Indian Sectoral Divergence Deepens

India’s sectoral ETFs reflect diverging trends in 2025, with financials surging and IT plunging amid global trade turmoil.

India’s sectoral exchange-traded funds (ETFs) have painted a striking picture of investor sentiment in early 2025, reflecting growing global economic uncertainty sparked by heightened U.S. tariffs and rising recessionary risks. From the steep selloff in IT to the resilience of financials, sectoral performance has sharply diverged—largely based on exposure to global shocks and domestic fundamentals.

IT Sector: Recession Fears Spark Sharp Selloff

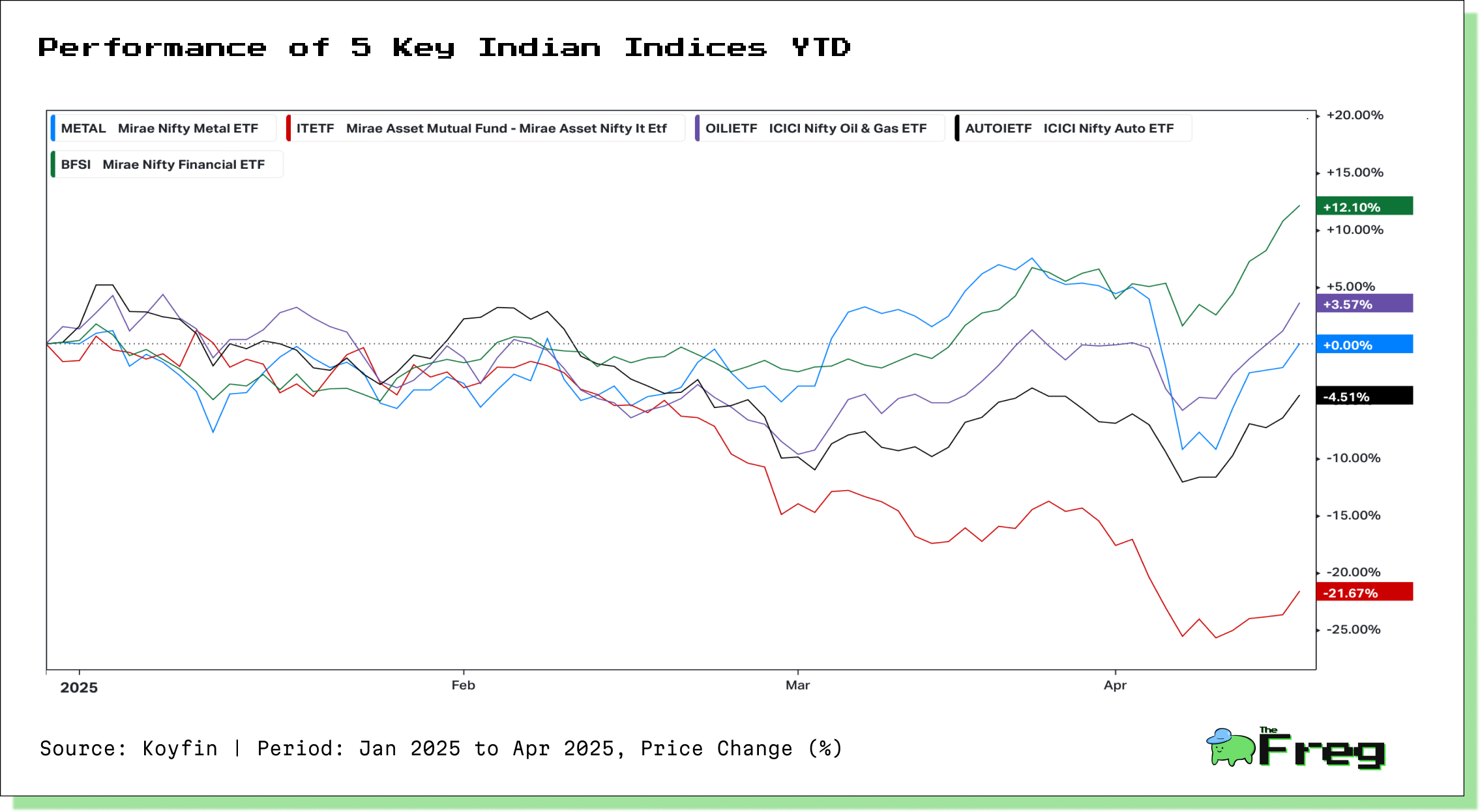

The Mirae Asset Nifty IT ETF (ITETF) has been the worst performer among major sectoral ETFs, plunging -21.67% year-to-date as of April 21, 2025.

