China’s Economic Moves: Stimulus Policies in Action

Beijing is pulling out all the stops to jumpstart its sputtering economy.

China's economy is navigating a critical juncture, with the government implementing a comprehensive stimulus package in September 2024 to counter slowing growth. Focused on monetary easing, property market support, and capital market stabilization, these measures aim to address weak consumer demand, a struggling property sector, and global economic uncertainties, though significant structural challenges persist in transitioning towards a consumption-driven economy.

Stimulus Measures Explained

China's recent economic stimulus package, aims to address the country's economic slowdown through a multi-pronged approach. The package focuses on three key areas:

- Monetary easing: The People's Bank of China (PBOC) implemented interest rate cuts and reduced the reserve requirement ratio (RRR) for banks, injecting liquidity into the financial system.

- Property market support: Measures include lowering mortgage rates on existing homes by approximately 0.5 percentage points, potentially saving homebuyers an estimated RMB 150 billion in interest. The government also launched a RMB 300 billion loan initiative to convert unsold homes into affordable housing.

- Capital market stabilization: While specific details are limited, the package includes efforts to boost investor confidence in the stock market.

These measures represent a significant shift in China's economic policy, moving away from the previous focus on deleveraging and risk control. The stimulus package reflects the government's growing concern over weak consumer demand, a struggling property sector, and global economic uncertainties. While the immediate impact of these measures remains to be seen, they signal Beijing's commitment to maintaining economic stability and achieving its growth targets for 2024 and beyond.

Challenges in Boosting Domestic Demand

China faces significant challenges in its efforts to boost domestic demand, despite recent stimulus measures. The primary obstacle lies in the country's deeply entrenched economic imbalances, with investment representing an unusually high 42% of GDP compared to the global average of 24%, while consumption accounts for only 56% against a global average of 76%. This structural issue makes it difficult to quickly shift towards a consumption-driven economy. Several factors contribute to weak consumer spending:

- High youth unemployment and deflationary pressures are eroding consumer confidence.

- The household sector receives a diminishing share of national income, limiting spending power.

- A rising household savings rate, partly due to economic uncertainties, further constrains consumption growth.

- Efforts to stimulate demand through fiscal measures are limited by concerns over increasing debt levels.

Sustainable growth in domestic demand would require significant reforms to redistribute income towards households, a process that is politically challenging and likely to be gradual. As a result, long-term household consumption growth is projected to slow to around 3-4% annually in real terms over the next five to ten years, potentially limiting overall GDP growth to around 3%.

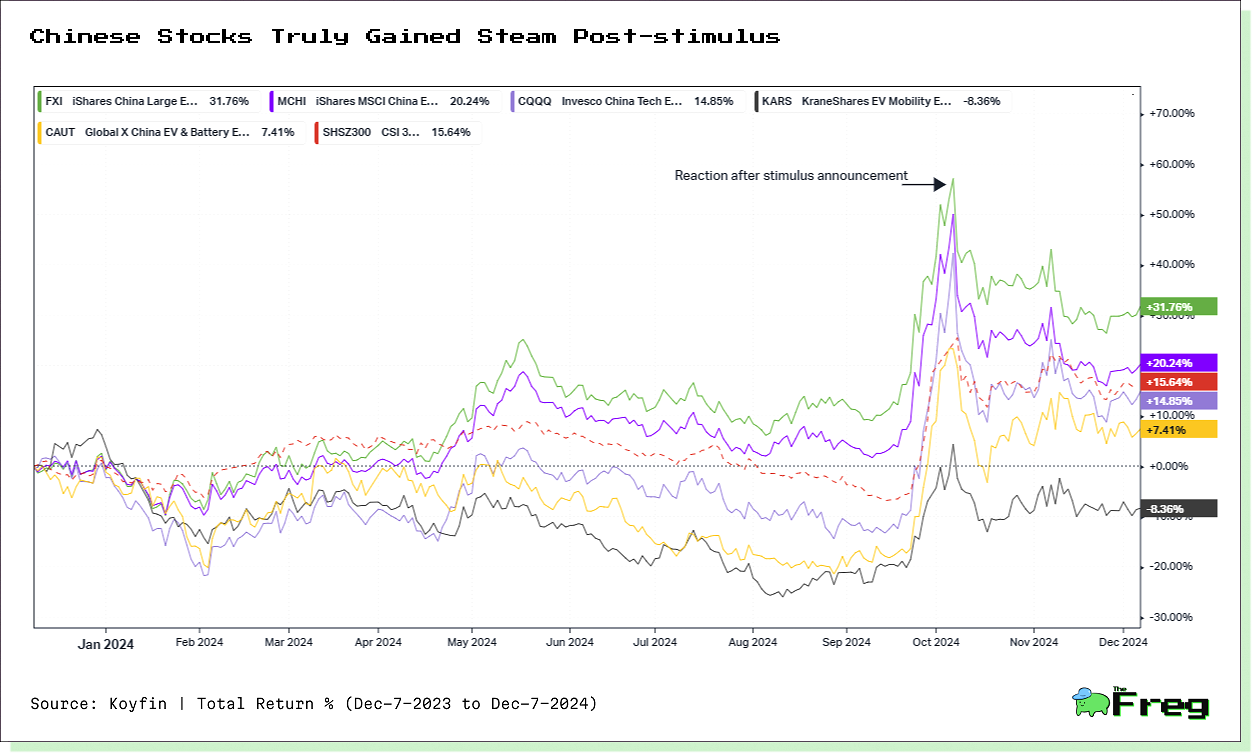

Stock Market Response

The People's Bank of China's announcement of schemes to inject up to 800 billion yuan ($112 billion) into the stock market sparked a rally in Chinese equities. This comes after a period of volatility, with Chinese stocks (CSI 300) down about 7.8% from their October 2024 peak, but up overall. The stimulus measures have particularly boosted investor sentiment in tech and electric vehicle sectors.

Despite the positive market reaction, challenges remain. The implementation of new tariffs between China and the U.S. continues to create uncertainty. However, investors seem to be focusing on potential upcoming trade negotiations and the National People's Congress meeting for further economic direction.

China's Economic Indicators Post-Stimulus

China's economic indicators showed mixed results in December 2024, reflecting the impact of stimulus measures introduced in September. Industrial output expanded by 6.2% year-on-year, surpassing expectations and indicating a robust manufacturing sector response to the stimulus.

Retail sales jumped 3.7% from a year earlier, exceeding forecasts and suggesting a gradual improvement in consumer spending. However, the property sector continued to face challenges despite targeted support measures. While there were signs of stabilization, the real estate market remained a drag on overall economic growth. Here's a summary of key metrics as of December 2024:

The data suggests that while the stimulus measures have had a positive impact on industrial production and consumer spending, the property sector continues to face headwinds. The government's efforts to balance growth with risk management in the real estate market remain a key challenge for China's economic recovery.

China's Economic Balancing Act

China's economic challenges persist as the world's second-largest economy implements measures to revive growth. Beijing has introduced a $1.4 trillion stimulus package, encompassing monetary easing, property market support, and stock market interventions.

However, the transition from an investment-driven model to a consumer-focused economy remains complex. Encouraging consumer spending is a significant hurdle. With high savings rates and economic uncertainty, Chinese households are cautious with their spending. Additionally, trade tensions, including tariff threats from the U.S., add further pressure.

Policymakers are balancing short-term stimulus with long-term structural reforms, a delicate process requiring precision and strategic planning. The critical question is whether China can achieve this economic shift without major setbacks. The global economy closely monitors these developments, as China's performance has far-reaching implications.