Can Indian Airlines Turn Expansion into Profits?

Indian airlines are expanding aggressively for summer 2025, adding over 1,300 weekly flights to meet soaring demand. Rising costs, airport congestion, and competition challenge profitability. Airlines must optimize routes, pricing, and efficiency to turn growth into financial success.

The Indian aviation industry is poised to take off for a busy summer in 2025, with airlines collectively adding over 1,300 weekly flights to accommodate surging travel demand. The sector will operate 25,610 weekly flights, a 5.5% increase from last year. Air India is leading this expansion, while budget carrier SpiceJet is also increasing its domestic flights. However, does more flights necessarily mean higher profitability?

The Flight Frenzy: Growth or Growing Pains?

Airlines often see peak travel demand in summer, but the expansion comes with risks. While increased connectivity can boost revenue, it also raises expenses such as fuel costs, airport fees, and maintenance.

Another challenge is infrastructure limitations. India’s busiest airports, including Delhi and Mumbai, already face congestion issues, leading to delays and inefficiencies. Additionally, global supply chain disruptions have slowed aircraft deliveries, meaning airlines must maximize their existing fleets. The ability to balance expansion with efficiency will be key to determining whether this surge in flights translates to financial success or added strain.

Load Factors and the Profit Puzzle

Another one of the biggest determinants of profitability in aviation is the load factor—the percentage of available seats that are filled with paying passengers.

- India's domestic air traffic surged by 23.4% year-on-year in January 2024, signaling strong demand.

- Expanding into tier-2 and tier-3 cities may help capture underserved markets and maintain high seat occupancy.

- The reduction in slot allocation could help maintain efficiency by focusing on high-demand routes.

Ultimately, Indian airlines must carefully balance growth with demand to ensure that new capacity does not lead to empty seats and revenue losses.

Load Factors for leading airlines in 2024 and 2025

RASK: The Real Measure of Success

Revenue per Available Seat Kilometer (RASK) is a crucial metric in airline profitability. It measures how much revenue an airline generates per available seat across its network. Expanding flights increases available seat capacity, but if demand doesn’t rise proportionally, RASK can decline.

To maintain strong RASK levels, airlines must focus on dynamic pricing—adjusting fares based on real-time demand. Strategic scheduling and maximizing high-demand routes are also critical. Additionally, revenue diversification through ancillary services (such as baggage fees, in-flight sales, and premium services) can help airlines offset any pressure on ticket prices.

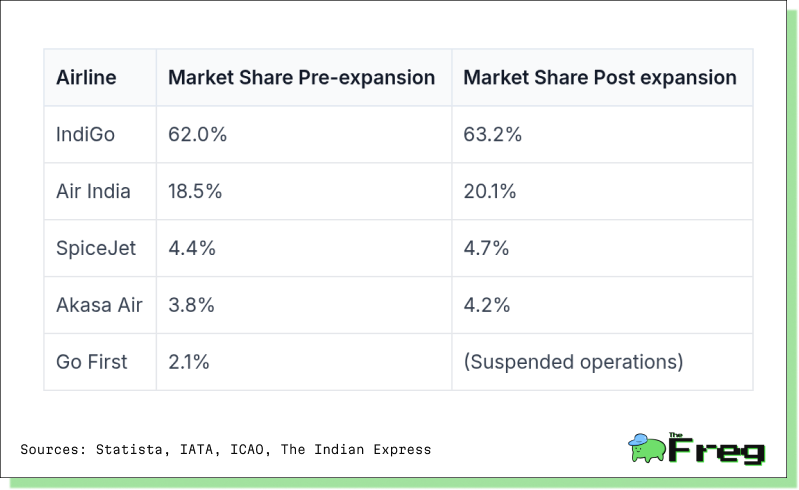

The Market Share Battle

The summer schedule changes in the Indian aviation market have triggered notable shifts in airline market share, reflecting an increasingly competitive landscape. IndiGo has further solidified its dominance, increasing its market share to 63.2%. This expansion allows IndiGo to capitalize on growing demand while reinforcing its leadership position.

Air India, following its merger with Vistara, has also gained ground, with its market share rising from 18.5% to 20.1%. Operating 4,310 weekly flights, the combined entity is leveraging the strengths of both airlines to expand its market presence. Meanwhile, Akasa Air, a relatively new entrant, has made impressive strides, increasing its share from 3.8% to 4.2%, demonstrating its ability to rapidly capture demand.

