Global Markets Rebound on Tariff Pause, but Caution Tempers the Cheers

A surprise tariff pause from Trump triggered a global rally, with Asian tech stocks soaring. But beneath the optimism lies caution, as markets weigh short-term relief against long-term trade and policy uncertainty.

A single statement from former U.S. President Donald Trump sent shockwaves through global financial markets: a 90-day pause on 'Libertion day' tariffs. Though brief and ambiguous, the announcement was enough to ignite a rally across Asian and European indices, while U.S. markets curiously lagged behind. The disparity in response reveals a deeper story—one of relief, recalibration, and unresolved unease.

A Familiar Playbook?

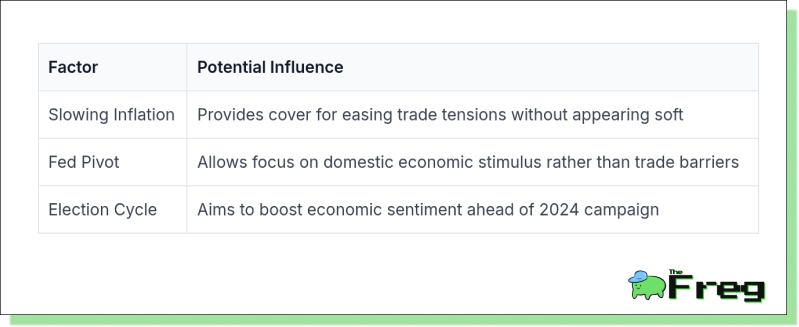

Trump’s move, while headline-grabbing, follows a well-worn path from his first term—announce a pause, create negotiation leverage, and stoke market optimism. Analysts suggest this is more electoral strategy than economic philosophy. With the 2024 campaign season heating up, a short-term lift in economic sentiment could prove politically advantageous.

Historical precedent implies this respite may be fleeting. During Trump’s previous tenure, similar pauses often preceded renewed escalation. Markets are well aware—and wary—of this pattern.

Asia Leads the Charge: Nikkei’s Explosive Rally

Nowhere was the optimism more palpable than in Tokyo. The Nikkei 225 surged by a staggering 8.8%, adding over 2,000 points in minutes. Export giants led the charge—Toyota Motor rallied 9.4%, Fast Retailing (parent of Uniqlo) climbed 8%, and chipmakers like Tokyo Electron and Advantest soared by double digits. The rally wasn’t just market exuberance—it reflected Asia’s acute sensitivity to U.S. trade policy and its hopes for more predictable global commerce.

The broader Asian rally extended across tech and manufacturing. Here are the top 10 performing Asian stocks and their daily rally percentages:

Apple suppliers like AAC Technologies and Hon Hai Precision Industry topped the charts, reflecting renewed confidence in tech supply chains. Japanese semiconductor firms such as Advantest and Tokyo Electron surged alongside Fast Retailing and Sony, while regional giants Samsung, Alibaba, Tencent, and TSMC all posted notable gains. The rally highlights the tech-heavy, trade-sensitive nature of Asian markets—and their rapid responsiveness to geopolitical shifts.

U.S. Markets Lag Amid Tech Drag

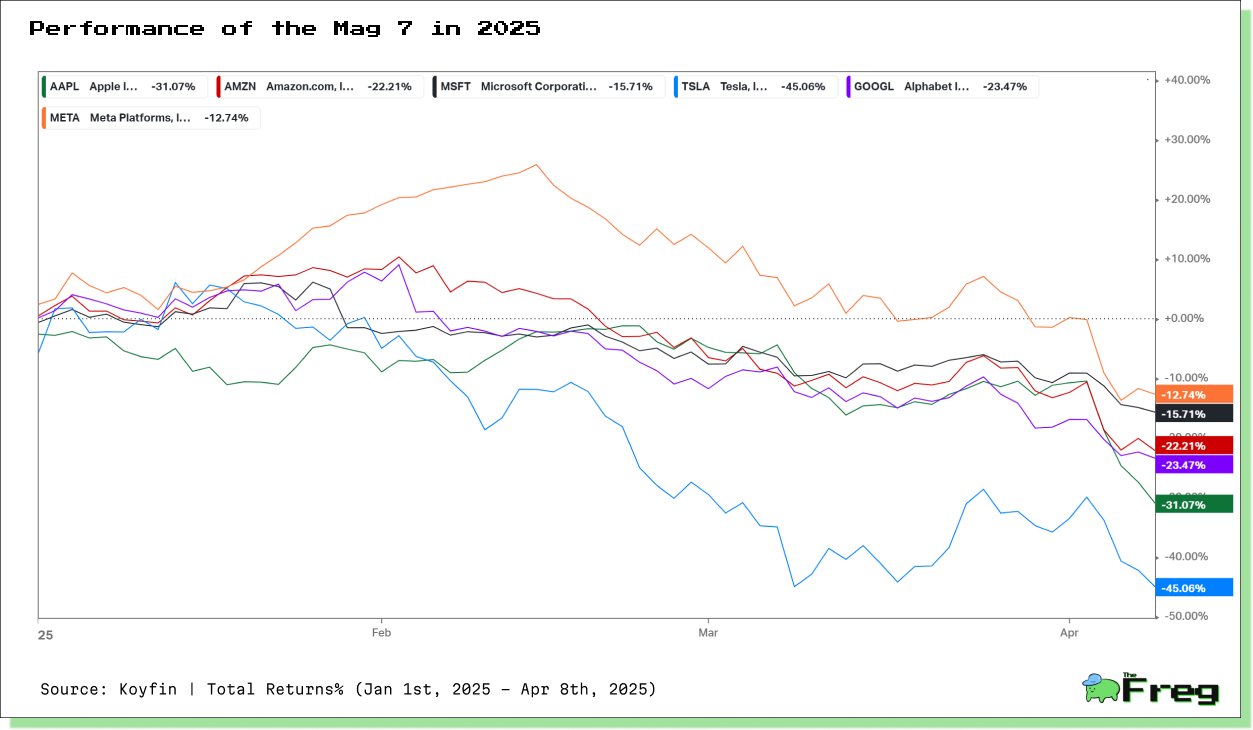

While global markets rallied on news of Trump's tariff pause, U.S. markets showed a more muted response. The S&P 500 rose by 9.5%—a significant gain, yet still behind its international counterparts. Two key dynamics help explain this relative underperformance.