While Indian IT firms weren’t directly targeted by U.S. tariffs, recession fears in the U.S.—especially after former President Donald Trump’s sweeping tariff announcement—have triggered widespread cutbacks in discretionary tech spending by American clients in manufacturing, retail, and logistics. JPMorgan, in response, raised global recession odds to 60%.

The Nifty IT Index sank to a 52-week low of 30,918.95 on April 7, with companies like Coforge, Mphasis, and Tech Mahindra seeing significant drawdowns.

Financial Services: Defensive Leads the Pack

In contrast, the Mirae Nifty Financial ETF (BFSI) has emerged as the top sectoral performer, gaining +12.10% YTD. This mirrors the strength in the Nifty Financial Services Index, which has benefited from robust domestic demand, solid balance sheets, and insulation from global trade turmoil.

Heavyweights such as HDFC Bank and ICICI Bank helped propel the index to a 52-week high. April alone saw the sector rise by 5.26%, driven by investor rotation into defensives, improving valuations, and positive technical momentum.

Metals and Autos: Collateral Damage from Trade Tensions

The Mirae Nifty Metal ETF (METAL) has hovered near breakeven (0.00% YTD), rebounding from earlier losses. After hitting a 52-week low on April 7, the sector rallied 4% on April 11, buoyed by the temporary suspension of U.S. tariffs on Indian metal exports. Yet, it remains highly sensitive to ongoing U.S.–China trade dynamics.

The ICICI Nifty Auto ETF (AUTOIETF) has declined -4.51% YTD, reflecting the auto sector’s vulnerability to trade frictions. Export-focused players like Bharat Forge and Tata Motors bore the brunt of the hit. However, mid-April optimism around potential tariff exemptions triggered a partial recovery.

Energy: Quiet Strength on Domestic Tailwinds

The ICICI Nifty Oil & Gas ETF (OILIETF) has posted a +3.57% YTD gain, benefiting from a defensive pivot into energy stocks. Despite a poor 12-month performance, the sector has rebounded sharply in recent weeks—rising 9.05% in five days through April 21—on the back of strong domestic demand and reduced impact from global trade actions.

Refinery-heavy constituents led the rally, outperforming upstream peers that were hurt by falling crude prices.

Macro Forces at Play: RBI Actions and Global Shocks

This sectoral divergence reflects a recalibration of investor risk in response to rising global headwinds. Export-linked sectors like IT and Metals remain vulnerable to external shocks, while domestically anchored sectors such as Financials and Energy have shown relative resilience.

Between January and April 2025, markets were shaped by a dual narrative: proactive monetary easing by the Reserve Bank of India (RBI) and intensifying global uncertainty, especially around trade and commodities.

RBI’s Pro-Growth Stance

In a bid to support growth amid weakening global demand, the RBI cut the repo rate by 50 basis points (25 bps each in February and April), lowering it to 6.00%.

The central bank also injected over ₹6.9 lakh crore in liquidity, transforming a January deficit into a ₹1.5 lakh crore surplus by April. These steps improved credit flow, reduced borrowing costs, and aided interest-sensitive sectors like Financials and Auto.

A mild 1.8% rupee depreciation, facilitated by the RBI’s accommodative stance, offered modest relief to exporters—though not enough to offset global demand destruction.

Global Trade Shocks and Market Turmoil

Globally, markets reeled from Trump’s surprise tariffs in early April, triggering sharp corrections and fears of a global recession. While the direct impact was muted, the second-order effects were significant, particularly for IT firms and metal exporters.

Meanwhile, oil prices fell over 10% in April amid OPEC+ oversupply and weaker demand forecasts. This helped ease inflation and supported refiners, but weighed on upstream oil companies.

In its April commentary, the RBI flagged the “rising risk of protectionism and currency wars,” adding urgency to its efforts to buffer the domestic economy.

Looking ahead, sector rotation is expected to continue as investors weigh evolving U.S. trade policy and domestic macro signals. Defensive sectors like Financials and Energy are likely to stay in favor, while battered segments such as IT and Autos may see selective bottom-fishing if global conditions stabilize.

For now, India's sectoral divergence offers a revealing lens into the push and pull between global headwinds and domestic resilience.