Foreign Outflows Continue in Asian Bonds

The looming threat of U.S. tariffs under Trump's second term, which has Asian economies nervously watching like cats eyeing a vacuum cleaner.

Foreign investors withdrew $3.07 billion from Asian bond markets in December 2024, marking the second consecutive month of outflows amid concerns over potential U.S. tariff hikes under President-elect Donald Trump, political instability in South Korea, and widespread currency depreciation across the region. Key markets like South Korea, Indonesia, and Malaysia were particularly impacted as economic and political uncertainties weighed heavily on investor sentiment.

Impact of U.S. Tariff Policies

The potential U.S. tariff policies under Trump's second term have Asian economies on edge, like a group of kids watching a bully approach the playground. Tariffs on Chinese imports and on all other imports could ripple through Asia's interconnected economies. For instance, lower U.S. demand for Chinese goods could domino into reduced demand for exports from ASEAN countries, even if they're not directly targeted. Some countries might try to play economic hopscotch, becoming "connector countries" to help Chinese companies dodge U.S. taxes. Meanwhile, others like India and Malaysia might unexpectedly find themselves winning at this economic game of musical chairs, potentially benefiting from companies looking to diversify their supply chains away from China.

Outflows at a Glance

This table shows a mixed bag of results, like a financial game of Snakes and Ladders. South Korea took the biggest hit, with investors pulling out $2.38 billion, ending a four-month buying streak. Indonesia also saw a significant outflow of $1 billion, while Malaysia experienced a more modest withdrawal of $310 million. On the flip side, India and Thailand managed to climb the ladder, attracting inflows of $445 million and $172 million respectively. Overall, these five Asian markets saw a net outflow of $3.07 billion in December, continuing the trend from November when $2.12 billion was withdrawn.

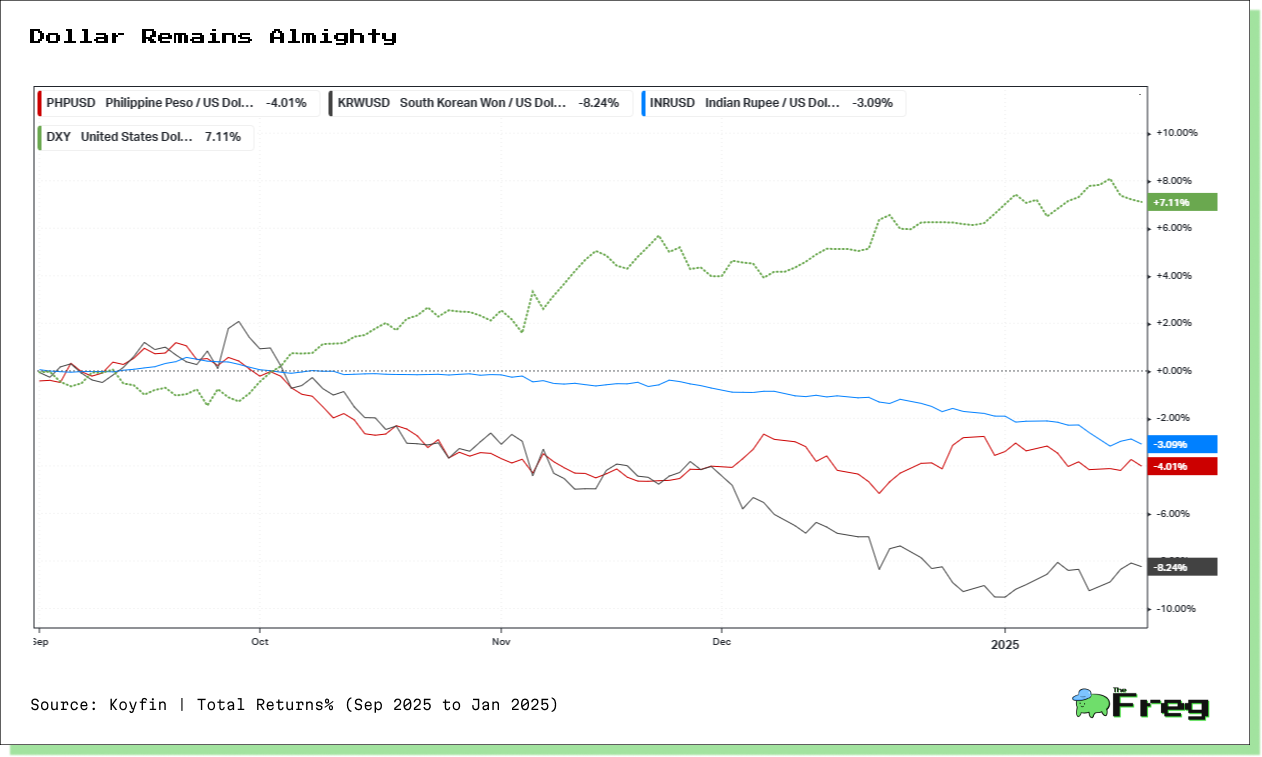

Currency Depreciation in Asian Markets

Asian currencies have been on a roller coaster ride, with many experiencing a downward slide against the US dollar. Like leaves caught in an autumn breeze, the Philippine peso took the biggest tumble, dropping 3% after the central bank cut interest rates in October.

This currency dance isn't just about economic factors. Political turmoil can send currencies spinning like a top. South Korea's won, for instance, plummeted to a 16-year low amid political instability. Meanwhile, the Indian rupee has been playing it cool, emerging as one of the most stable Asian currencies. It's like a game of currency musical chairs, where some currencies find a seat while others are left standing when the music stops.