China’s Overspill: Will ASEAN Pay the Price?

ASEAN must ask itself: does it want to be China’s outlet mall—or its economic equal?

In 2024, China posted a record-shattering $992 billion trade surplus. While that number turned heads globally, it’s causing real distress a bit closer to home—in Southeast Asia.

As Chinese factories hum at overcapacity, Southeast Asia finds itself at the receiving end of an export deluge. With excess goods flooding ASEAN markets at unbeatable prices, regional economies face mounting risks: job losses, deflation, and widening trade imbalances.

The key question: Is ASEAN becoming the dumping ground for China’s industrial overspill?

Overcapacity on Overdrive

China’s manufacturing machine has hit overdrive. Backed by over $1.7 trillion in subsidies since 2018 through the Made in China 2025 initiative, Chinese production in sectors like petrochemicals, solar panels, and electric vehicles now exceeds global demand by 20–30%.

This isn’t just about volume—it’s about efficiency. Chinese factories boast

40–50% higher output than their ASEAN counterparts in key sectors. When combined with aggressive pricing strategies, the result is devastating for regional competition.

Chinese firms are leveraging ASEAN not just as a factory floor—but increasingly, as a market for their surplus

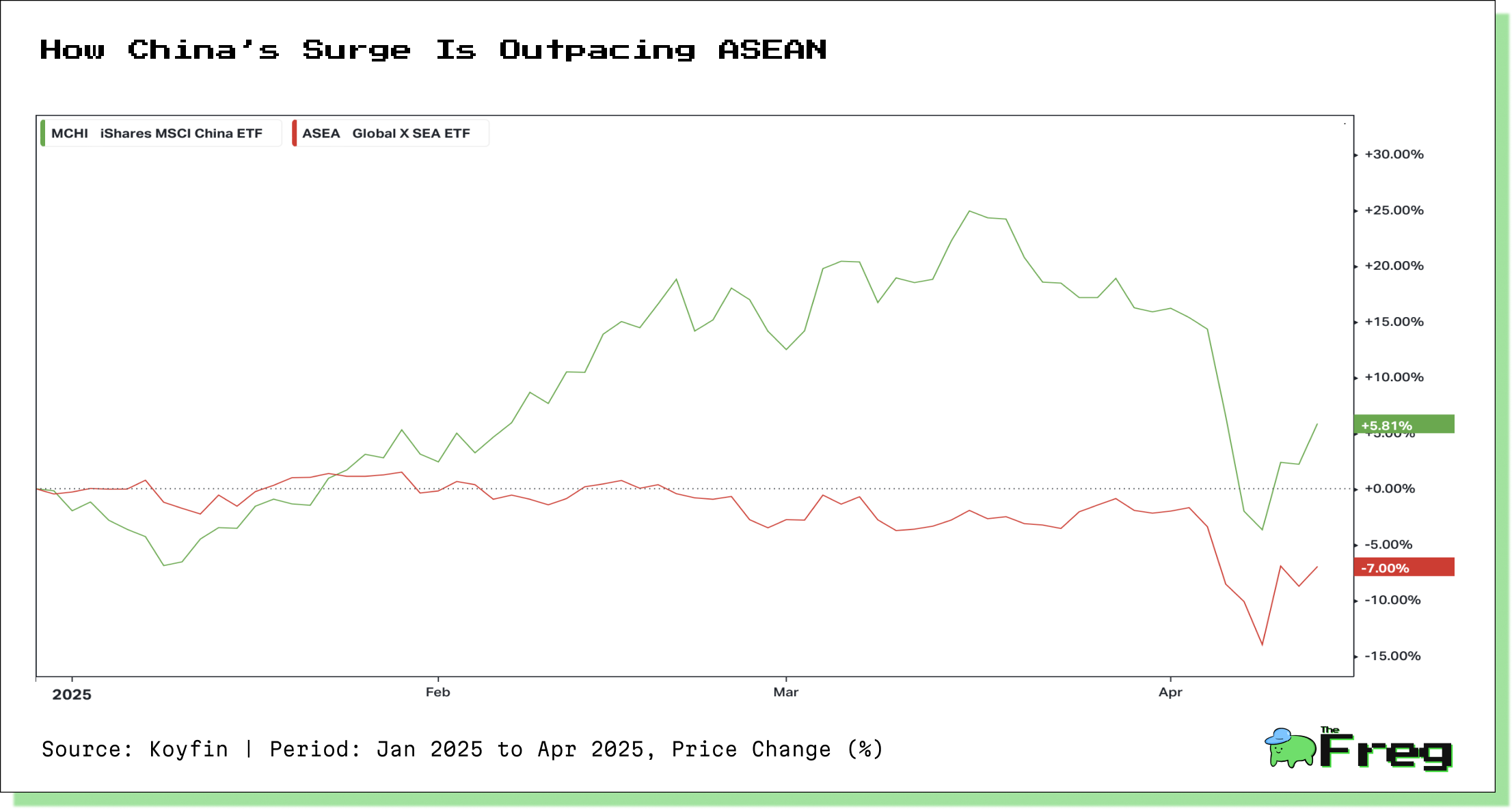

ASEAN Takes the Hit

The economic damage is already visible:

- Indonesia lost 12,000 textile jobs in March 2025 alone, due to a surge in $4 billion worth of Chinese fabric imports.

- Malaysia’s $30 billion EV investment is at risk, threatened by a 41% increase in Chinese EV and battery exports.

- The Asian Development Bank downgraded ASEAN’s 2025 GDP forecast from 4.8% to 4.1%, citing widening trade imbalances.

The producer price index for the region fell 1.2% in Q1 2025—a sign of deflationary pressure driven by an influx of cheap Chinese goods.

The Currency Card

Another twist? The yuan’s depreciation since 2024. With the offshore yuan hitting historic lows (7.428 against the USD), Chinese imports are now

15–20% cheaper than local products in ASEAN markets.

