From Hedge Funds to Main Street: The Market Impact of Rising Bearishness

Hedge funds have sharply increased their bearish bets on U.S. stocks, reaching levels not seen since 2020, according to a recent Goldman Sachs report.

Drivers of Pessimism

Several key factors are fueling this cautious stance:

- Economic Uncertainty: Slowing growth, persistent inflation, and rising interest rates create a challenging investment environment, prompting hedge funds to adopt a defensive posture.

- Inflation Pressures: Higher borrowing costs and shrinking corporate margins erode investor confidence, increasing downside risk.

- Geopolitical Tensions: Global conflicts and trade uncertainties disrupt supply chains, adding volatility and dampening market sentiment.

This widespread pessimism could exacerbate market instability, potentially triggering a self-reinforcing downturn. However, history suggests that extreme hedge fund positioning often precedes market reversals, creating opportunities for contrarian investors.

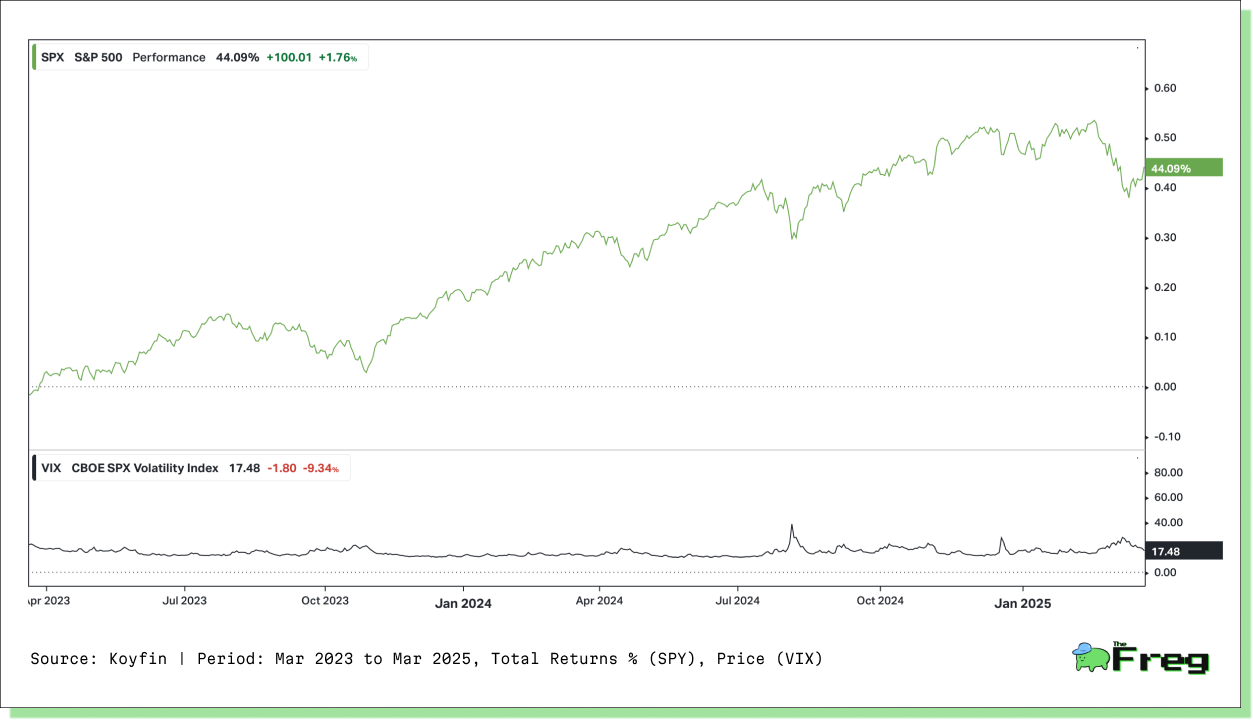

The VIX (Volatility Index) plays a crucial role in the context of hedge fund pessimism and market sentiment. As a measure of expected market volatility over the next 30 days, the VIX often serves as a barometer for investor fear and uncertainty. The VIX's inverse relationship with the S&P 500 can help investors gauge the potential impact of hedge fund positioning on broader market trends.

Ripple Effects on Retail & Institutional Investors

Retail Investors

- Higher Volatility: As hedge funds unwind positions, market swings may intensify, increasing uncertainty for retail investors.

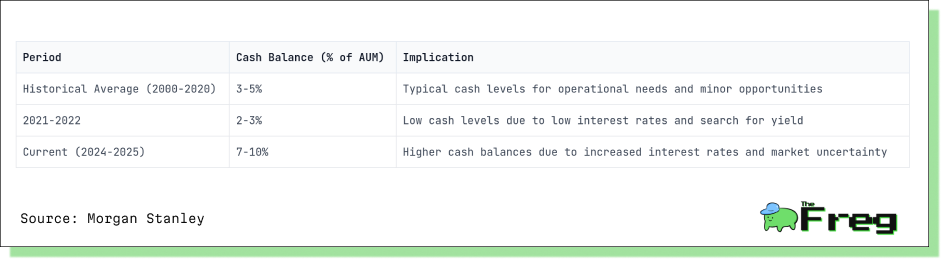

- Flight to Safety: Risk-averse investors may shift capital from equities to bonds or cash, reinforcing downward pressure.

- Eroding Confidence: Prolonged pessimism can drive retail investors out of the market, fueling further selloffs.

Institutional Markets

- Herding Behavior: Other institutional investors may follow hedge fund strategies, amplifying market moves.

- Sector Rotation: Defensive sectors could benefit at the expense of growth stocks, particularly in technology.

- Liquidity Strain: Forced liquidations may disrupt markets, driving asset prices below fundamentals.

- Systemic Risk: In extreme cases, broad-based selling could trigger financial instability, requiring intervention from regulators.

As hedge funds continue to reposition, markets face heightened volatility and uncertainty. Whether this signals the next major downturn or a buying opportunity remains to be seen.