Hedge Funds and Treasuries: A Risky Bond

Hedge funds, using high leverage, dominate Treasury trading, replacing stable foreign buyers and amplifying volatility, challenging market stability and regulation.

The U.S. Treasury market—long considered the bedrock of global finance—is undergoing a quiet but consequential transformation. Hedge funds, known for their aggressive pursuit of returns and sophisticated trading strategies, have become both significant participants and potential destabilizers of this critical market. Recent volatility in Treasury trading, highlights a complex and increasingly fragile relationship between hedge fund activity and government debt issuance.

The Leverage Engine: How Hedge Funds Amplify Risk

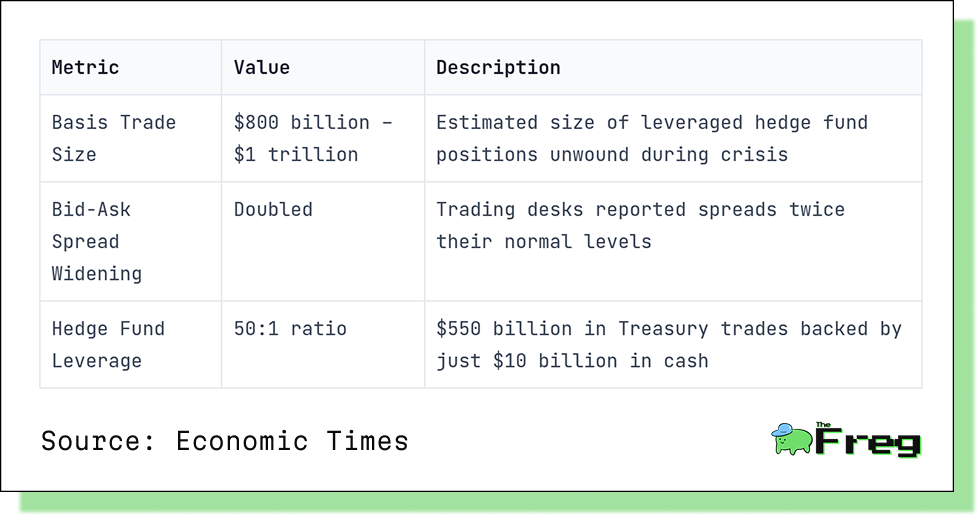

Through mechanisms such as repurchase agreements (repos), futures contracts, and total return swaps, funds can control massive exposures with relatively little capital. In particular, basis trading—a strategy that profits from small discrepancies between Treasury bonds and futures—is a key area where leverage is heavily employed.

