China’s High-Stakes Defense of the Yuan

China intensifies yuan defense and bans rare earth exports as U.S. tariffs surge, escalating the most intense trade standoff yet.

As trade tensions with the United States heat up again, China is stepping in to protect its currency and calm its markets. The Chinese government is using both its central bank and major state-backed investors to keep the yuan from falling and to stop stock prices from crashing.

Tariff Escalation Timeline

A quick look at how this trade battle intensified:

- Feb 1, 2025: Trump signs Executive Order — 10% tariffs on all Chinese imports

- Feb 4: China hits U.S. coal, LNG, and crude oil with 10–15% tariffs

- Mar 3–4: Both sides raise tariffs again—20% from the U.S., 15% more from China

- Apr 2–4: U.S. and China add another 34% each

- Apr 7: U.S. adds a shocking 50% boost

- Apr 9: Final blow—U.S. tariffs hit 145%, China hits 84% and bans rare earth exports

Rare earth ban alert: These materials are essential for EVs, smartphones, defense systems, and more. This ban directly threatens U.S. tech and military supply chains.

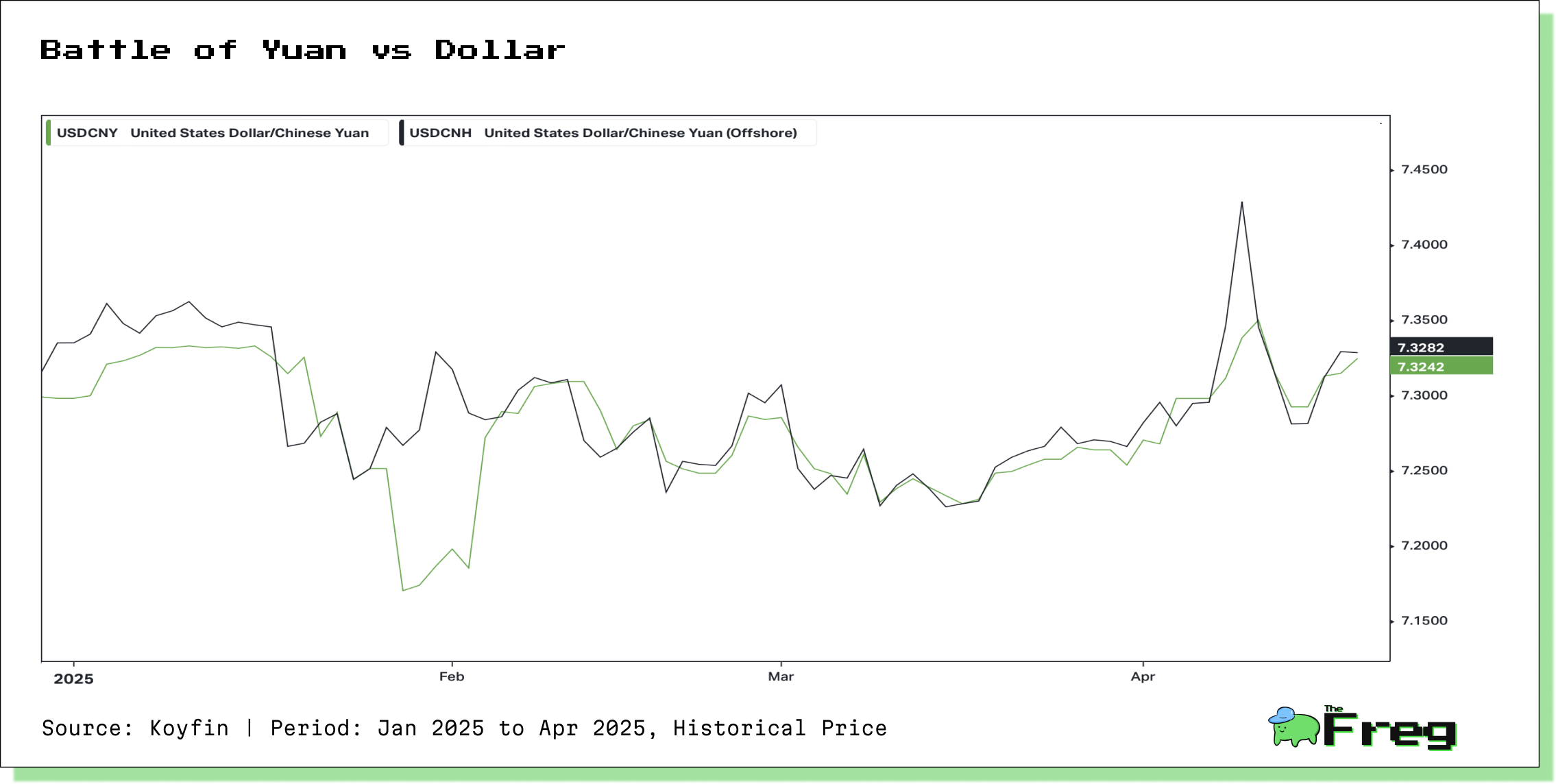

The Yuan Drops—China Responds Fast

When Donald Trump announced new tariffs on Chinese goods, the yuan dropped to its lowest level in seven weeks. In response, China’s central bank—the People's Bank of China (PBOC)—told big state-owned banks to stop buying U.S. dollars and instead start buying yuan to push its value back up.

The PBOC also held firm on the yuan’s official daily value, which it sets each day. By not allowing that rate to drop, the central bank sent a strong message that it won’t allow the currency to weaken too quickly. This tactic is used to prevent panic in the markets and discourage people from moving money out of China.

