Indian Stocks Have Turned Volatile

Rising US yields, AI boom, profit taking and high valuations resulting in Indian stocks facing a short-term bear market.

After years of steady growth fueled by post-pandemic easy money policies, Indian stock markets have recently experienced increased volatility, with major indices declining from their historic peaks achieved in late September 2024 due to various factors including rising US treasury yields, economic slowdown, and disappointing corporate earnings.

Rising US treasury yields and AI boom

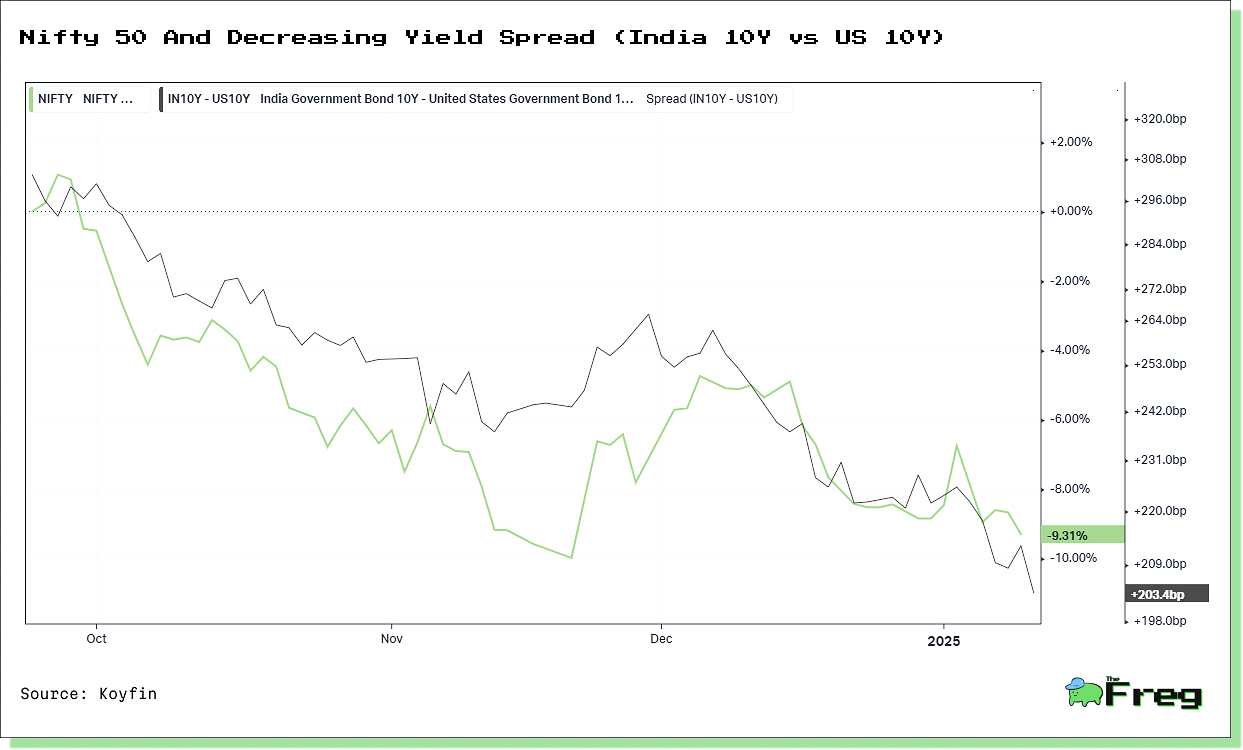

The rise in US Treasury yields has significant implications for global financial markets, particularly affecting emerging economies like India. As US 10-year yields reached 4.76%, narrowing the spread with Indian 10-year government securities to 203 basis points, foreign portfolio investor (FPI) inflows into India are likely to be impacted. Additionally, rising yields often result in rupee depreciation, affecting companies with dollar-denominated debt while potentially benefiting export-oriented sectors like pharmaceuticals and technology.

