Europhoria: Why U.S. Investors Are Betting Big on European ETFs

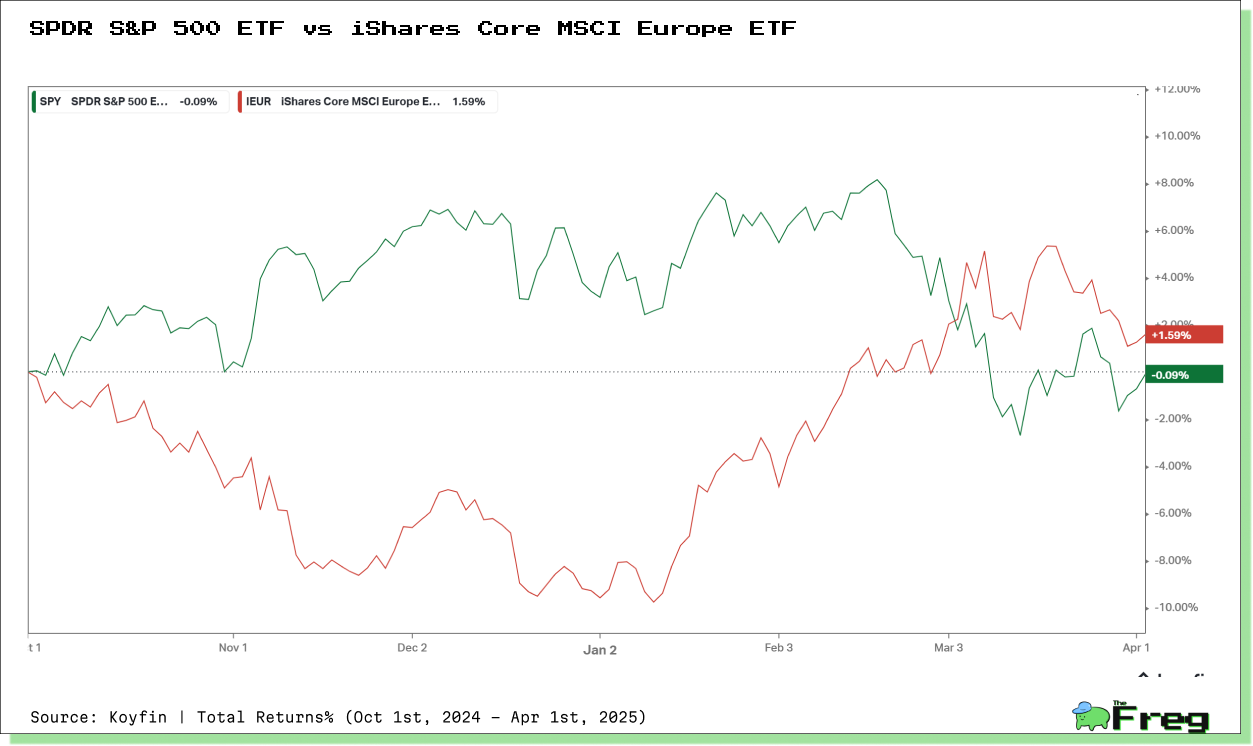

U.S. investors are pouring record funds into European ETFs, driven by attractive valuations, policy shifts, and economic uncertainty at home. However, trade tensions, fiscal policies, and geopolitical shifts could shape the future of this transatlantic investment boom. Is Europe the next big bet?

European equity markets have emerged as a magnet for U.S. investors, with a record $10.6 billion funneled into European-focused exchange-traded funds (ETFs) in the first quarter of 2025. The appeal? Attractive valuations, shifting fiscal policies, and economic uncertainties in the United States. But with global trade tensions mounting and fresh tariffs on the horizon, could this trend reverse just as quickly as it began?

Geopolitics and Investment Diversification

Rising geopolitical tensions between the U.S. and China are prompting investors to diversify their portfolios by increasing exposure to European markets. As trade disputes and technology restrictions intensify, many companies are reassessing their supply chain strategies, with 43% of U.S. firms adjusting their supplier or sourcing approaches to mitigate risks. This shift is benefiting alternative manufacturing hubs in Europe, as businesses seek to reduce reliance on Chinese production.

While the U.S. has imposed tighter restrictions on Chinese investments, the European Union has maintained a more balanced trade relationship with Beijing, making European assets attractive to investors looking for global exposure. However, this strategy is not without risks—China’s recent clampdown on foreign investments highlights the uncertainties surrounding international trade policies. As the global economic landscape evolves, investors must navigate the complex interplay of geopolitical factors that continue to shape capital flows and market dynamics.

