India Turns Accommodative: What the Latest Rate Cut Means

The RBI cuts interest rates again, shifting to an accommodative stance to stimulate growth amid slowing demand and global trade tensions.

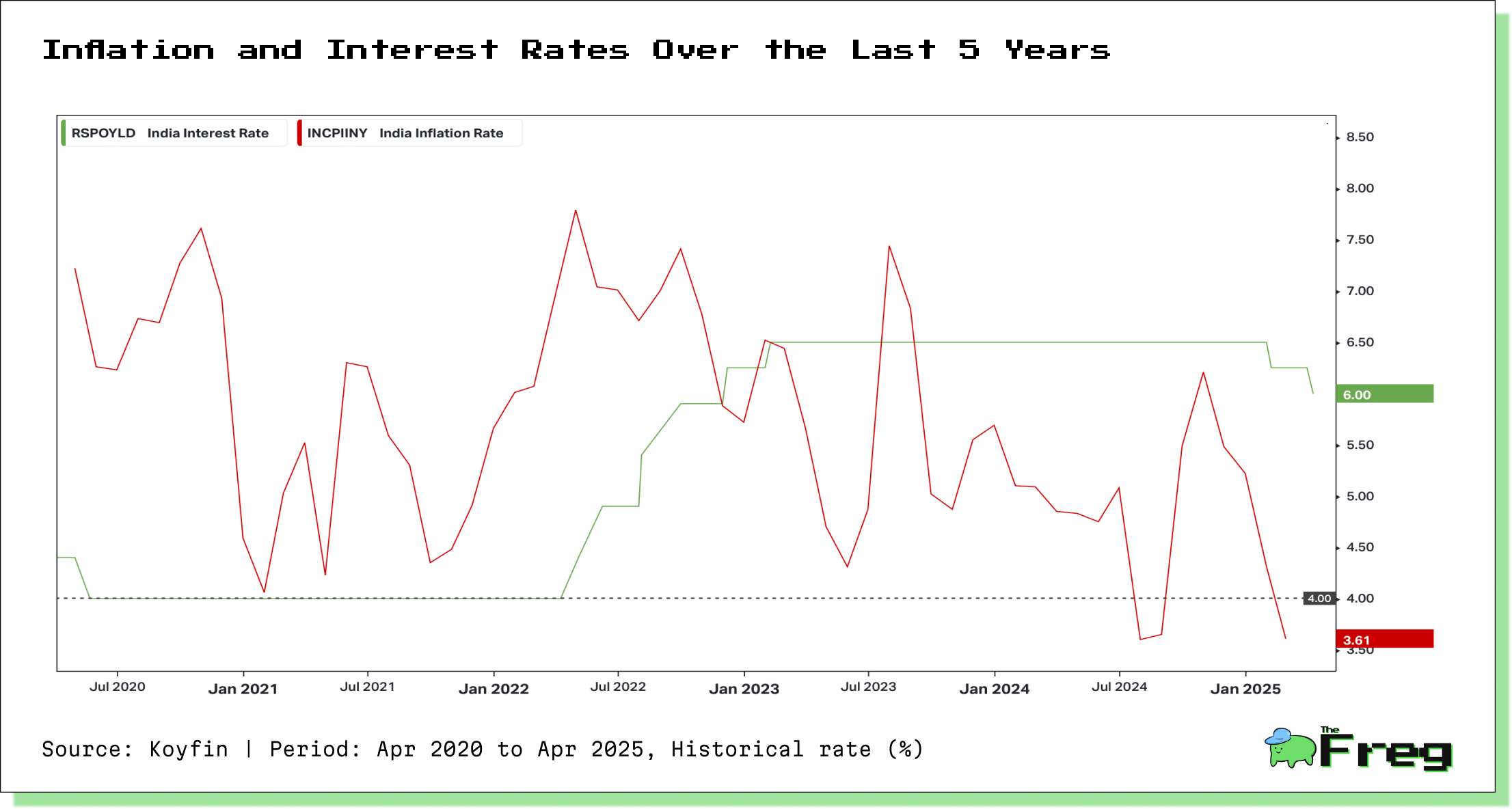

India’s central bank, the Reserve Bank of India (RBI), has cut its key interest rate — the repo rate — by 25 basis points for the second consecutive time. More importantly, the RBI has shifted its stance from “neutral” to “accommodative”, signalling a stronger commitment to reviving economic growth.