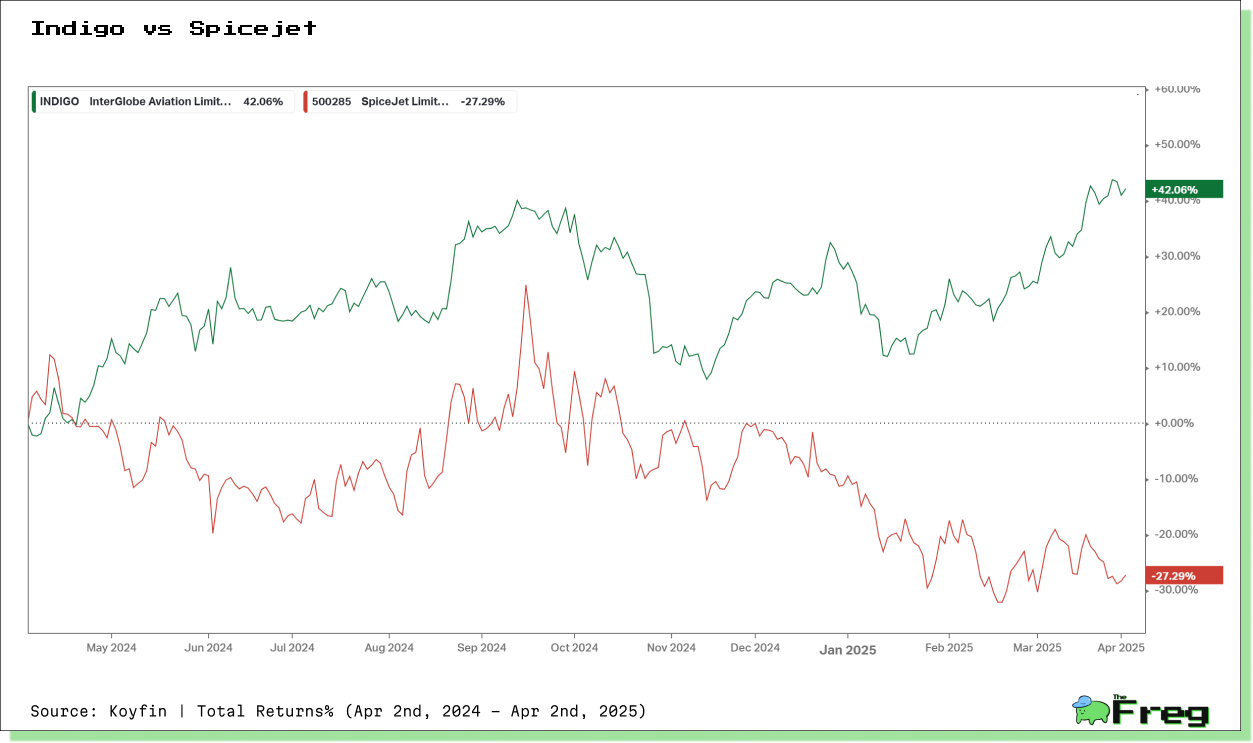

SpiceJet, despite its financial hurdles, has managed a modest increase in market share adding 24 new domestic flights. However, this small gain still leaves it vulnerable against larger competitors. The suspension of Go First's operations has redistributed its 2.1% market share among the remaining carriers, creating further opportunities for expansion—especially on the routes previously dominated by Go First.

The Indian aviation industry remains highly dynamic, with airlines adjusting strategies to optimize networks and sustain growth. The summer schedule changes have intensified competition, pushing airlines to strengthen their market positioning while managing operational challenges.

Operational Roadblocks: A Reality Check

Expanding flight schedules introduces several operational risks:

- Flight Disruptions: Weather-related delays, particularly dense fog in Delhi and other airports, have caused mass cancellations in previous years. An expanded schedule means greater exposure to such disruptions.

- Labor Shortages: The aviation industry is facing a critical shortage of pilots, maintenance engineers, and ground staff, which could limit airlines' ability to operate additional flights seamlessly.

- Airport Congestion: More flights don’t necessarily mean faster service. Indian airports are already experiencing congestion, leading to longer turnaround times and potential scheduling inefficiencies.

- Fuel Price Volatility: Airlines operate on thin margins, and fluctuating fuel costs can significantly impact profits. Airlines may need to explore fuel hedging strategies to protect against cost spikes.

Can Expansion Be Profitable?

Expanding flight routes presents both opportunities and risks, and for airlines like SpiceJet, profitability depends on a strategic approach. Optimizing Revenue per Available Seat Kilometer (RASK) through smart pricing and network planning is crucial, as is investing in fuel-efficient aircraft to cut long-term costs. Beyond ticket sales, boosting ancillary revenue from baggage fees, partnerships, and in-flight services can provide a much-needed financial cushion. At the same time, enhancing operational efficiency—minimizing delays, improving customer satisfaction, and streamlining costs—will be key to maintaining a competitive edge. While India's aviation market is booming, profitability remains elusive, making it clear that the key to success isn't just flying more—it’s flying smarter.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.