Global Semiconductor Trade at a Crossroads: Tariffs, Tensions, and the Tech Divide

A sweeping analysis of how escalating U.S. semiconductor tariffs are reshaping global trade, corporate strategy, and the balance of technological power.

The global semiconductor industry stands at a pivotal juncture as proposed U.S. tariffs spark diplomatic tremors and strategic recalibrations among key players. With China, Japan, and South Korea reportedly preparing a coordinated response to anticipated American trade measures, the implications are vast, potentially reshaping supply chains and innovation pipelines worldwide.

Shifting Alliances and Strategic Expansion

Nowhere is the fallout from trade tensions more visible than in Taiwan and South Korea. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading chip foundry, has announced a monumental $165 billion investment in the United States over the next four years. This includes three fabrication plants, advanced packaging units, and a state-of-the-art R&D hub. The expansion, aimed at bolstering U.S. semiconductor self-sufficiency, is also a strategic hedge against tariffs reportedly being announced soon by President Donald Trump.

Meanwhile, South Korea’s Samsung faces mounting challenges. With nearly half of its smartphones manufactured in Vietnam — a country now subject to a 46% tariff on U.S.-bound goods — Samsung is exploring production shifts to Brazil, India, and South Korea, where tariffs range between 10% and 27%. Even so, the firm’s smartphone division could see a staggering loss of $2.7 billion if it opts to absorb these tariff costs rather than relocating production. Its television business, fortunately, is shielded due to existing facilities in Mexico.

China’s Dilemma: Growth Amid Constraints

China remains both a critical player and a cautionary tale. In 2024, its integrated circuit exports soared to $160 billion, a 17.4% increase year-on-year. Yet beneath this impressive headline lies a vulnerability. Export controls by the U.S. continue to restrict access to advanced manufacturing tools, curbing Chinese progress in sub-7nm technology. The country still imports roughly 80% of its semiconductor needs, reinforcing its trade deficit and exposing its strategic Achilles' heel.

Faced with the possibility of expanded U.S. tariff threats, China may double down on self-reliance through initiatives like "Made in China 2025," as seen in recent domestic breakthroughs, including Huawei’s development of a 7nm chip. However, these efforts are undermined by a reliance on foreign equipment and materials — including from Japan and the Netherlands — potentially vulnerable to further trade restrictions.

The Tariff Target Map

The global impact of U.S. semiconductor tariffs transcends borders:

- Taiwan (TSMC): Currently exempt from proposed tariffs, TSMC remains strategically exposed. Its U.S. investment aims to shield its customer base, including Apple and Nvidia, from future policy shocks.

- South Korea (Samsung, SK Hynix): Facing potential tariff fallout, both firms are reinforcing domestic capacity, notably with a $471 billion chip hub in South Korea.

- Japan & the Netherlands: While not directly targeted, these nations are vital links in the chip ecosystem. Japan supplies critical tools, while ASML in the Netherlands is the sole maker of EUV lithography machines — the crown jewels of advanced chip production.

America’s Semiconductor Exposure

U.S.-based firms find themselves caught between policy ambitions and operational realities. Intel is investing $20 billion in domestic fabs in Ohio, an effort supported by the CHIPS Act's $53 billion incentive fund. Yet Intel and others, including Nvidia, AMD, and Apple, still depend heavily on offshore production, especially through TSMC and Samsung. Tariffs could raise costs and complicate production timelines, prompting a slow and difficult reshoring effort. For example, TSMC's Arizona plant has faced delays until at least 2028 due to labor shortages and permitting complexity.

Export Trends: A Tale of Rising Dependencies

The top semiconductor exporters to the U.S. over the past five years highlight the industry’s evolving geography:

Taiwan and South Korea continue to dominate U.S. imports, largely due to their specialization in cutting-edge and memory chips. Malaysia's rise as an assembly and packaging powerhouse is noteworthy, while China's export growth reflects the global dependency on its manufacturing base despite ongoing tensions.

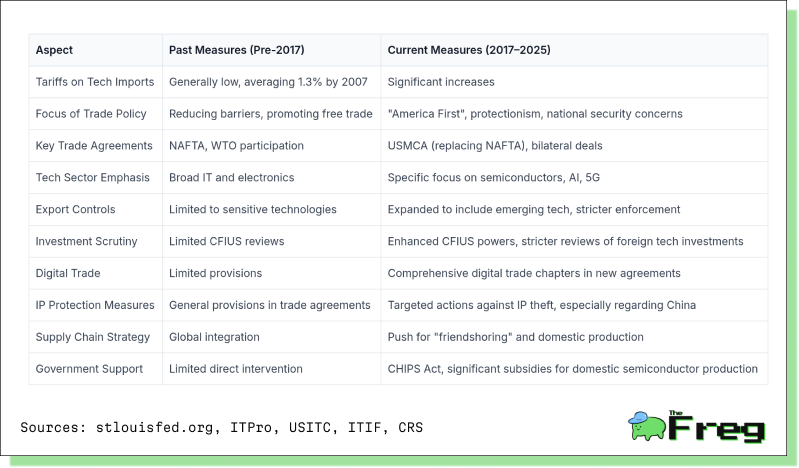

Historical Context: A Paradigm Shift in Trade Policy

A comparison of U.S. tech trade policies reveals a stark evolution. Prior to 2017, tariffs averaged just 1.3% on tech goods, with trade policy focused on liberalization. Today, tariffs on Chinese tech products can reach 125%, with national security and industrial policy taking precedence. Investment scrutiny has intensified, as has the scope of export controls. The CHIPS Act, digital trade provisions, and bilateral agreements have replaced older multilateral frameworks like NAFTA.

Innovation Under Pressure

These trade dynamics are reshaping global innovation. The pivot toward national self-sufficiency threatens open research networks that have historically accelerated progress in AI, quantum computing, and advanced manufacturing. The emergence of distinct U.S.-led and China-led "techno-blocs" is fragmenting global standards and duplicating R&D efforts.

While such moves may secure strategic advantages, they risk slowing global innovation. National security concerns now routinely override market logic, prompting government intervention in what was once a deeply integrated global industry.

A Volatile Outlook

Looking ahead, the semiconductor sector is navigating a volatile and deeply politicized environment. Regional dynamics are key:

- China faces the dual challenge of U.S. sanctions and retaliatory uncertainties.

- Taiwan must manage geopolitical exposure while sustaining global demand.

- South Korea is recalibrating production strategies in response to tariff threats.

- The U.S. is pushing for domestic capability but remains dependent on overseas production.

Critical watchpoints include:

- Trump's expected tariff announcement.

- Corporate reactions from firms like TSMC, Intel, and Samsung.

- Implementation pace of the CHIPS Act.

- Global summits on trade and tech.

As the global semiconductor chessboard rearranges, the industry’s future will be shaped not just by innovation, but by the strategic foresight of its players and the policy choices of its stewards.