Bond ETFs Beat Stocks

As economic uncertainty looms and trade tensions escalate, investors are flocking to safe-haven assets, with gold and bonds taking center stage. The shift away from stocks, particularly in the tech sector, highlights a growing appetite for stability and risk mitigation.

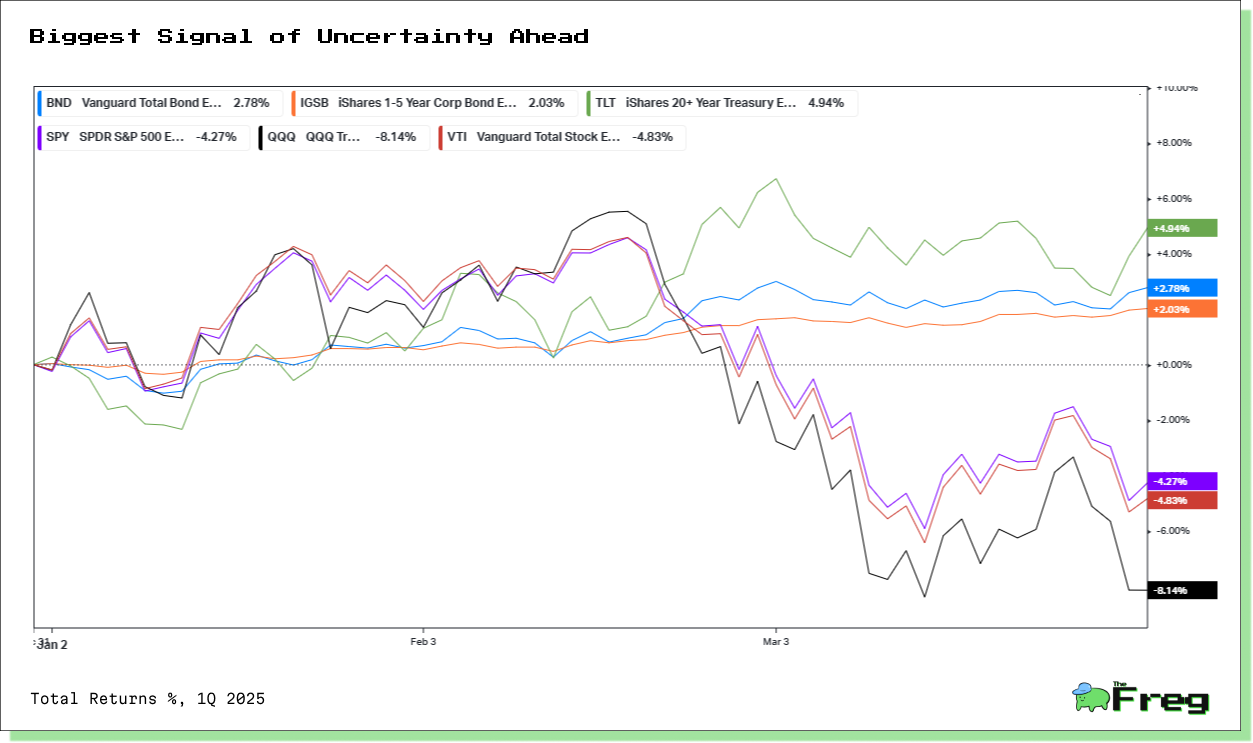

According to Bloomberg, US bond ETFs have taken center stage in the first quarter of 2025, outperforming their equity counterparts as investors seek shelter amid economic uncertainties and recessionary concerns sparked by recent policy shifts.

Surge in Short-Term Bond ETFs

Short-term bond ETFs have experienced a significant surge in popularity, with record inflows amid market turbulence, as investors seek safer havens in an uncertain economic climate.

Notable short-term bond ETFs leading the surge include SPDR Portfolio Short-Term Corporate Bond ETF (SPSB), iShares Short-Term Corporate Bond ETF (IGSB), and JPMorgan Ultra-Short Income ETF (JPST). These funds offer attractive yields, reduced interest rate and credit risk, increased liquidity, and higher return potential compared to money market funds. For instance, SPSB boasts a 4.54% SEC yield with a low 0.04% expense ratio, making it an appealing option for investors looking to park their money in a relatively stable investment vehicle.

Retail Investors Flock to Fixed Income

The fixed income market has seen a significant influx of retail investors in 2025, driven by attractive yields and a desire for stability amid market uncertainties. Exchange-traded funds (ETFs) have emerged as a popular vehicle for retail investors to gain exposure to fixed income assets.

Gen Z investors are leading this charge, with 30% starting to invest in early adulthood compared to just 6% of Baby Boomers. The accessibility and flexibility of bond ETFs have made them particularly appealing to retail investors, offering diversification, transparency, and regular income. As the fixed income landscape evolves, retail investors are increasingly turning to ETFs as a cost-effective way to navigate the bond market and capitalize on current yield opportunities.

US Equities Underperform

The U.S. equity market experienced a significant downturn in the first quarter of 2025, with the S&P 500 and Nasdaq 100 posting their worst quarterly performances since 2022. This underperformance can be attributed to several key factors:

- Trump's tariff policies: The introduction of new tariffs by President Trump heightened concerns over potential global trade conflicts, negatively impacting economic growth prospects and triggering inflation fears.

- Tech sector decline: The "Magnificent Seven" tech stocks, which had previously driven market gains, faced substantial losses.

- Valuation concerns: U.S. stocks were trading at historically high valuations, with the S&P 500's trailing one-year price-to-earnings ratio well above its long-term average.

- Shift to European markets: Investors began moving capital to European stocks, which outperformed the S&P 500 by an impressive 18.4% in dollar terms, driven by more attractive valuations and fiscal stimulus.

- Economic policy uncertainty: The Trump administration's unpredictable policies increased market volatility and led to a retreat in investor equity positioning.

These factors combined to create a challenging environment for U.S. equities, resulting in a 4.5% drop for the S&P 500 and a 8.25% plummet for the Nasdaq 100 in Q1 2025.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.