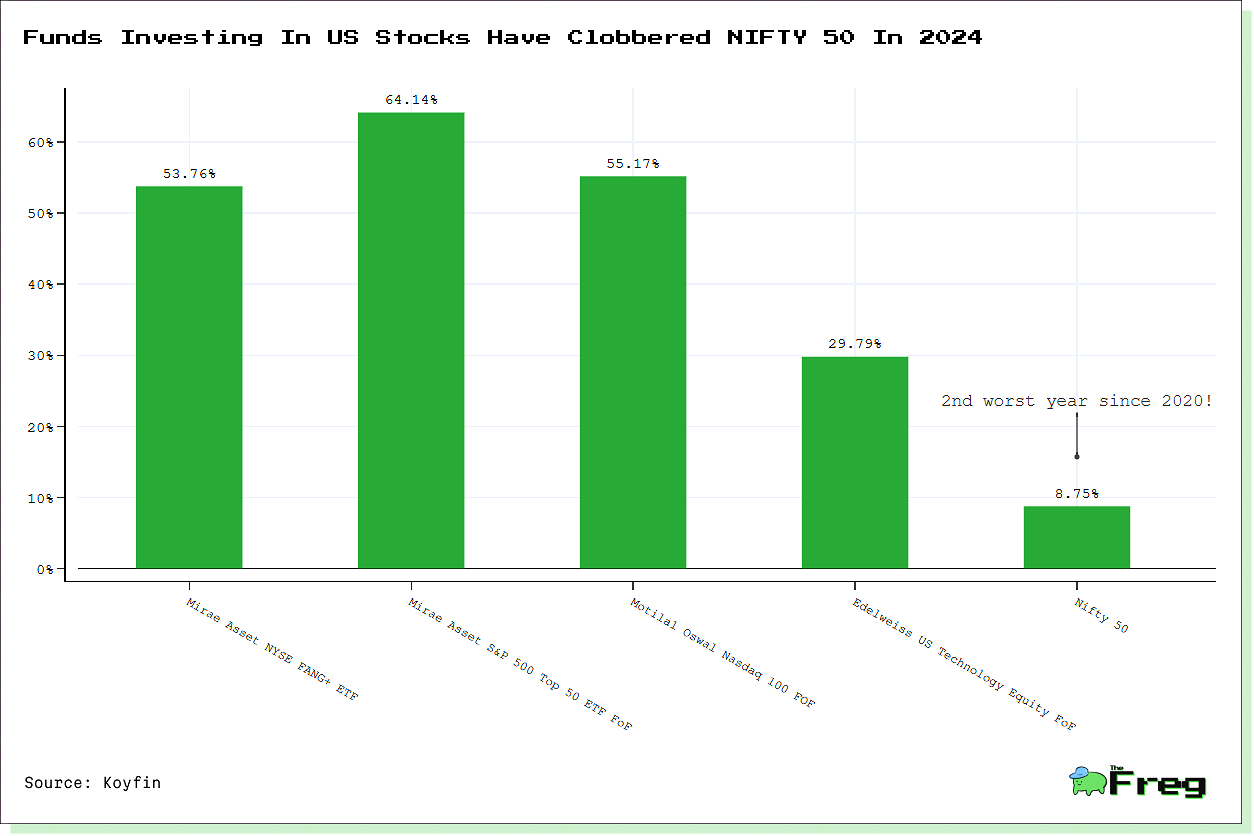

The artificial intelligence boom in the United States has also led to a significant shift in foreign portfolio investment (FPI) patterns, with Indian investors increasingly allocating funds to US tech stocks. This trend has been particularly evident in the performance of US tech-focused mutual funds in India which have outperformed the top Indian stock benchmark - Nifty 50 in 2024 by a significant margin.

Elevated valuations trigger selloff and India's GDP growth not as expected

The Indian stock market has experienced a significant selloff triggered by elevated valuations and concerns over economic growth. HSBC recently downgraded India to 'Neutral', citing softening profits and high valuations as key factors.

India's GDP growth, while still robust, has not met the expectations set by some analysts. This discrepancy between economic performance and market valuations has led to increased volatility and profit-taking. The situation is further complicated by the increased participation of young, relatively new retail investors who have entered the market post-pandemic and may not have experienced a prolonged market correction. As a result, any significant downturn could have a substantial impact on investor sentiment and spending patterns, potentially exacerbating market volatility.

1. Foreign investors got cold feet due to lofty valuations, pulling out billions and sending the benchmark index (Nifty 50) on a nosedive.

2. Defensive sectors like pharma and tech became the new cool kids as investors played it safe.

3. The US Treasury yield hikes caused some serious jitters, especially when paired with a stronger dollar.

4. Indian investors started eyeing US markets for diversification and a shot at those sweet AI and tech stock gains.