While a full-blown devaluation seems unlikely—Beijing fears capital flight—controlled depreciation remains on the table, sharpening China’s pricing edge even further.

Policy Whack-a-Mole

In response, ASEAN governments have launched a mix of defensive and strategic policies:

- Thailand imposed 25% tariffs on Chinese steel.

- Vietnam tightened EV import regulations.

- Malaysia and Indonesia spent $12 billion in Q1 2025 to stabilize their currencies against yuan volatility.

Longer-term moves include:

- The Philippines' $5B semiconductor fund to move up the value chain.

- Vietnam and Thailand boosting exports to India and the Middle East by 18%.

- Malaysia’s push for regional tariff coordination during its ASEAN chairmanship.

E-Commerce: The Quiet Invasion

China’s overspill isn’t just hitting traditional trade. Through cross-border e-commerce, millions of low-value parcels land in Vietnam and Indonesia daily—cheap, fast, and disruptive.

At the same time, Chinese firms are relocating production into ASEAN, particularly in clean energy. While this might bring investment, it also risks displacing local suppliers and deepening economic dependency.

Bracing for Impact

If left unchecked, China’s overspill could trigger a cascade of issues across ASEAN:

- Deflation, reducing consumer spending and investment.

- Industrial displacement, as local firms fold under price pressure.

- A $190+ billion trade deficit with China, straining FX reserves.

- Greater scrutiny from the West, wary of Chinese-linked supply chains.

ASEAN must respond not just with stopgaps, but with vision: deeper industrial policy, regional cohesion, and smart export diversification.

Final Word: Resist or Ride the Tide?

China’s economic overspill is not a one-off. It’s the structural outcome of state-backed overcapacity, and it’s not going away anytime soon.

So ASEAN stands at a crossroads.

Will it absorb the shock, risking industrial hollowing and economic imbalance? Or will it step up, upgrade, and fight back with strategic coordination?

“China’s overspill isn’t just a surplus story—it’s a stress test for ASEAN’s economic future.”