Crypto Custody: How Secure Are Bitcoin ETPs

The cryptocurrency market continues to grapple with significant security breaches, with billions lost between 2019 and 2023. As custodians adopt advanced measures, the need for robust, secure solutions grows amid increasing cyber threats.

BlackRock's launch of a physically backed Bitcoin ETP in Europe signals a significant moment for the evolving cryptocurrency market. As reported by Yahoo Finance, this move spotlights the growing importance of secure custody solutions—a critical aspect for both institutional and retail investors navigating a landscape marked by cyber threats.

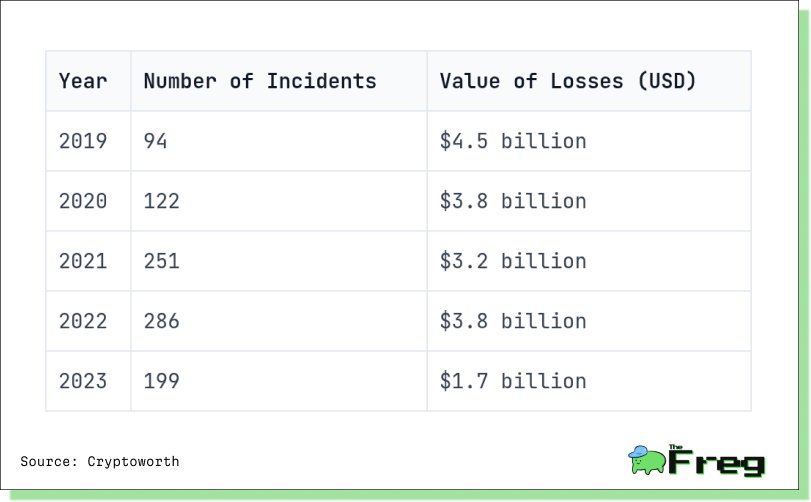

A Look at the Data: The Cost of Crypto Breaches

Between 2019 and 2023, the cryptocurrency market faced numerous security breaches, resulting in billions of dollars in losses. Notably, the peak in hacking incidents occurred in 2022, with 286 reported cases, while the highest financial losses, totaling $4.5 billion, were recorded in 2019. Despite a decline in incidents and losses in 2023, the data underscores a persistent threat to the market's stability.

Hacking Incidents Exposing Custody Vulnerabilities

The industry's vulnerability was starkly highlighted in February 2025 when Bybit, a prominent cryptocurrency exchange, fell victim to a devastating cyberattack that drained approximately $1.5 billion in Ethereum tokens—the largest exploit to date. This incident illustrated the evolving tactics of cybercriminals and exposed persistent weaknesses in crypto custody infrastructure.

Even with sophisticated safeguards like cold storage and multi-signature wallets, custodians face various threats: UI manipulation, phishing, malware attacks, internal mismanagement, and hardware or software failures. The consequences extend beyond financial losses, threatening investor confidence and intensifying regulatory scrutiny.

The Vital Role of Custodians and Security Protocols

Custodians serve as the gatekeepers of digital assets, relying on a combination of cold and hot storage solutions to secure holdings. Cold storage, which keeps private keys offline, remains a gold standard for safeguarding against cyberattacks. Top custodians like Komainu—an initiative by CoinShares, Nomura, and Ledger—adhere to stringent security protocols, including 24/7 network monitoring, segregated networks, regular external penetration testing, and compliance with global standards.

Despite these measures, the cryptocurrency sector continues to grapple with substantial security breaches. Over $2.1 billion in losses were reported in the first three quarters of 2024 alone, underscoring the necessity of regulated custodians that prioritize robust security measures and asset segregation.

