Code, Conflict, and Capital: How Geopolitics Shapes Indian IT

India’s $283 billion IT industry is navigating global uncertainties, adapting to geopolitical tensions, evolving H-1B visa policies, and shifting enterprise spending patterns.

Geopolitical tensions and economic uncertainty are reshaping IT spending patterns among Indian enterprises. With the $283 billion Indian IT sector navigating a complex landscape, companies are adopting new strategies to mitigate risks and maintain growth.

Geopolitics Reshaping IT Spending

Geopolitical events are significantly reshaping IT spending patterns among Indian companies, with several key occurrences driving these changes:

- US-China trade tensions: Increased investment in supply chain diversification and cybersecurity to reduce dependence on Chinese technology.

- Russia-Ukraine conflict: Accelerated spending on cloud services and data localization to ensure business continuity and data sovereignty.

- Global economic uncertainty: Shift toward cost-optimization strategies, leveraging AI and automation for efficiency gains.

- Cybersecurity threats: Rising geopolitical tensions have led to increased spending on advanced security solutions to combat state-sponsored cyberattacks.

- Regulatory changes: New data protection laws and trade restrictions are driving investments in compliance and risk management technologies.

These geopolitical factors are pushing Indian IT companies to reallocate budgets toward resilience-building technologies and strategies to navigate an increasingly complex global landscape.

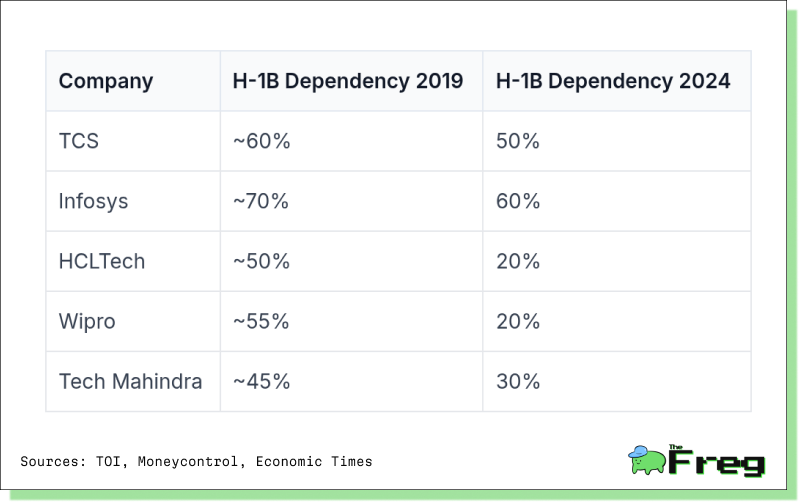

H-1B Visa Policy Shifts: Less Impact, More Resilience

Changes to H-1B visa policies were once considered a major threat to Indian IT firms. However, leading players like TCS, Infosys, and Wipro have significantly reduced their dependence on these visas, making them less vulnerable to regulatory shifts.

Key Adaptations:

- Reduced Visa Dependency: TCS now hires over 50% of its U.S. workforce locally, needing only 3,000-4,000 H-1B visas annually.

- Increased Local Hiring: Infosys reports 60% of its U.S. workforce consists of local hires.

- Cost Adjustments: Stricter visa policies could increase operational costs by 10-30%, but companies are better prepared to absorb the impact.

- Offshoring Gains: Tightened U.S. visa rules may actually boost offshoring, as American firms struggle with talent shortages and rising labor costs.

BFSI Sector’s Evolving IT Investment Strategies

The Banking, Financial Services, and Insurance (BFSI) sector is shifting its IT spending priorities amid global risks. With competition from fintech startups and big tech firms, banks are directing budgets toward innovation and resilience.

Key IT Spending Trends:

- Risk Management Focus: Increased investments in anti-financial crime tools, AI-driven governance, and cybersecurity.

- Digital Transformation: Adoption of cloud computing, artificial intelligence, and big data analytics for better efficiency and customer engagement.

- Rise in Software Spending: Software investments are outpacing hardware and services, highlighting a move towards modernized business platforms.

- In-House Tech Development: Banks are investing in internal talent, with self-developed applications rising by 40% from 2013 to 2022.

Market Impact: Global IT spending in the BFSI sector is expected to hit $59.9 billion in 2024, a 4.9% increase from the previous year.

AI’s Expanding Role in IT Cost Optimization

Indian enterprises are turning to artificial intelligence to manage IT budget constraints while driving efficiency and innovation.

How AI is Reshaping IT Budgets:

- Automated Processes: AI-powered automation reduces legacy system maintenance costs by up to 25%.

- Smarter Resource Management: AI-driven analytics optimize project workloads and IT resource allocation.

- AI-Augmented Talent: AI tools help IT professionals complete coding tasks 56% faster, reducing reliance on specialized hires.

- Optimized IT Investments: AI insights improve decision-making, potentially boosting project success rates by 25%.

Projected Growth: AI spending in India is expected to grow 2.2 times faster than overall digital technology spending over the next three years, generating $115 billion in economic impact by 2027.

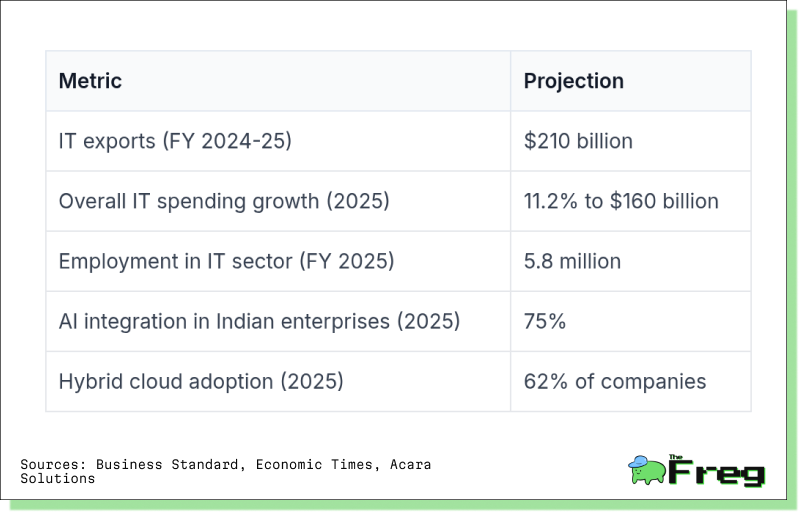

What’s Next for India’s IT Industry?

The Indian IT sector is poised for significant growth and transformation in the coming years, driven by emerging technologies and changing market dynamics. Here's a snapshot of key projections and trends for the industry:

The industry is expected to surpass the $300 billion revenue milestone in FY26, with growth rates gradually increasing from 4% in FY24 to 5.1% in FY25, and potentially 6% in FY26. Key drivers of this growth include increased spending on software, IT services, cybersecurity, business intelligence, and data analytics. The sector is also likely to benefit from rising artificial intelligence deals and continued expansion of the workforce. However, challenges remain, including the need for upskilling in niche and core tech areas, which will be crucial for sustaining growth momentum.