BYD Tops Tesla: Key Drivers of Its $100B Surge & Investor Impact

BYD’s $107 billion revenue in 2024 surpassed Tesla, driven by expansion and hybrid sales.

Chinese electric vehicle giant BYD has surpassed Tesla in annual revenue for the first time, reporting an impressive $107 billion in sales for 2024. This milestone, fueled by BYD's diverse product lineup and aggressive expansion strategy, signals a major shift in the global EV market. However, questions remain about the sustainability of this growth in an increasingly competitive industry.

The rise in hybrid vehicle sales is reshaping the automotive landscape, influencing both industry dynamics and consumer preferences. In the United States, hybrid electric vehicle sales surged by 53% in 2023, reaching nearly 1.2 million units. A similar trend is evident globally, with India experiencing a 27% increase in hybrid car sales in 2024.

Meanwhile, Tesla’s market share in China has been steadily declining, recently dropping to 3.8% and continuing on a downward trajectory. Several factors have contributed to this trend:

- Intense competition: from domestic manufacturers, particularly BYD, which offers highly competitive vehicles at attractive price points.

- Production line disruptions: at Tesla's Shanghai factory, leading to temporary shutdowns and reduced output.

- Regulatory hurdles: affecting Tesla’s ability to implement advanced driver-assistance systems in China.

- Shifting consumer preferences: favoring more affordable electric vehicles with comparable features.

Chinese consumers are increasingly favoring BYD over Tesla for several key reasons:

- Competitive pricing: BYD offers a wider range of affordable electric vehicles, with models like the Seagull priced under $10,000, significantly undercutting Tesla's entry-level offerings.

- Advanced features: BYD is incorporating high-tech "luxury" features into even its lower-priced models, appealing to Chinese consumers' preference for technology-rich vehicles.

- Localized software: BYD's systems are tailored to Chinese driving conditions and consumer preferences, offering a more familiar user experience.

- Diverse product lineup: BYD's extensive range of electric and hybrid vehicles caters to various market segments, from budget-conscious buyers to luxury seekers.

- Nationalist sentiment: As a homegrown brand, BYD benefits from Chinese consumers' inclination to support domestic manufacturers.

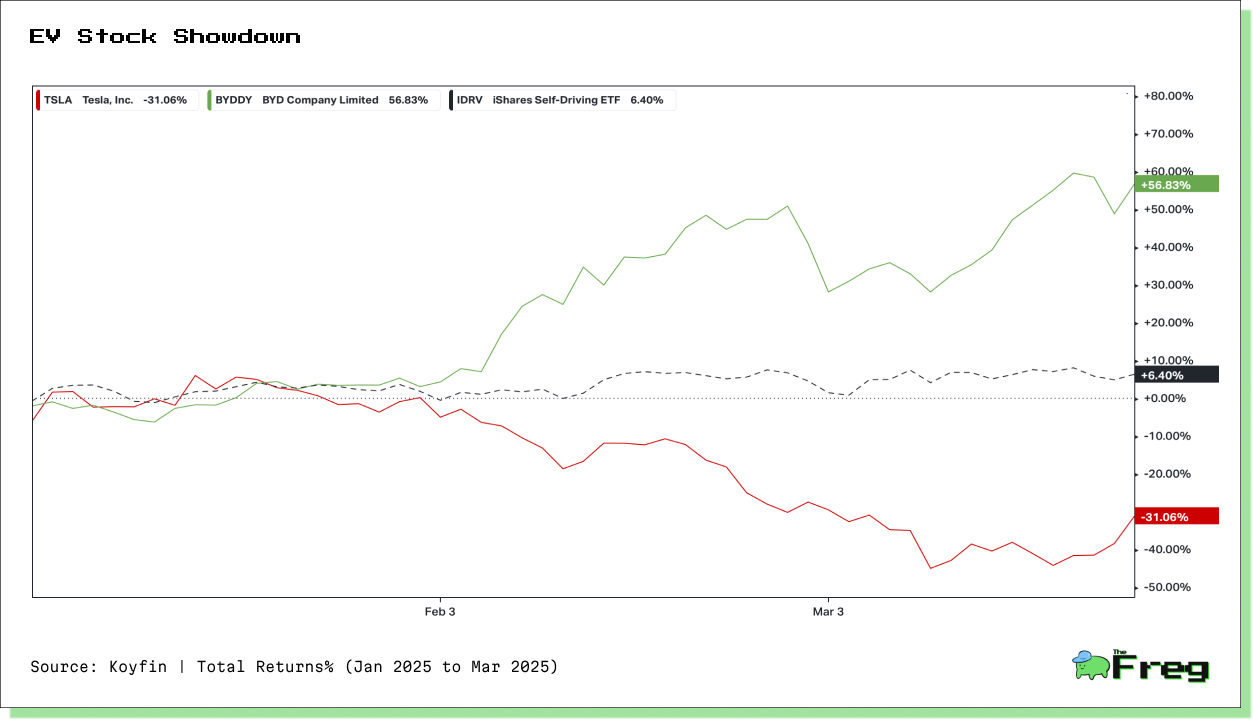

BYD’s stock has responded positively to its strong performance, with its Hong Kong-listed shares soaring approximately 56% in 2025. This reflects growing investor confidence in the company’s technological advancements and expansion strategy. In contrast, Tesla’s stock has struggled, losing nearly half its value since the start of 2025 and marking nine consecutive weeks of decline.

Despite BYD’s revenue surpassing Tesla’s, Tesla still maintains a significantly higher market capitalization—approximately $800 billion compared to BYD’s valuation. This suggests that investors continue to price in substantial long-term growth potential for Tesla, even as it faces short-term challenges.