Germany’s Fiscal Expansion: A Game Changer for Growth

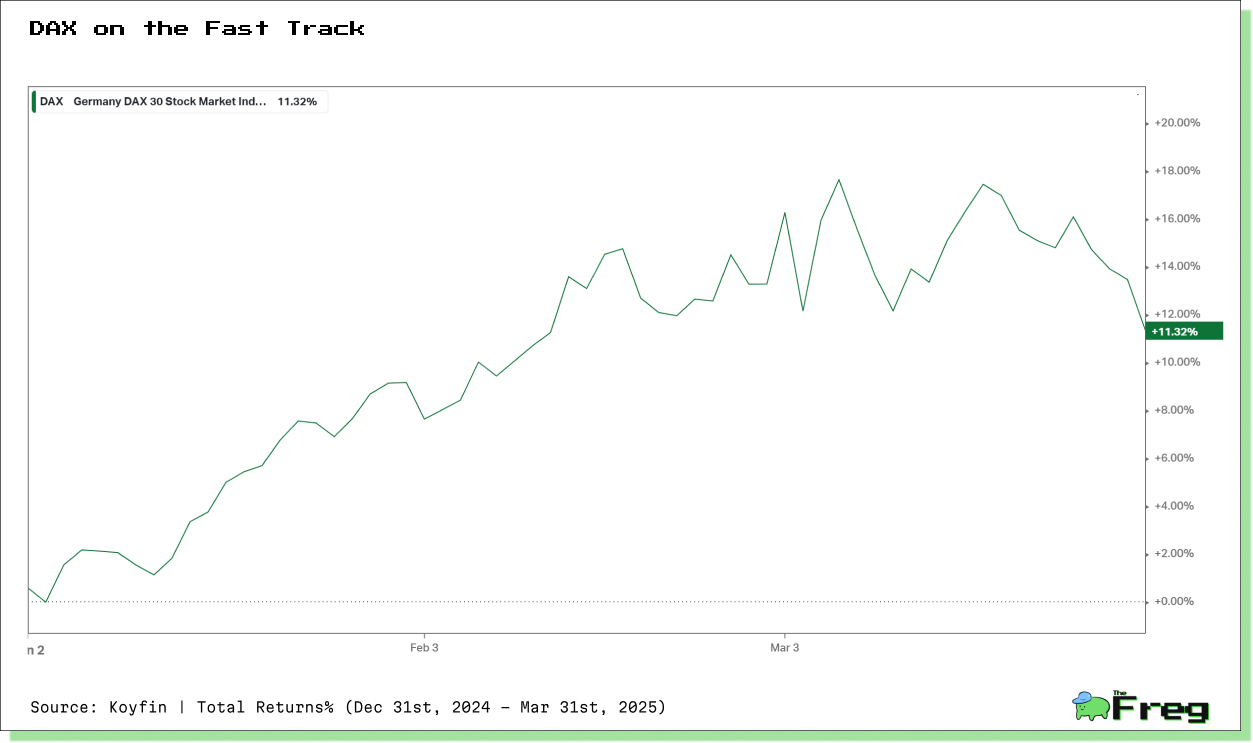

Germany's recent fiscal expansion marks a significant departure from its traditionally conservative economic policies. With a €500 billion infrastructure investment fund and increased defense spending, the country is embracing a more proactive approach to stimulating growth. This shift has already had a profound impact on European markets, with Germany’s DAX index surging 11% year-to-date and the STOXX Europe Aerospace & Defense ETF jumping over 40%. The fiscal stimulus is particularly benefiting the defense and industrial sectors, with companies like Hensoldt AG and Rheinmetall AG experiencing substantial gains.

Additionally, increased infrastructure and green energy investments are expected to boost industrial stocks and renewable energy firms, while prolonged higher interest rates may strengthen European banks. Sovereign bond markets are also responding positively, as Germany’s fiscal strategy helps stabilize spreads across the Eurozone. With GDP forecasts now revised upwards—Germany’s fiscal overhaul could serve as a catalyst for broader European economic growth. However, questions remain about the long-term sustainability of such spending and its potential inflationary impact, making it a critical development for investors to monitor.

