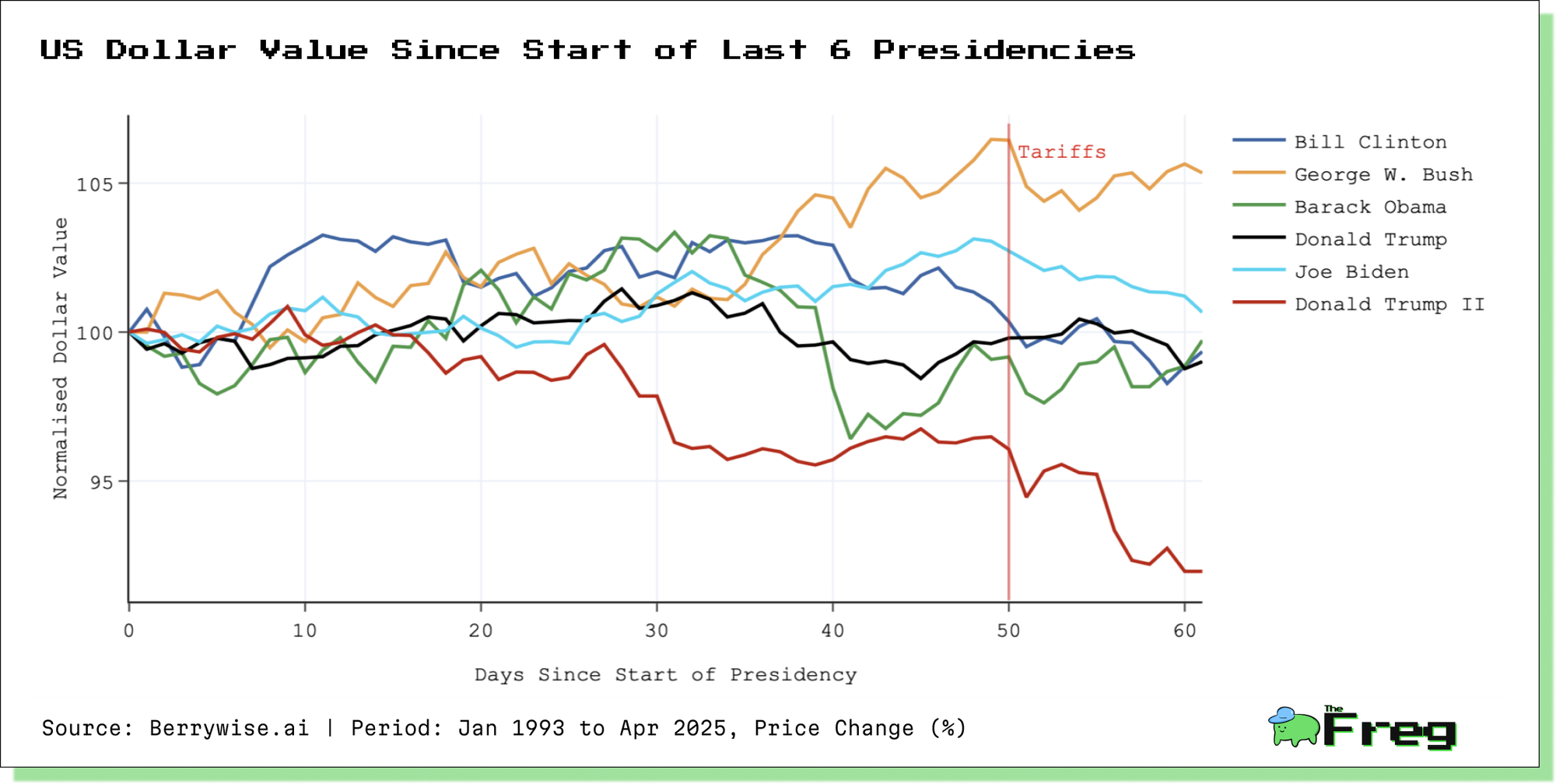

Dollar Sees Sharpest 4-Month Drop of Any Presidential Term

The U.S. dollar’s sharpest decline from the start of a presidency reflects deep investor concerns over political interference and economic policy uncertainty.

The U.S. dollar has recorded its most substantial four-month decline of any presidential term in a quarter-century, falling to a three-year low in global currency markets. This sharp depreciation, driven by a confluence of political uncertainty, aggressive trade policy shifts, and investor concerns over central bank independence, marks a significant turning point for the global financial system’s most critical reserve currency.