What’s Driving the Rate Cut?

The Indian economy is facing multiple headwinds:

- Manufacturing growth has slowed sharply

- Urban consumer demand remains subdued

- Private investment is not picking up as expected

To address these issues, the RBI is lowering borrowing costs. Cheaper loans can encourage both consumer spending and business investment, which helps stimulate the economy.

RBI Governor Sanjay Malhotra stated that the central bank is now more focused on supporting growth than fighting inflation. With inflation projected

at 4%, the RBI believes there is enough space to cut rates without destabilizing prices.

Global Turbulence: The U.S. Tariff Effect

Global uncertainty — particularly rising U.S. tariffs — is another factor influencing the RBI’s move.

- These tariffs threaten Indian exports and overall economic momentum

- A trade agreement with the U.S. is under discussion, but nothing is finalized

As a result, the RBI revised its GDP forecast for FY26 from

6.7% down to 6.5%, highlighting its cautious outlook amidst ongoing global risks.

Forward Guidance: Reading Between the Lines

The RBI is also using forward guidance — subtle signals about future policy direction — to guide market expectations.

- This tactic helps stabilize interest rate forecasts

- It gives businesses and households more confidence when planning borrowing and spending

But forward guidance works best in stable environments. In today’s volatile global setting, the RBI must remain flexible, while also being transparent.

India’s Path vs Global Central Banks

Not all central banks are taking the same route:

- India: Cutting rates to stimulate growth

- U.S. Fed & ECB: Keeping rates high to fight inflation

- Bank of England: Holding steady at 5.25%, balancing risks

- Bank of Japan: Maintaining ultra-loose (even negative) rates to encourage spending

These varied approaches reflect each country's unique economic conditions.

But Are There Risks?

The Reserve Bank of India's decision to pursue further rate cuts and an accommodative stance is not without risk. Several potential downsides could undermine its objectives:

- Inflationary Risks

Although inflation is projected at 4%, unforeseen supply shocks, global commodity price hikes, or a poor monsoon could push inflation higher, constraining the RBI’s policy flexibility. - Asset Bubbles and Mispricing of Risk

Prolonged low interest rates can encourage investors to take on excessive risk, inflating asset prices — particularly in real estate and equities — and potentially leading to financial instability. - Transmission Challenges

Banks may not fully pass on rate cuts to borrowers, especially if credit risk perceptions remain high. Notably, some private banks have raised deposit rates even as the RBI is easing. - External Economic Uncertainty

Global headwinds — from tariffs to slowing demand — may continue to drag on exports and foreign capital inflows, weakening the impact of domestic monetary easing. - Currency Depreciation

An accommodative stance could lead to rupee weakness, making imports costlier and potentially widening the trade deficit — which may reignite inflationary pressure. - Long-Term Structural Risks

Relying too heavily on monetary policy might delay needed reforms in infrastructure, labor markets, or manufacturing. Growth built on easy credit is not a substitute for structural improvement. - Fiscal-Monetary Policy Coordination

Without corresponding fiscal measures, like increased government investment, the stimulus from rate cuts may have a muted effect. Confidence in recovery depends on coordinated action.

The RBI must navigate these risks with caution, ensuring that monetary support for growth does not compromise financial stability or long-term resilience.

Final Take

The RBI’s latest actions — a second rate cut and a shift to an accommodative stance — reflect its urgent push to revive growth amid both domestic and global challenges.

Whether this strategy will work depends on:

- How quickly banks transmit lower rates to borrowers

- The trajectory of global trade and inflation

- The RBI’s ability to balance stimulus with long-term financial stability

For now, the message is clear: the RBI is ready to act — and that’s good news for borrowers and businesses alike.