Institutional vs. Retail Custody Confidence

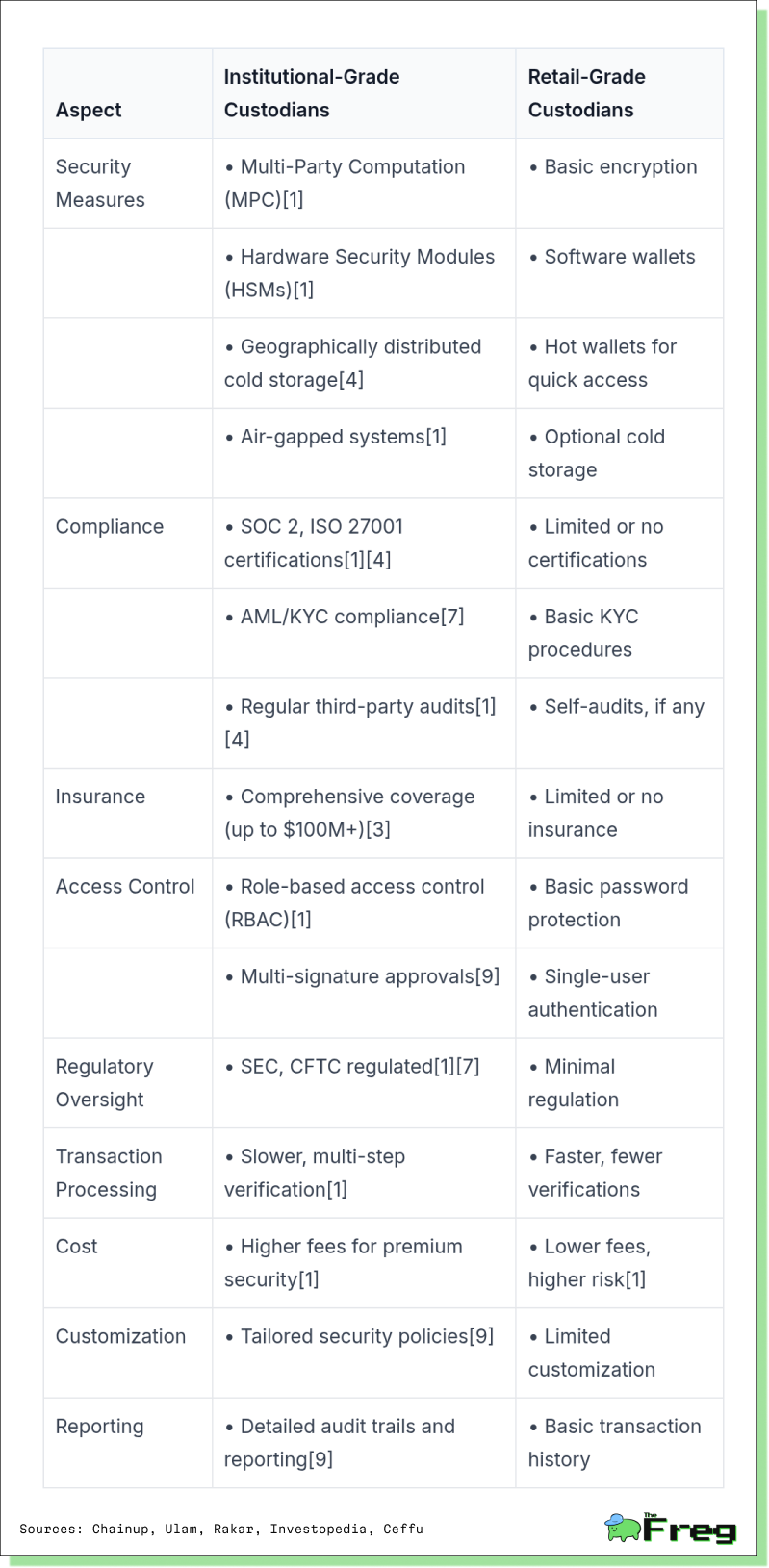

Conversely, retail investors often opt for self-custody solutions or exchange-based wallets, which, though accessible and cost-effective, lack the sophisticated security frameworks seen in institutional-grade custody. Institutional investors generally place greater trust in custody solutions than retail investors, largely due to the rigorous security standards and compliance frameworks offered by institutional-grade custodians. These providers often implement advanced measures like Multi-Party Computation (MPC) and Hardware Security Modules (HSMs) while ensuring compliance with AML/KYC standards.

The Road Ahead: Enhancing Crypto Custody

As the cryptocurrency market continues to mature, the future of custody solutions lies in advanced technologies and collaborative approaches. AI-driven fraud detection, automated compliance monitoring, Proof of Reserves (PoR) for transparency, and insurance-backed protection are set to redefine standards.

The integration of tokenized traditional assets and deeper collaboration between traditional finance and crypto-native firms promise more sophisticated, secure, and compliant solutions for both institutional and retail investors. Balancing accessibility, compliance, and robust security will be essential as the industry navigates the complexities of safeguarding digital assets in an increasingly interconnected financial landscape.