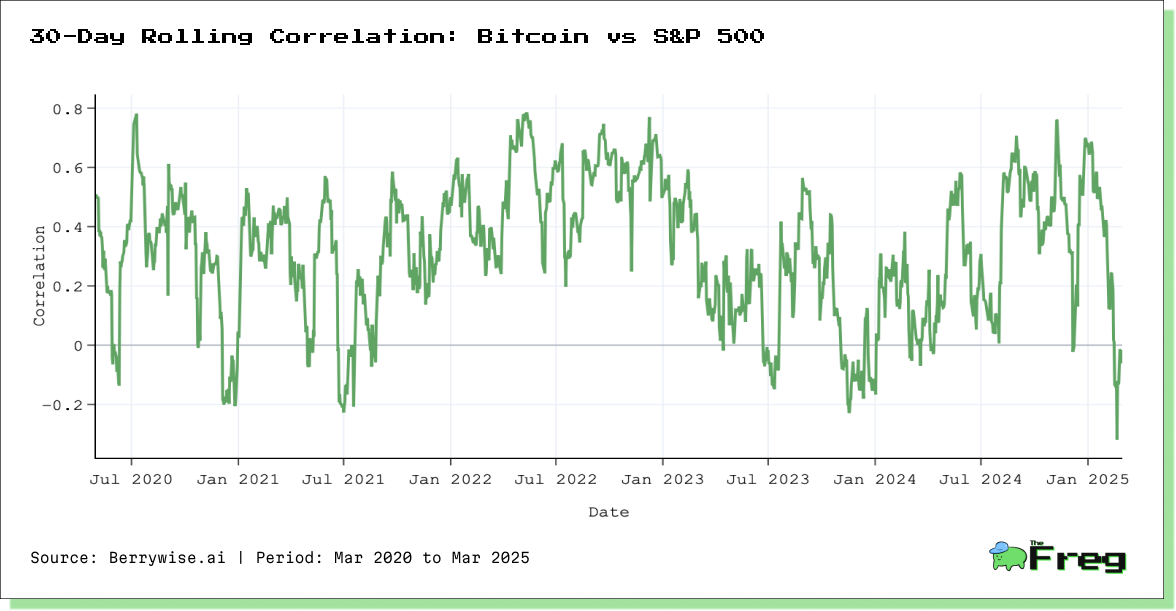

A rolling 30-day correlation graph of Bitcoin and the S&P 500 Index highlights Bitcoin’s evolving market behavior.

Key insights from historical data:

- Positive correlation (>0.5): 24% of the time

- Low correlation (-0.2 to 0.2): 26% of the time

- Negative correlation (<-0.5): 0% of the time

While Bitcoin’s low correlation indicates some diversification benefits, it does not serve as a hedge against the S&P 500. A true hedge asset would exhibit a strong negative correlation, generating positive returns when the S&P 500 declines. Instead, Bitcoin’s fluctuating correlation patterns suggest it moves independently rather than in opposition to traditional equities.

Key Drivers of Bitcoin-S&P 500 Correlation

Several macroeconomic factors influence Bitcoin’s correlation with traditional markets:

Federal Reserve Policies – Interest rate decisions significantly impact both Bitcoin and equities. For example:

- In June 2022, the Fed raised rates by 0.75%, leading to a sharp decline in Bitcoin’s price as investors shifted to safer assets.

- In 2024, a 50 basis-point rate cut boosted U.S. stocks and cryptocurrencies, with Bitcoin surpassing $64,000.

Global Economic Crises – Market-wide liquidity concerns, such as those seen during the COVID-19 pandemic, tend to increase Bitcoin’s correlation with equities as investors seek stability.

Inflation Trends – Rising inflation can drive investors toward alternative assets, influencing demand for both Bitcoin and stocks.

Institutional Involvement – Recent developments suggest increased institutional interest in Bitcoin. Vanguard, traditionally skeptical of cryptocurrency, has begun engaging with Bitcoin-related stocks like GameStop, signaling a shift in institutional sentiment.

Investor Implications of Bitcoin’s Decoupling

Bitcoin’s zero correlation with the S&P 500 presents important considerations for investors:

- Diversification Benefits – With reduced correlation, Bitcoin may serve as a valuable portfolio diversifier, mitigating exposure to stock market fluctuations.

- Strategic Portfolio Rebalancing – As Bitcoin operates more independently, investors must adjust their allocation strategies accordingly.

- Focus on Crypto-Specific Factors – With less influence from traditional markets, investors should prioritize blockchain adoption, regulatory developments, and technological innovations.

- Risk Considerations – While offering diversification, Bitcoin remains a highly volatile asset, requiring prudent risk management strategies.

Bitcoin’s decoupling from the S&P 500 marks a significant shift in its market behavior. While this trend offers diversification advantages, investors must recognize that correlations evolve over time. A proactive approach—adjusting allocations based on market conditions and focusing on crypto-specific fundamentals—will be essential for effectively incorporating Bitcoin into investment portfolios.