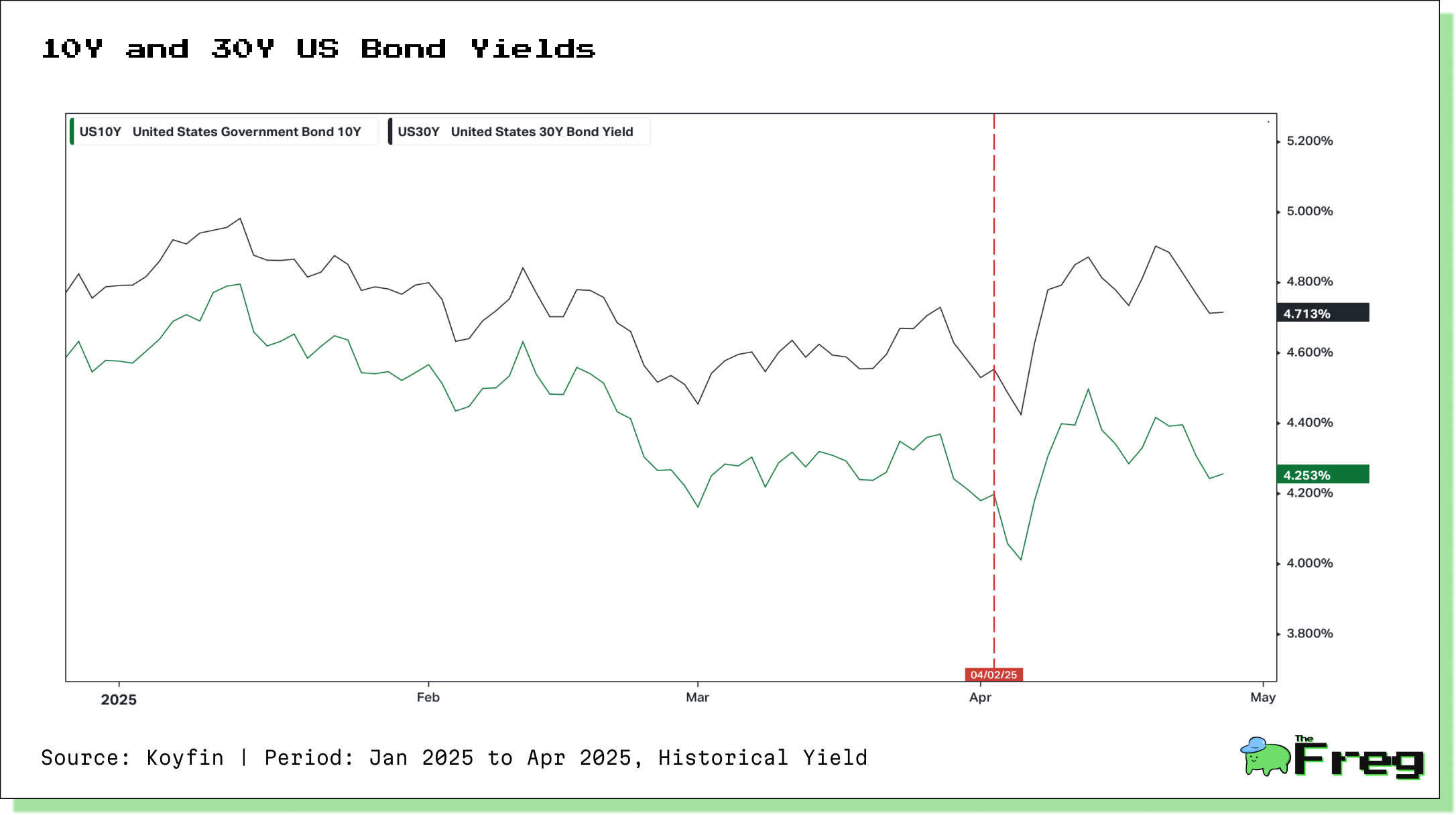

In some cases, hedge funds utilize leverage ratios as high as 50:1, using Treasury securities as collateral for short-term borrowing. While this approach can yield substantial profits during stable market conditions, it also creates systemic vulnerabilities. When market dynamics shift, as they did during the March 2020 crisis, leveraged funds are often forced to unwind positions quickly, exacerbating volatility and disrupting pricing in both cash and derivative markets.

This was starkly evident in 2020 when a wave of hedge fund liquidations widened the spread between Treasury bonds and futures, undermining market stability. These episodes reveal the fragile underpinnings of what is, in essence, the world’s safest asset class.

Shifting Demand: From Foreign Buyers to Hedge Funds

Another critical factor driving hedge fund influence is the decline of traditional, long-term buyers of U.S. government debt. Foreign investors, who once reliably absorbed a large portion of Treasury issuance, have begun to reduce their holdings. In their place, hedge funds are stepping in—not as committed holders, but as opportunistic traders seeking arbitrage.

This shift creates a new kind of vulnerability. While foreign central banks tend to hold Treasuries for stability and reserve purposes, hedge fund participation is conditional and reactive. Their willingness to hold U.S. debt can disappear rapidly if market conditions change, interest rates spike, or financing becomes constrained.

Central Bank Policy and the “Volatility Paradox”

Overlaying all of this is the critical role of central bank policy. When the Federal Reserve tightens monetary policy or reduces its balance sheet, it impacts both sides of hedge fund operations—shrinking the supply of reserves that support repo lending and raising the cost of leverage.

This creates what some economists call the “volatility paradox”: when market participants expect the Fed to intervene during periods of stress, they may feel emboldened to take on more leverage in calm times—ironically increasing the risk of severe disruptions if those expectations prove incorrect.

Striking the right balance between market discipline and policy backstops will be critical in managing this evolving dynamic.

Regulatory Response: Threading the Needle

Regulators are now facing a complex dilemma: how to curb excessive leverage and reduce systemic risk without stifling the very liquidity and innovation hedge funds bring to the market.

Several key reforms are under consideration:

- Expanding Central Clearing: The SEC has proposed broadening central clearing requirements for Treasury securities and repo agreements. This move would reduce counterparty risk, enhance transparency, and dampen the risk of cascading failures during market stress.

- Improving Transparency: Enhanced data collection on hedge fund exposures—especially in opaque areas like bilateral repo markets and derivatives trades—would give regulators better visibility into potential systemic threats.

- Targeted Leverage Controls: Rather than imposing blanket limits, regulators could adopt risk-based margin and leverage requirements tailored to specific strategies, such as basis trades, that have shown fragility during past stress episodes.

- Strengthening Risk Management Practices: Requiring hedge fund managers to adopt more rigorous risk controls, including independent oversight functions and stress testing, could help prevent excessive risk-taking without constraining market dynamics.

- Recalibrating Dealer Constraints: Revisiting regulations like the Supplementary Leverage Ratio (SLR) could enable bank dealers to step in more effectively during market disruptions, absorbing shocks and supporting liquidity.

The regulatory goal is not to suppress hedge fund activity, but to build a more resilient framework that can absorb shocks without resorting to extraordinary interventions.

A Market in Transition

As traditional buyers retreat and sophisticated, leveraged investors rise to fill the gap, the character of the market is evolving—from one built on long-term stability to one increasingly shaped by short-term arbitrage and risk-taking.

Even financial titans like Warren Buffett appear to be positioning cautiously. Berkshire Hathaway’s recent $300 billion allocation to Treasury bills—surpassing even the Federal Reserve’s holdings—signals both confidence in their safety and a strategic readiness for volatility ahead.

Ultimately, the Treasury market must remain not just functional, but reliably so, even in moments of acute stress. Ensuring that its new class of key participants—hedge funds—contribute to that stability rather than undermine it will be one of the defining financial challenges of the coming decade.