Foreign Investors Return to India

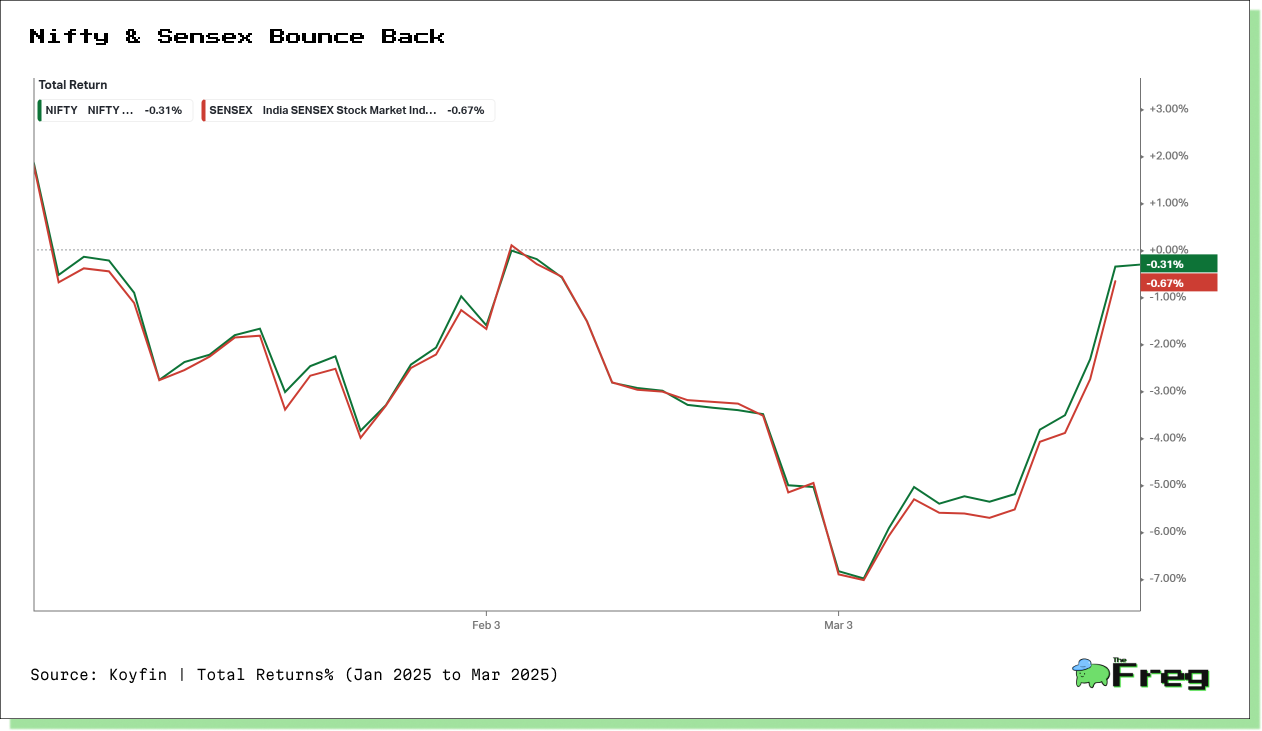

India's stock markets rebounded in March 2025, attracting foreign investors amid improved economic fundamentals and appealing valuations. Despite the optimism, global uncertainties and growth challenges raise questions about the rally's sustainability.

Indian stock markets have staged a remarkable recovery in March 2025, with the Nifty 50 and BSE Sensex rallying over 5.6% in just six trading sessions, reversing the losses incurred earlier in the year as foreign investors return to the market.

What’s Driving the Optimism?

Several factors are fueling this renewed confidence for Foreign Portfolio Investors (FPIs): a stronger GDP growth outlook, cooling inflation, and expectations of interest rate cuts by the Reserve Bank of India (RBI). Despite the momentum, experts caution that without sustained earnings growth, the rally could lose steam, especially amid ongoing global uncertainties.

