CATL's Hong Kong Listing Greenlit

CATL, China's battery behemoth, secures regulatory approval for a Hong Kong listing that could raise at least $5 billion.

According to Reuters, Chinese battery giant CATL has received approval from China's securities regulator for a share sale in Hong Kong, potentially raising at least $5 billion in what could be the city's largest listing in four years. The Shenzhen-based company plans to issue approximately 220 million shares on the Hong Kong Stock Exchange, marking a significant move in the revival of Hong Kong's equity capital markets.

CATL's Global Expansion Strategy

CATL, China's leading battery manufacturer, is aggressively pursuing global expansion as domestic competition intensifies. The company plans to add two new overseas factories to its previously announced six, with potential locations in Spain (in partnership with Stellantis) and Morocco. This expansion is now a top priority, personally led by CATL's chairman Robin Zeng, who has mobilized the company with the slogan "Whoever goes overseas is the hero of the company".

To fuel its international growth, CATL is employing a multi-faceted strategy. This includes building new production facilities, forming joint ventures with global automakers, and licensing its technology to overseas manufacturers. The company is also investing in training its management to better understand international markets and customers, reflecting its commitment to becoming a dominant player in the global EV battery market. With overseas business already accounting for 31% of CATL's total sales in the first nine months of 2024, the company is well-positioned to capitalize on the growing global demand for electric vehicle batteries.

Impact of Hong Kong IPO

The listing is expected to raise at least $5 billion, potentially becoming the largest in Hong Kong since Kuaishou's $6.2 billion offering in 2021. This move comes at a crucial time for Hong Kong's equity markets, which have seen a resurgence in 2025 after three consecutive years of declining deal values.

The IPO's impact extends beyond CATL itself:

- It's part of a broader trend of Chinese companies tapping into Hong Kong's market, with the city surpassing India to become the world's second-largest market for share sales in 2025.

- The listing is likely to attract global institutional investors, particularly those facing restrictions on investing in mainland China-based companies.

- It will enhance the diversity of sectors represented among Hong Kong-listed stocks, which are currently dominated by internet firms and banks.

- The successful listing could further boost investor confidence in Chinese enterprises, potentially leading to more listings and capital inflows in the future.

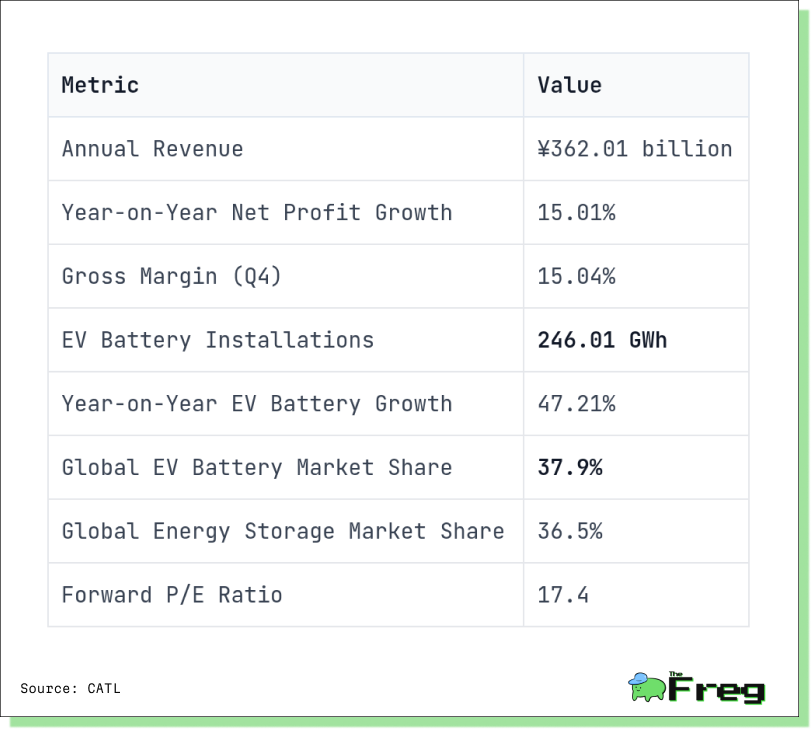

CATL Financial Highlights

This table summarizes CATL's key financial and operational metrics for 2024. Despite a revenue decline due to lower lithium prices, CATL maintained strong profitability and market leadership.