Confidence on the Brink

Consumer confidence has plunged to historic lows, driven by inflation, wage stagnation, rising debt, and widespread economic and political uncertainty.

Consumer confidence in the U.S. has dropped to 50.8—its second-lowest level since 1952. It’s not just a statistic—it’s a signal. From grocery bills to global conflict, Americans are feeling the weight of uncertainty. While inflation, stagnant wages, and rising debt top the headlines, the deeper story is about eroding trust: in the markets, in leadership, and in the economy itself.

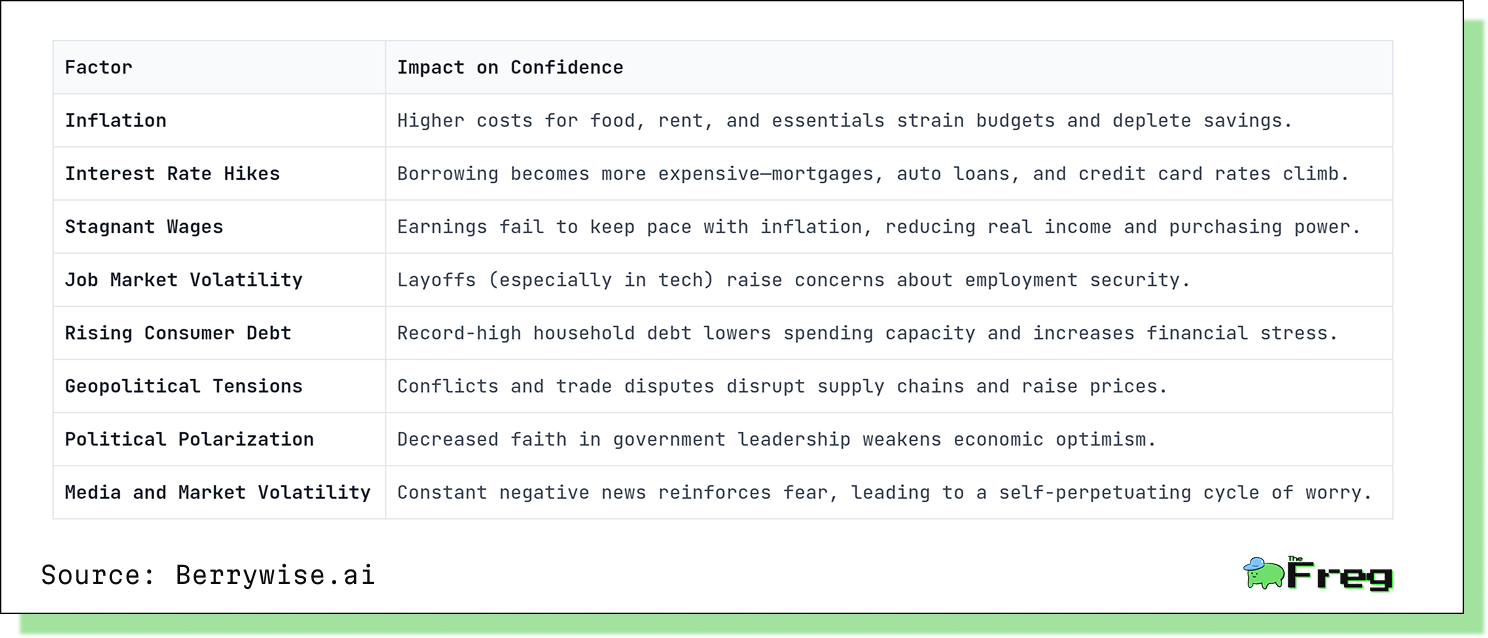

What’s Driving the Decline?

To better understand this economic mood shift, here’s a snapshot of the key pressure points:

Inflation: The Everyday Economic Squeeze

It’s no surprise inflation leads the list. Essentials like groceries, energy, and rent have surged in price. With pandemic-era savings largely exhausted, families are now relying more on credit. This has left households increasingly vulnerable to financial shocks.

To fight inflation, the Federal Reserve has raised interest rates—but this fix has come at a cost. Mortgage rates are climbing, credit card balances are more expensive to carry, and small business loans are harder to secure. Consumers are stuck between rising costs and rising debt.

Stagnant Wages, Uneasy Jobs

While unemployment remains low, wage growth has failed to keep up with the rising cost of living. This erosion of purchasing power leaves families with less disposable income and fewer financial options.

Adding to the tension is job market volatility, especially in the tech sector, where layoffs have made headlines for months. Even those with stable employment are beginning to question how long that stability will last. As financial uncertainty creeps in, confidence continues to erode.

Global Tensions, Local Consequences

Economic anxiety isn’t just about domestic pressures—it’s global. Geopolitical tensions, including the war in Ukraine and rising friction between the U.S. and China, have disrupted trade and supply chains, driving up costs and limiting product availability.

Simultaneously, the stock market has remained volatile, shaking investor confidence and shrinking household wealth. Rising interest rates have also cooled the housing market, pushing homeownership further out of reach for many Americans. Combined, these factors paint a picture of instability that further chips away at consumer optimism.

Debt Is Mounting—and It's Holding Us Back

U.S. household debt has reached record levels, now estimated at nearly 40% of GDP. From traditional credit cards to emerging “Buy Now, Pay Later” schemes, consumers are taking on more debt just to keep pace with rising expenses.

But as interest rates climb, the cost of managing this debt grows, leaving consumers with fewer resources for future spending. What might appear as resilience in the short term is masking a more vulnerable long-term financial picture. The weight of this debt load is a key contributor to declining consumer confidence.

Perception Matters: The Psychological Toll

Beyond economics, perception plays a powerful role. Continuous news coverage of inflation, layoffs, and recession risks has created a climate of fear and pessimism. Consumers are bombarded with negative headlines, and that media cycle feeds a growing sense of helplessness.

Compounding the issue is political polarization. Many Americans have lost confidence in the government's ability to manage the economy effectively. That lack of trust fuels uncertainty—and economic decisions are made as much from emotion as from spreadsheets.

History’s Warning Signs Are Flashing

The current decline in consumer confidence resembles the warning signs seen before major downturns, such as the 2008 financial crisis. Notably, the Conference Board’s Expectations Index has fallen to 65.2—a level that historically signals a high risk of recession.

What makes today’s landscape unique, however, is the backdrop of a post-pandemic recovery, evolving global tensions, and unprecedented fiscal responses. These complexities make it difficult to predict whether the current trend will stabilize—or deepen into a broader economic slide.

What Needs to Happen Now

Consumer confidence is not just a reflection of economic data—it’s a forward-looking gauge of how people feel about their financial future. When confidence falls, spending slows, investment stalls, and the entire economy feels the ripple effects.

To reverse this trend, policymakers, business leaders, and financial institutions must focus not just on stabilizing economic fundamentals, but also on restoring trust. Addressing inflation, supporting real wage growth, and providing clearer communication about future policy will be essential steps.