Stock Market Help from the “National Team”

While the central bank supports the currency, another group—known as the “National Team”—helps support the stock market. This team includes government-controlled funds like Central Huijin Investment and China Securities Finance Corporation. When stock prices drop sharply, they jump in and buy large amounts of shares and ETFs (exchange-traded funds) to stop the slide.

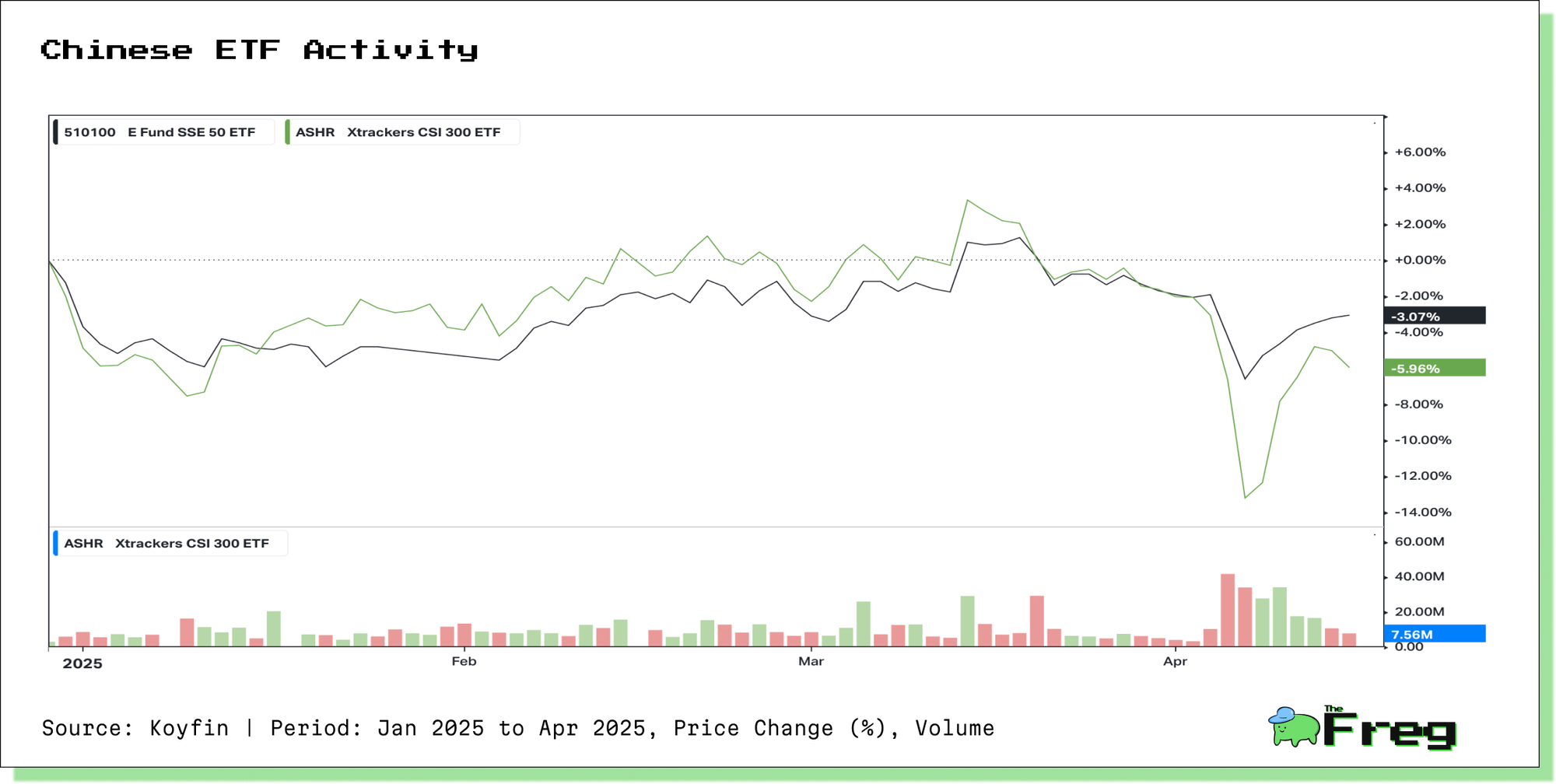

In April 2025, after a 7% plunge in Chinese stocks, the National Team made a big move. They promised to invest over 180 billion yuan (around $24 billion) and started buying up popular ETFs like the Harvest CSI 300 and E Fund SSE 50, which saw record-breaking trading activity. Thanks to this effort, the market quickly recovered, with major indexes rebounding the next day.

Does All This Intervention Really Work?

While these efforts can calm markets in the short term, they raise some serious questions. Can investors trust a market that’s so tightly controlled by the government? Some experts worry that frequent intervention makes it harder to know the true value of stocks and the currency.

This isn’t the first time China has stepped in like this. Back in 2015, after a market crash, the government froze stock trading for over half the listed companies, banned big investors from selling, and changed market rules overnight. Critics say it felt like the rules of the game were being rewritten to benefit the government.

What It Means for the Rest of the World

In a parallel move to buffer against U.S. shocks, China is strengthening ties in its own neighborhood:

At a major diplomacy conference (April 8–9), President Xi Jinping called for:

- Stronger regional alliances

- Deeper supply chain integration

- Constructive dispute resolution

This strategy aims to reduce reliance on U.S. trade and create new outlets for Chinese goods, tech, and capital.

China’s currency and equity moves don’t happen in isolation:

- Chinese equities influence nearly 50% of short-term Asian market swings

- Currency instability or overreaching intervention could shake global confidence

With the trade war entering its most volatile phase yet, China is all-in on damage control—tightening currency controls, propping up stocks, and pivoting toward regional partnerships. The world is watching not just how China reacts, but whether this intervention-heavy model can hold up under pressure.