Dragon Year Birth Bump And Modest Rise In Chinese Stocks

Stimulus, small rise in births and declining consumer confidence.

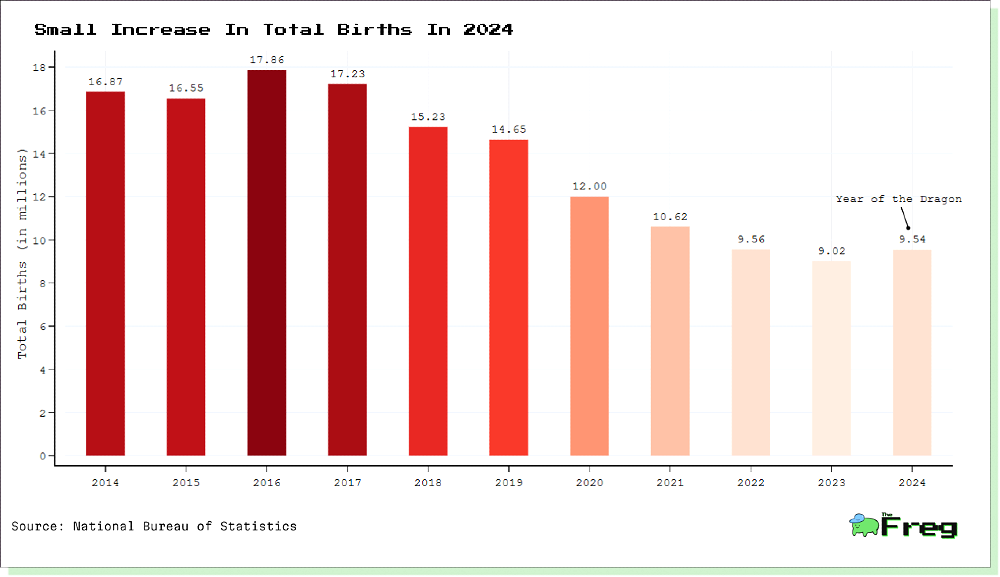

According to China's National Bureau of Statistics, the country's population declined for the third consecutive year in 2024, dropping by 1.39 million to 1.408 billion, despite a slight increase in births during the auspicious Year of the Dragon.

Cultural Beliefs and Birth Trends

Cultural beliefs significantly influence birth trends in China, particularly during auspicious years like the Year of the Dragon. The traditional Chinese zodiac associates Dragon years with good fortune and success, leading to spikes in marriages and births during these periods. For instance, live births increased by 289,224 in 2000 and 935,854 in 2012, both Dragon years, compared to their preceding years.

This phenomenon extends beyond mere superstition, as parents of Dragon year children often have higher expectations and invest more resources in their offspring's education and development. However, these cultural beliefs can also lead to unintended consequences, such as increased competition for educational resources and job opportunities for larger Dragon year cohorts. Despite these trends, China's overall fertility rate remains low at 1.09 as of 2022, highlighting the complex interplay between cultural factors and broader demographic challenges.

Impact of Rising Childcare Costs

The rising cost of childcare in China has become a significant factor influencing the country's declining birth rate and economic landscape. Chinese families spend an average of 6.3 times the country's GDP per capita to raise a child to 18 years of age, surpassing costs in the US, Japan, and the UK. This financial burden disproportionately affects women, often leading to reduced work hours and lower wage rates.

- Urban families spend around 666,699 yuan ($93,000) on raising a child, while rural families allocate 364,868 yuan ($51,000).

- Childcare costs in major cities like Shanghai and Beijing can exceed 1 million yuan per child.

- The high costs have led to a "3A" problem in childcare services: accessibility, affordability, and accountability.

- To address these issues, the Chinese government has introduced subsidies and policies to promote affordable childcare, such as offering 10,000 yuan in central subsidies for each new childcare slot since 2020.