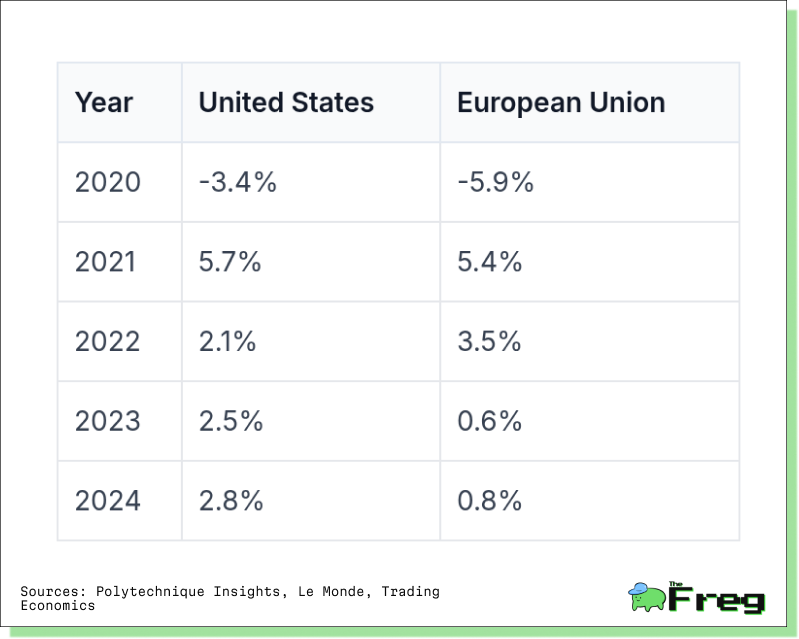

Comparison of the Gross Domestic Product Growth Rates

The Valuation Gap: Bargain or Red Flag?

Despite recent gains, European equities remain significantly cheaper than their U.S. counterparts. The STOXX Europe 600 index trades at a forward P/E ratio

of 13.9, compared to the S&P 500’s 18.4—marking a valuation gap of nearly 25%.

What’s behind this disparity?

- Sector Composition: The U.S. market is dominated by high-growth tech giants, while Europe leans toward cyclical industries like banking and energy.

- Economic Performance: The U.S. continues to outpace Europe in GDP growth and corporate earnings.

- Investor Sentiment: U.S. stocks are buoyed by long-standing optimism, while Europe faces concerns over political fragmentation.

Some analysts argue this gap presents an opportunity, with European stocks offering better value on a sector-adjusted basis. Others warn that structural challenges—such as weaker capital markets and regulatory complexities—could prevent Europe from closing the gap entirely.

Can Europe’s Market Rally Hold?

European stocks have outperformed their U.S. counterparts in 2025, but is this momentum sustainable? Several factors could determine the trajectory:

- Economic Resilience: The European Central Bank forecasts GDP growth of 1.1% in 2025 and 1.4% in 2026, indicating stable—if modest—expansion.

- Valuation Advantage: Europe’s discount to the U.S. remains compelling for value-focused investors.

- Political Uncertainty: Upcoming EU elections and lingering Brexit ramifications could rattle markets.

- Trade Tensions: Further tariff escalations could dampen sentiment.

- Fiscal Stimulus: Germany’s ambitious spending plans could provide a buffer against external shocks.

The Trade War Effect: Will Tariffs Scare Off Investors?

Just as U.S. investors were warming up to Europe, a new hurdle has emerged: escalating trade tensions. President Donald Trump’s announcement of reciprocal tariffs has sent shockwaves through European markets. The pan-European STOXX 600 index slipped 0.5%, while Germany’s DAX tumbled 0.7%, as investors braced for the financial fallout.

Among the hardest-hit sectors are:

- Automotive: German automakers face the looming threat of a 25% tariff on car exports.

- Luxury Goods: Market darlings like LVMH and Hermès saw double-digit declines in March, signaling investor anxiety.

- Healthcare: Novozymes, a key player in pharmaceuticals, witnessed a staggering 27% drop in share value.

- Technology: Industry heavyweights like SAP and ASML weren’t spared, experiencing sharp price corrections.

Economists predict these tariffs could shave 0.3 percentage points off the eurozone’s GDP over the next two years. If tensions persist, investor enthusiasm for European ETFs could wane, redirecting capital back toward U.S. markets.

So are European ETFs a Golden Opportunity or a Bubble?

The recent surge in U.S. investment into European ETFs underscores a growing confidence in the region’s potential. However, the landscape is far from risk-free. Trade tensions, political uncertainty, and structural market differences continue to pose challenges.

For now, the combination of attractive valuations, fiscal stimulus, and geopolitical diversification makes Europe an appealing bet. But whether the current rally transforms into a lasting trend—or fades under economic and political pressures—remains the ultimate question for investors navigating these shifting tides.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.