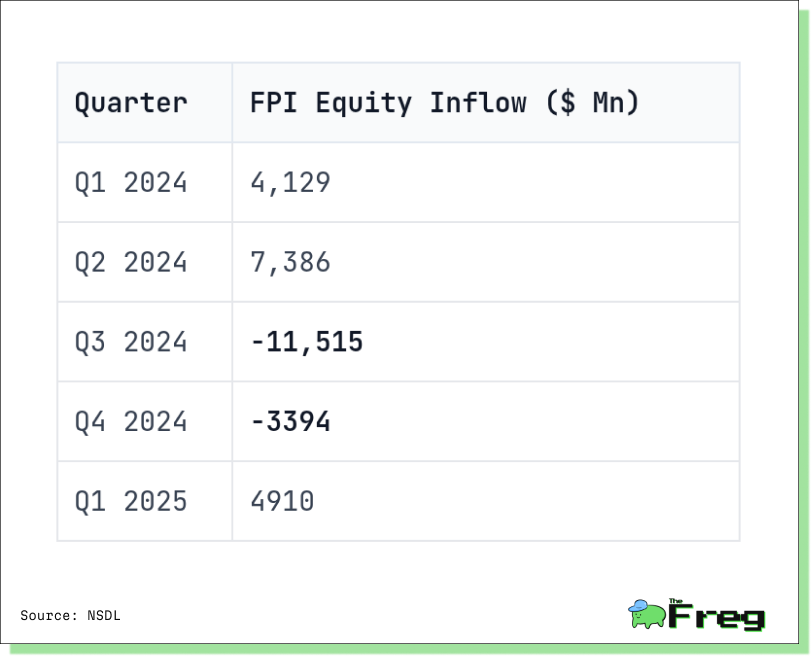

FPI Trends: Volatility and Recovery

Foreign Portfolio Investments (FPIs) saw significant volatility recently. In the first half of 2024, FPI inflows remained positive, peaking in Q2 with $7.3 billion. However, a sharp outflow of $11.5 billion in Q3 marked the largest quarterly outflow in recent years, driven by rising US bond yields and geopolitical tensions. The outflow persisted into Q4, though at a reduced pace ($3.3 billion), as investors shifted focus to other emerging markets like China. The narrative changed in Q1 2025, with an inflow of $4.9 billion, driven by improved corporate earnings, political stability, and India's inclusion in global bond indices. Domestic investors often helped stabilize the market during FPI selloffs.

Who’s Investing?

Foreign Portfolio Investment (FPI) in India has seen significant contributions from various countries, with a notable shift in investment focus between equity and debt markets. The United States remains the largest source of FPI, accounting for approximately 35% of total inflows, followed by Singapore (18%), Mauritius (15%), and Luxembourg (9%)

Where's the investment focus?

- Equity markets: The US, Singapore, and Luxembourg investors have shown a strong preference for Indian equities, particularly in sectors like financial services, information technology, and consumer good.

- Debt markets: Mauritius-based funds have been more active in debt investments, especially following India's inclusion in global bond indices.

Recent trends indicate a growing interest in Indian debt markets, with FPI inflows in debt. This shift is largely attributed to India's inclusion in major global bond indices and attractive yields offered by Indian debt securities

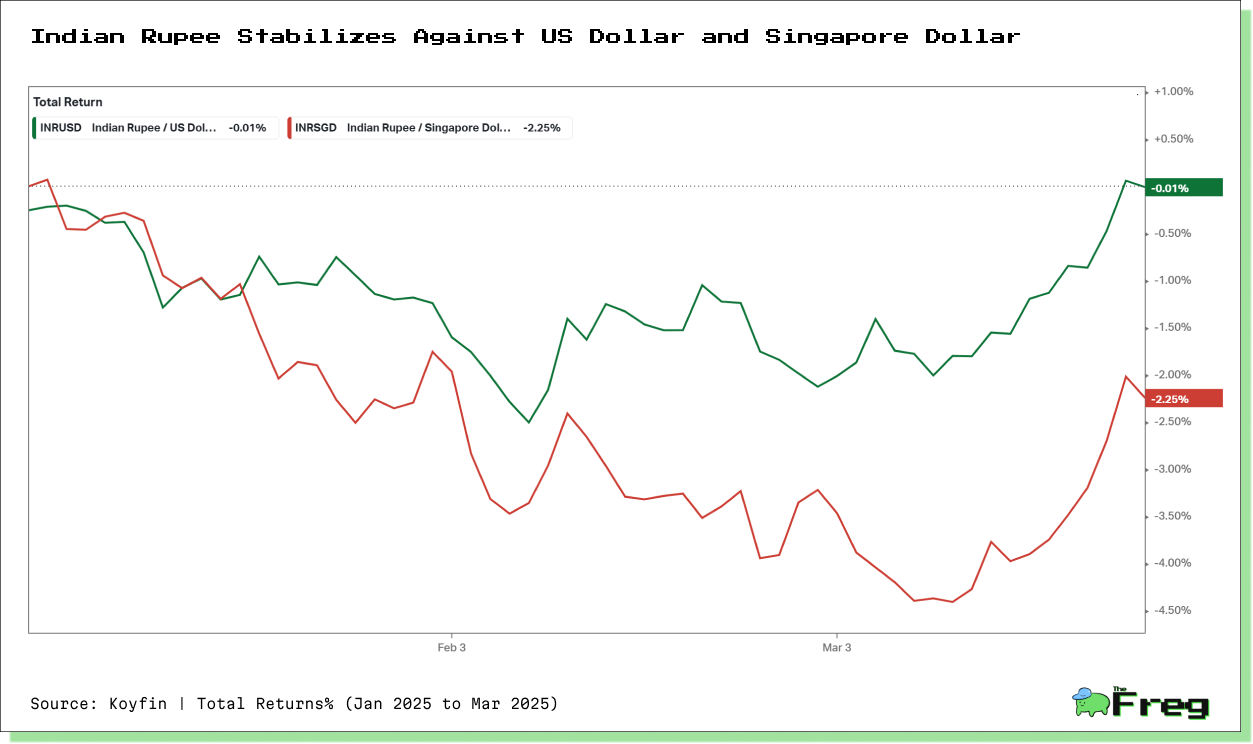

The Currency Factor

Currency dynamics play a key role in influencing foreign investment. A stronger rupee generally attracts investors, boosting their returns when converted to foreign currencies, and vice versa. In recent weeks, the Indian rupee has stabilized against major currencies like the US dollar and Singapore dollar, signaling increased investor confidence. While currency stability supports investment inflows, it is just one factor—economic growth, corporate earnings, and global market trends also heavily influence investor sentiment.

Looking Ahead

While India's markets have shown impressive strength, sustaining this momentum depends on economic growth, solid corporate earnings, and managing global risks. As foreign investors cautiously return, the next few months will reveal whether this rally is a genuine turnaround or just a temporary rebound.