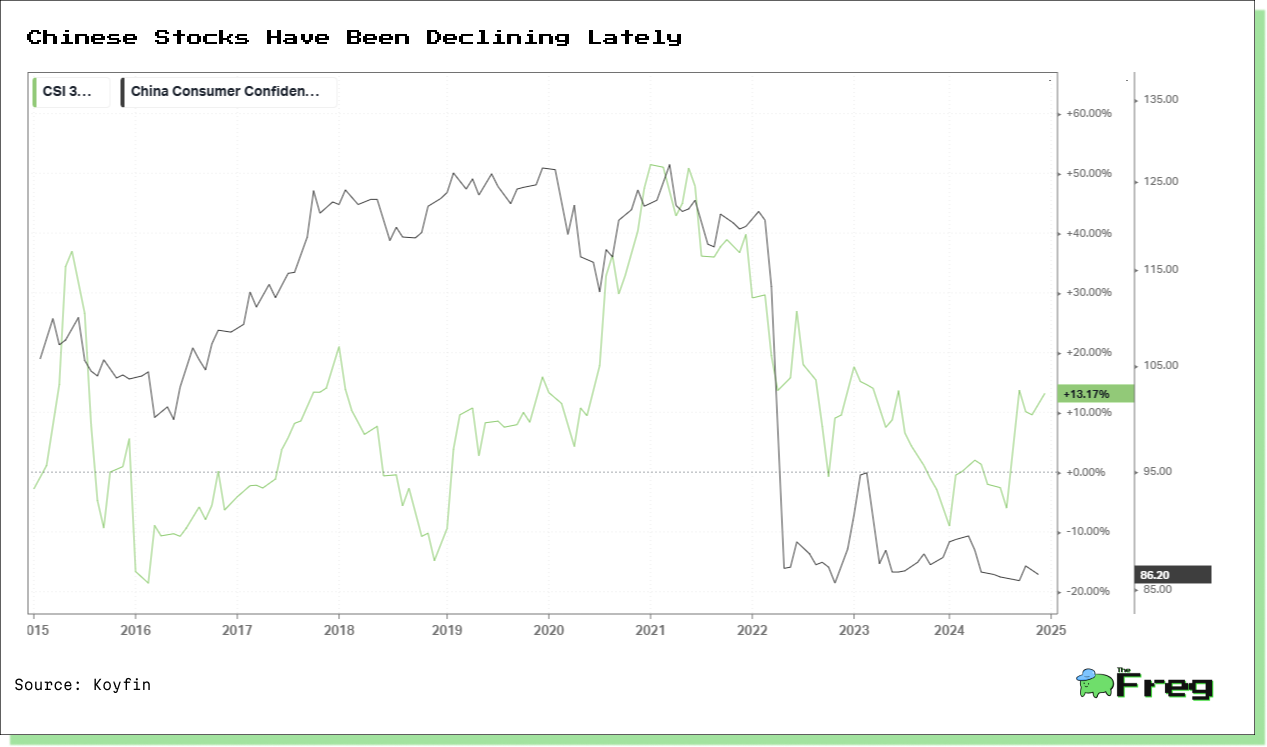

Stock Market Impact

China's population decline has significant implications for its stock market, reflecting broader economic challenges. The shrinking workforce and aging population are contributing to a bearish sentiment among investors and declining consumer confidence, with the CSI 300 Index falling 11% in 2023. This decline is partly attributed to concerns about long-term economic growth prospects as the working-age population decreases.

The demographic shift is affecting various sectors of the Chinese economy, which in turn impacts stock market performance. Consumer-focused companies are particularly vulnerable as the shrinking population leads to reduced domestic demand. Conversely, healthcare and elderly care stocks may see increased interest as the aging population creates new market opportunities. Despite these challenges, the Chinese government's efforts to stimulate the economy and support key industries could help mitigate some of the negative effects on the stock market in the short term. The recent stimulus resulted in modest bump with CSI 300 up by 16.5% in 2024.