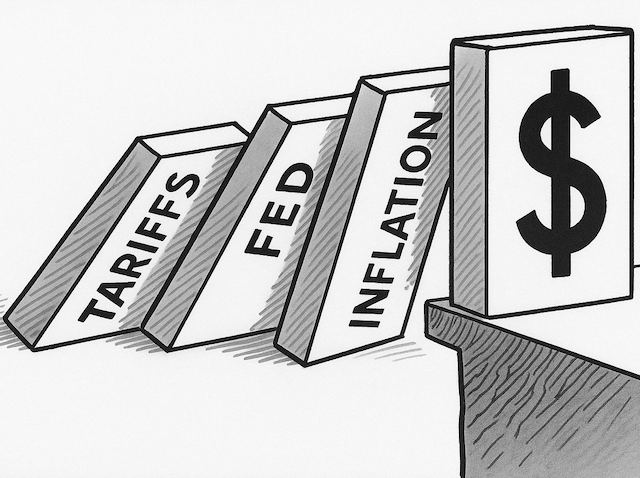

Tariff Announcements and Market Reaction

Contributing to the dollar’s decline was the administration’s April 2 announcement of sweeping “reciprocal tariffs” on imports from 180 countries. Dubbed “Liberation Day” by the White House, the policy imposes a 10% baseline tariff with additional duties tied to trade imbalances—effectively pushing U.S. tariff rates to levels not seen in nearly a century.

Contrary to traditional economic expectations, which suggest tariffs should strengthen the domestic currency, the dollar depreciated significantly. G10 currencies including the euro, yen, and pound rose 1–2% against the dollar, reflecting a sharp drop in investor sentiment. Analysts suggest the divergence stemmed from concerns that such tariffs could spark global economic instability, slow U.S. growth, and potentially trigger stagflation. The decline in the dollar was accompanied by a broader market reaction: U.S. equities underperformed global peers, bond yields rose, and capital moved into traditional safe havens.

Investor Sentiment and Global Rebalancing

The global response to the dollar’s weakness has been multifaceted. According to Bank of America’s Global Fund Manager Survey, a net 61% of respondents expect the dollar to decline further in the next 12 months—a level of bearish sentiment not seen in nearly two decades. Foreign capital is increasingly being redirected toward gold, the Japanese yen, and the Swiss franc, all of which have appreciated over 10% against the dollar in 2025.

Emerging market central banks face a more complex landscape. While a weaker dollar provides relief on debt servicing costs and may offer room for monetary easing, central banks in countries such as Brazil and Indonesia have been forced to intervene in currency markets to prevent excessive volatility. Brazil’s central bank alone spent $17 billion in one week to defend the real, underscoring the risks of destabilizing capital flows.

Political Interference and Central Bank Autonomy

One of the primary factors behind the dollar’s weakening has been the escalating public confrontation between President Trump and Federal Reserve Chair Jerome Powell. In recent weeks, President Trump intensified his criticism of Powell, calling for immediate interest rate cuts and questioning the Fed Chair’s leadership through social media and public remarks. Reports that the administration is actively exploring legal avenues to remove Powell—despite longstanding legal protections ensuring Federal Reserve independence—have significantly increased market uncertainty.

This unusual level of political pressure has unsettled investors, many of whom view the Fed’s autonomy as a cornerstone of U.S. economic stability. Markets responded sharply to these developments, with the dollar falling to a ten-year low against the Swiss franc and the euro surpassing $1.15. Analysts warn that sustained interference in the Fed’s operations could lead to longer-term risks, including increased inflation expectations, volatility in interest rate policy, and erosion of institutional credibility.

Outlook for the Dollar

Looking ahead, the dollar’s trajectory remains uncertain. Analysts are divided on whether the current decline represents a temporary correction or signals a longer-term shift in the dollar’s role as a global reserve currency. UBS and J.P. Morgan forecast a potential partial recovery in the second half of 2025, citing stronger-than-expected U.S. growth projections—2.7% compared to 1.7% for other developed markets—as a possible stabilizing force.

However, structural concerns persist. If political interference in monetary policy continues or tariff escalation leads to broader trade disruptions, further depreciation is likely. Goldman Sachs warns that the dollar could fall an additional 10% against major currencies over the next year under such conditions.

The dollar’s sharpest four-month decline is more than a short-term market reaction. It reflects growing concerns about U.S. economic policymaking, the independence of its institutions, and its role in the global financial system. While a recovery remains possible, much will depend on the administration’s ability to restore investor confidence and reaffirm the credibility of core economic institutions.