Chinese Stocks Surge Past EM Peers

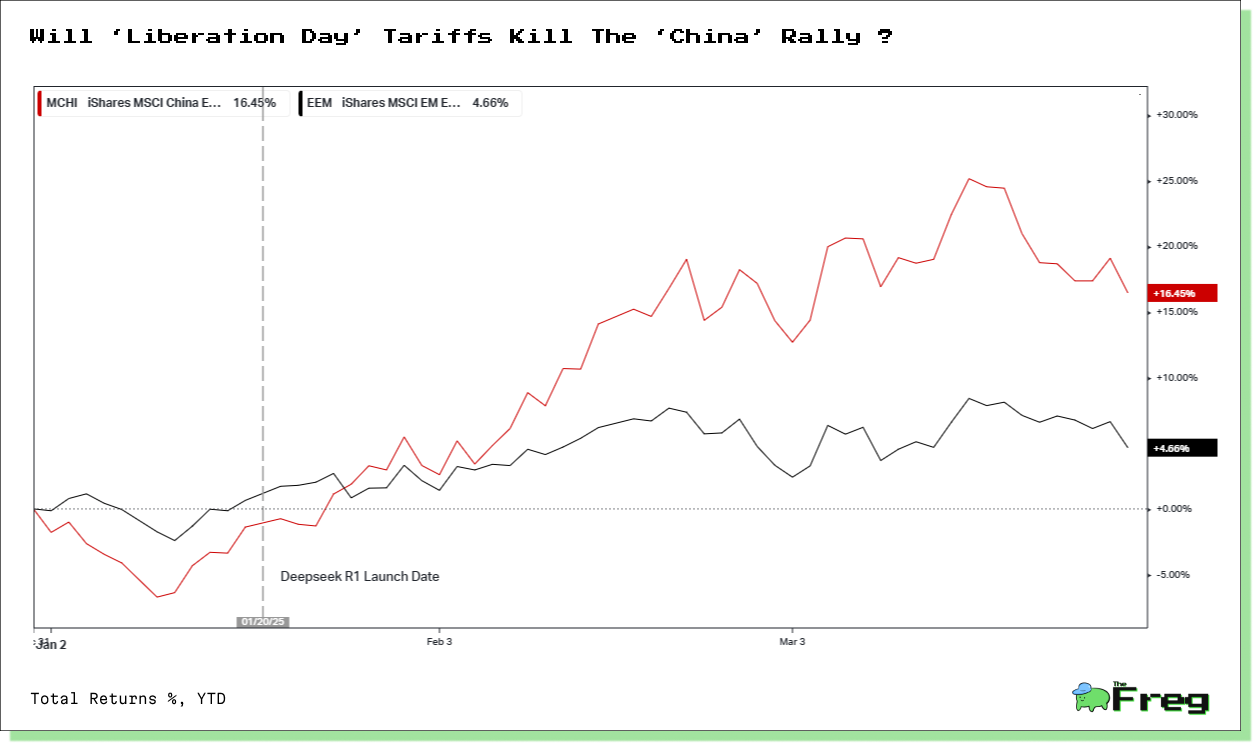

China's tech stocks have surged, outpacing global and emerging market peers amid an AI boom. The "7 Titans," including Alibaba and Tencent, have added $439 billion in market value, while broader emerging market equities have largely stagnated.

Chinese stocks, particularly in the tech sector, have been outpacing their emerging market counterparts, driven by a surge in artificial intelligence enthusiasm and renewed investor optimism. According to Bloomberg, mainland equities have experienced a significant rally in recent months, breaking free from a prolonged downturn, while broader emerging-market indices have remained relatively stagnant.

DeepSeek's Role in AI Boom

DeepSeek, a Chinese AI startup, has emerged as a disruptive force in the global AI landscape, challenging the dominance of US tech giants and sparking a reevaluation of AI stock valuations. The company's breakthrough in developing high-performance AI models at a fraction of the cost of its Western counterparts has sent shockwaves through the tech industry. DeepSeek's success is attributed to its innovative approach, including the use of commercial off-the-shelf hardware, a streamlined training pipeline, and advanced knowledge distillation techniques.

The impact of DeepSeek's achievements extends beyond technological advancements, influencing market dynamics and investor sentiment. Its rapid rise to the top of app store charts and claims of matching leading US models' performance have triggered a significant reassessment of AI stocks, particularly affecting tech giants like Nvidia, Microsoft, and Meta. This shift has not only highlighted the potential for more cost-effective AI development but also raised questions about the sustainability of massive investments made by US companies in AI infrastructure. Just look at CoreWeave here.

Impact of Chinese Stimulus Policies

China's recent economic stimulus package, unveiled in September 2024, has triggered a significant rally in Chinese stocks and impacted global markets. Although the gains due to stimulus has been pared before DeepSeek drove it to new highs.

The comprehensive measures included interest rate cuts, reduced reserve requirements for banks, and support for the struggling real estate sector. This stimulus had led to immediate positive reactions in both mainland and Hong Kong stock markets, with the Hang Seng Index reaching its highest point since March 2022.

The impact extends beyond Chinese markets, affecting various global industries. Mining companies like Freeport-McMoRan saw their shares rise due to increased demand for metals, while luxury goods makers such as LVMH and Burberry also benefited from the potential boost in Chinese consumer spending. However, economists caution that these measures may not be sufficient to fully address China's weak domestic demand, suggesting that additional fiscal easing may be necessary to sustain long-term economic growth.

China Outpacing EM Peers

The MSCI China Index has demonstrated remarkable outperformance compared to its emerging market peers, excluding China, in recent months. Since the end of August, the MSCI China Index has surged by 32%, while the MSCI Emerging Markets Index (ex-China) has only delivered 2%. This divergence marks a significant shift from historical patterns where broader EM stocks typically moved in tandem with China.

Several factors have contributed to China's market resurgence:

- Government stimulus measures aimed at revitalizing the economy

- A technology-driven boom, particularly in AI-related sectors

- Attractive valuations, with Chinese stocks trading at a substantial discount to other emerging markets

- Renewed investor optimism following a prolonged downturn

Emergence of China's '7 Titans'

China's tech sector has seen a remarkable resurgence, with the emergence of the "7 Titans" - a group of leading Chinese technology companies that have outperformed their American counterparts in 2025. This group, coined by Societe Generale SA, includes Alibaba, Tencent, Xiaomi, BYD, SMIC, JD.com, and NetEase. These companies have collectively added $439 billion to their market value, with their stocks surging over 45% year-to-date.

The rise of the 7 Titans has been fueled by several factors:

- Government support: Beijing's recent initiatives to enhance tech sector support have bolstered investor confidence.

- AI innovations: Companies like Alibaba have unveiled new AI tools, showcasing China's competitive edge in this field.

- Attractive valuations: The 7 Titans trade at 18 times forward earnings, a 40% discount compared to the US "Magnificent Seven".

- DeepSeek's impact: The emergence of DeepSeek, a Chinese AI startup, has challenged perceptions about China's AI capabilities.

This shift in market dynamics represents a significant reversal from earlier expectations and highlights China's growing technological prowess on the global stage.