Commodities Roar Ahead in 2025 as Markets Navigate Crosswinds

Amid market volatility and geopolitical tension, commodities continue to outperform equities in 2025. From gold to copper, investors are shifting toward tangible assets in a rapidly evolving global landscape.

In a year already marked by volatility and uncertainty, the commodities market has emerged as a rare bright spot, surging ahead while equities falter and geopolitics intensify. With the Bloomberg Commodities Index up 8.3% in the first quarter, 2025 is proving to be a banner year for raw materials—led by staggering rallies in gold, copper, and oil.

A Shift in Market Sentiment

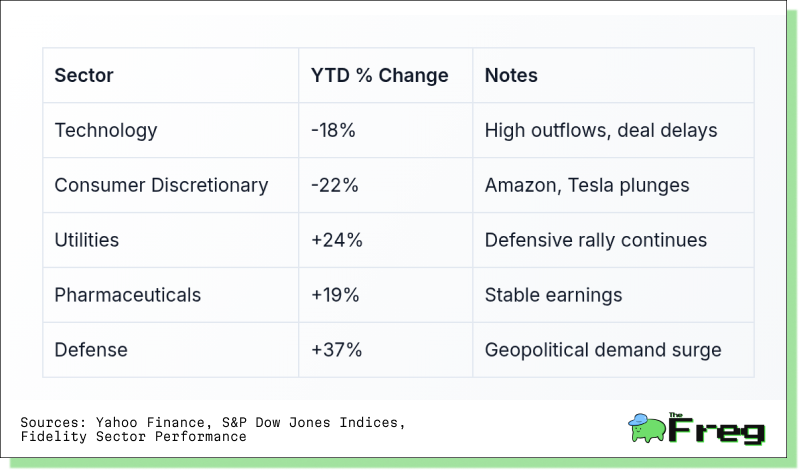

Equity markets, especially in the U.S. and Asia, have taken a bruising. The S&P 500 notched its worst quarterly performance in three years, falling 4.4%, while the Nasdaq suffered steeper losses. Meanwhile, European and UK equities posted gains, and emerging markets—boosted by China’s rebound and a precious metals rally—outperformed. In stark contrast, commodities took center stage, with gold leading the charge, followed closely by industrial metals.

This sectoral rotation underscores a broader shift in investor sentiment. As geopolitical risks mount and inflation expectations stir, markets are recalibrating. Defensive sectors like utilities, pharmaceuticals, and defense are rallying, while speculative tech and consumer discretionary stocks are tumbling. Amazon and Tesla are down 17.3% and 33.5% respectively this year, as investor appetite for growth-oriented plays wanes.

The Geopolitical Engine

At the heart of this commodities rally lies a potent mix of geopolitical instability and supply chain upheaval. Gold, for example, has surged over 28% year-to-date, breaking past $3,382 per ounce in April—a record high. Central banks are hoarding the metal, adding 1,136 metric tons in 2024, the largest annual haul since 1967.

Elsewhere, copper is enjoying a nearly 19% uptick, buoyed by demand from electric vehicles, data centers, and renewable energy infrastructure. Crude oil has also rallied, despite fears of oversupply. OPEC+ surprised markets by accelerating production increases in April, pushing prices down momentarily but signaling longer-term resilience.

Trump’s revived trade war rhetoric has further roiled markets. Proposed tariffs—60% on Chinese imports—have spooked investors and triggered inflation fears. China’s retaliation, particularly with export controls on rare earth minerals, has heightened tensions, with ripple effects across global supply chains.

Inflation Hedge or Recession Warning?

The sharp rise in commodity prices, particularly gold, is sending mixed signals. On one hand, it reflects classic safe-haven behavior amid recession fears. On the other, it suggests a return of inflation worries. JPMorgan and Goldman Sachs have raised their recession odds to 45% and 60% respectively, while betting markets now price in a 62% chance of a downturn.

The U.S. yield curve, which steepened from -0.5% to 0.3% in early 2025, is flashing recession warnings. The Atlanta Fed estimates Q1 GDP contracted by 2.2%, factoring in soaring gold imports. For many investors, capital preservation has trumped returns—a mindset not seen since the pandemic-era economic shocks.

Tangible Assets Over Tech Dreams

The pivot from tech to tangibles is unmistakable. Technology-focused mutual funds have shed up to 18% this year, with deal delays plaguing sectors from banking to manufacturing. Meanwhile, defensive sectors are thriving—utilities are extending their 2024 rally, and the defense sector is up 37% in 2025.

Financial services and pharmaceuticals have also gained ground, each up around 19%. Investors are clearly repositioning portfolios, favoring long-duration U.S. Treasuries, gold, and the dollar. These traditional hedges have grown volatile but remain core components of risk-off strategies.

Commodities by the Numbers

A closer look at the supply-demand dynamics reveals stark contrasts:

- Gold: Central bank purchases and Chinese institutional mandates are driving demand. A growing supply deficit—projected to hit 1,200 tons by Q4—could push prices to $4,500/oz, according to Goldman Sachs.

- Oil: Demand is rising modestly, but OPEC+ policy shifts and disruptions in Nigeria and Libya are creating volatility. Brent crude hovers between $70-$75/barrel.

- Copper: The green energy transition is a structural demand driver, with deficits expected to reach 1.8 million tonnes by 2027. Chinese output cuts and declining ore quality amplify the bullish outlook.

Energy Transition Metals: The Next Frontier

Clean energy technologies are rewriting the rules of commodity demand. The International Energy Agency projects a sixfold increase in critical minerals consumption by 2050. EVs are already the largest consumers of lithium, with demand for nickel, cobalt, and graphite surging.

Yet supply is lagging. Production gaps exceed two-thirds for several key minerals. McKinsey estimates a $2.1 trillion investment is needed by 2050 to meet net-zero targets. Copper, lithium, and platinum face particularly acute shortfalls, setting the stage for long-term price appreciation.

A Market Redefined

2025 is reshaping market assumptions. The divergence between equities and commodities, the geopolitical realignments, and the flight to tangible assets suggest we’re entering a new investment regime. In this world, diversification isn’t just prudent—it’s essential.

As inflation flares and trade wars deepen, commodities aren’t just participating—they’re leading. And for investors attuned to these shifts, the rally may be just beginning.