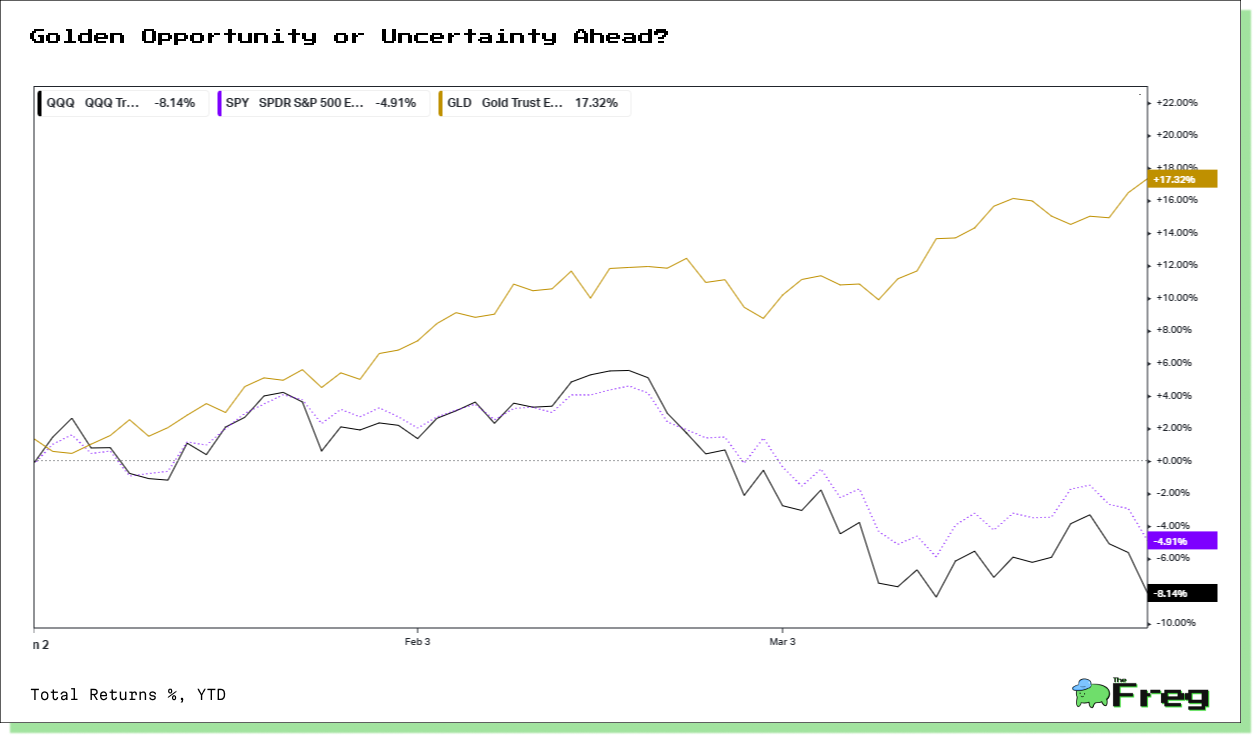

Gold's Unstoppable Rally

Goldman Sachs has raised its end-2025 gold price forecast citing stronger-than-expected ETF inflows and sustained central bank demand.

Goldman Sachs has raised its end-2025 gold price forecast to $3,300 per ounce, up from $3,100, as the precious metal continues its remarkable rally. This bullish outlook comes amid stronger-than-expected demand from central banks and solid inflows into gold-backed ETFs, sparking questions about how far the gold run might extend and what's driving this surge.

Central Banks' Role in Gold Rally

Central banks have emerged as key drivers of the recent gold rally, with their unprecedented buying spree pushing demand to record levels. In 2024, global gold consumption hit 4,974 tonnes, with central banks purchasing more than

1,000 tonnes for the third consecutive year. This surge in central bank demand is primarily driven by:

- Diversification strategy: Central banks are reducing reliance on traditional reserve currencies like the US dollar.

- Hedge against inflation and geopolitical risks: Gold serves as a stable strategic asset amid economic uncertainty.

- Reduced dependence on Western financial systems: Particularly evident in emerging markets in Asia and Eastern Europe.

The sustained interest from central banks has become a stabilizing force in the gold market, providing steady demand less reactive to short-term price fluctuations. This trend, coupled with rising investor demand and geopolitical tensions, has contributed significantly to gold's bullish momentum and record-breaking prices.

Central bank gold purchases in 2024 reached unprecedented levels, with several countries significantly increasing their reserves. Here's a breakdown of the top buyers:

The National Bank of Poland led the charge with 90 tonnes, followed closely by India's Reserve Bank, which added 73 tonnes to its reserves. China, despite pausing purchases in May and June, still managed to acquire 44.2 tonnes.

These purchases reflect a growing trend among central banks to diversify their reserves and hedge against economic uncertainties. The continued strong demand from central banks has been a key factor in supporting gold prices and is expected to remain a significant driver in the precious metals market.

ETF Inflows Surge

The strong momentum in gold ETF inflows continued into February 2025, with global physically-backed gold ETFs reporting their third consecutive month of inflows totaling US$9.4 billion, the strongest since March 2022. This surge in demand was particularly notable in North America, where flows turned positive and recorded one of the strongest months on record.

Key highlights of the February 2025 ETF flows include:

- North American ETFs led the charge with significant inflows, reversing previous outflow trends.

- European inflows narrowed but remained positive.

- Asian ETFs registered strong demand, contributing to the global uptick.

This robust ETF performance aligns with the broader bullish sentiment in the gold market, supporting Goldman Sachs' revised price target of $3,300 per ounce by the end of 2025.

Geopolitical Tensions Driving Demand

Geopolitical tensions have emerged as a significant driver of gold's recent rally, with escalating conflicts and trade disputes fueling demand for the precious metal as a safe-haven asset. The sudden fall of the Syrian government and President Bashar al-Assad's flight to Russia have heightened instability in the Middle East, outweighing the effects of a stronger US dollar and rising Treasury yields. Additionally, ongoing trade tensions, including tariffs imposed by the US on Mexico, Canada, and China, have increased market uncertainty and boosted gold's appeal.

The impact of geopolitical risks on gold prices is substantial, with the World Gold Council's Gold Return Attribution Model (GRAM) indicating that these factors have contributed 4.3% to gold's return in 2024. Research shows that every

100-unit increase in the Geopolitical Risk (GPR) index corresponds to a 2.5% rise in gold prices. As a result, investors and central banks alike are turning to gold as a hedge against inflation, currency instability, and geopolitical risks.

Gold's 2025 Outlook

As we look ahead to 2025, gold's trajectory appears poised for continued growth, with major financial institutions projecting ambitious price targets. Goldman Sachs has raised its end-2025 forecast to $3,300 per ounce, citing stronger-than-expected ETF inflows and sustained central bank demand. Other institutions are even more bullish, with Bank of America projecting $3,500 per ounce and DoubleLine anticipating a potential rise to $4,000.

However, potential headwinds such as a stronger US dollar could temper gold's rise. Despite these challenges, the consensus among analysts points to a bullish outlook for gold in 2025, with prices potentially ranging between $2,600 and $3,805.