First, weakness in the "Magnificent Seven"—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla—weighed heavily on the index. These mega-cap tech names fell roughly 16% over the quarter, dragging the S&P despite broader market enthusiasm.

Second, a sector rotation into defensive stocks tempered gains in growth-heavy indices. The Nasdaq Composite, for instance, rose 12.2%, but still underperformed versus several overseas benchmarks. This shift reflected lingering concerns over U.S. macro stability and uncertainty surrounding domestic policy direction.

Mixed Fortunes in Emerging Currencies

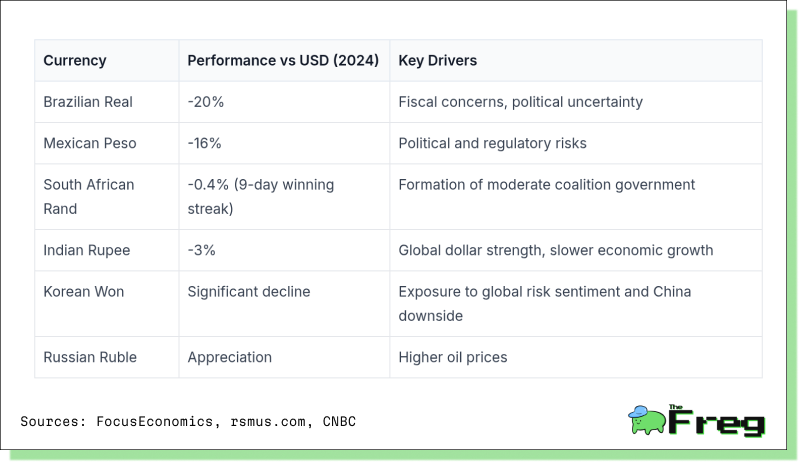

The ripple effect extended to currencies and bonds. Investors rotated into emerging market assets, embracing the perceived window of opportunity created by tariff relief. The Australian Dollar rebounded from multi-year lows, while traditional safe havens like the Japanese Yen and Swiss Franc softened.

Emerging currencies, however, moved unevenly. While some—like the Brazilian Real and South African Rand—gained, others such as the Mexican Peso and Indian Rupee remained under pressure from local fiscal and macroeconomic challenges. The Korean Won wavered on China-related trade jitters, and the Russian Ruble benefited from firm oil prices.

Bond markets echoed this complexity. ETFs tracking local currency debt saw inflows, but frontier market dollar bonds faced selling pressure, with yields rising sharply.

The mixed picture highlights that while global sentiment has improved, local fundamentals remain decisive.

This mosaic of performance underscores the layered drivers at play: from local governance and fiscal credibility to global risk sentiment and commodity dependencies.

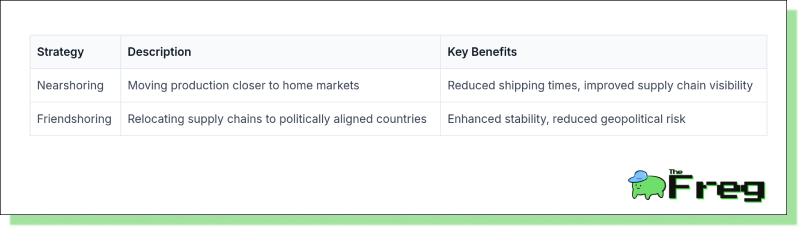

Structural Shifts in Global Trade

Beyond the headlines, the global trade landscape is evolving. Tariff volatility and pandemic-era disruptions have pushed companies toward Nearshoring and Friendshoring. Apple’s increased manufacturing presence in India is emblematic of this realignment

The emergence of China-led blocs like the Regional Comprehensive Economic Partnership (RCEP), alongside the EU’s push for "strategic autonomy," signals a multipolar trade order. Data from 2023 reflects this transition: a reduced U.S.-China trade deficit, a surge in intra-ASEAN trade, and stronger EU-India engagement all suggest new trade corridors are gaining momentum.

Policy Uncertainty: The Unseen Market Risk

If the rally sparked by Trump’s announcement was emotional, the undercurrent was analytical caution. U.S. markets lagged their global peers, reflecting investor wariness over long-term policy clarity. The Federal Reserve’s dovish stance amid persistent inflation only amplifies the ambiguity.

Relief Sparks a Rally, But the Reset Runs Deeper

The tariff pause was a jolt—enough to move trillions in capital and spark double-digit rallies. But markets, though quick to celebrate, remain alert. The strategic dance between trade policy and electoral politics is far from over, and the global economy continues to navigate a landscape reshaped by disruption, divergence, and adaptation.

In this moment, the message is clear: relief may be temporary, but recalibration is here to stay. Key investor takeaways:

- Diversify geographically to hedge against political shocks.

- Prepare for reversals, especially during election cycles.

- Watch the supply chain narrative, which increasingly dictates trade and investment flows.