India's External Debt: A Balancing Act Amid Global Uncertainty

India's external debt has reached $717.9 billion, raising concerns about sustainability amidst global uncertainties. While reserves provide a buffer, challenges like the depreciating rupee and rising borrowing costs require careful financial management.

India's external debt has surged to $717.9 billion as of December 2024, raising pressing questions about its sustainability. While the debt-to-GDP ratio remains below international danger levels, the sheer scale of borrowing and its impact on the Indian Rupee and foreign exchange reserves warrant closer scrutiny. As global economic conditions grow increasingly uncertain, India's ability to navigate its debt obligations will hinge on careful policy decisions and strategic financial management.

The Currency Mix: A Double-Edged Sword

Rupee Under Pressure: A Tug-of-War with the Dollar

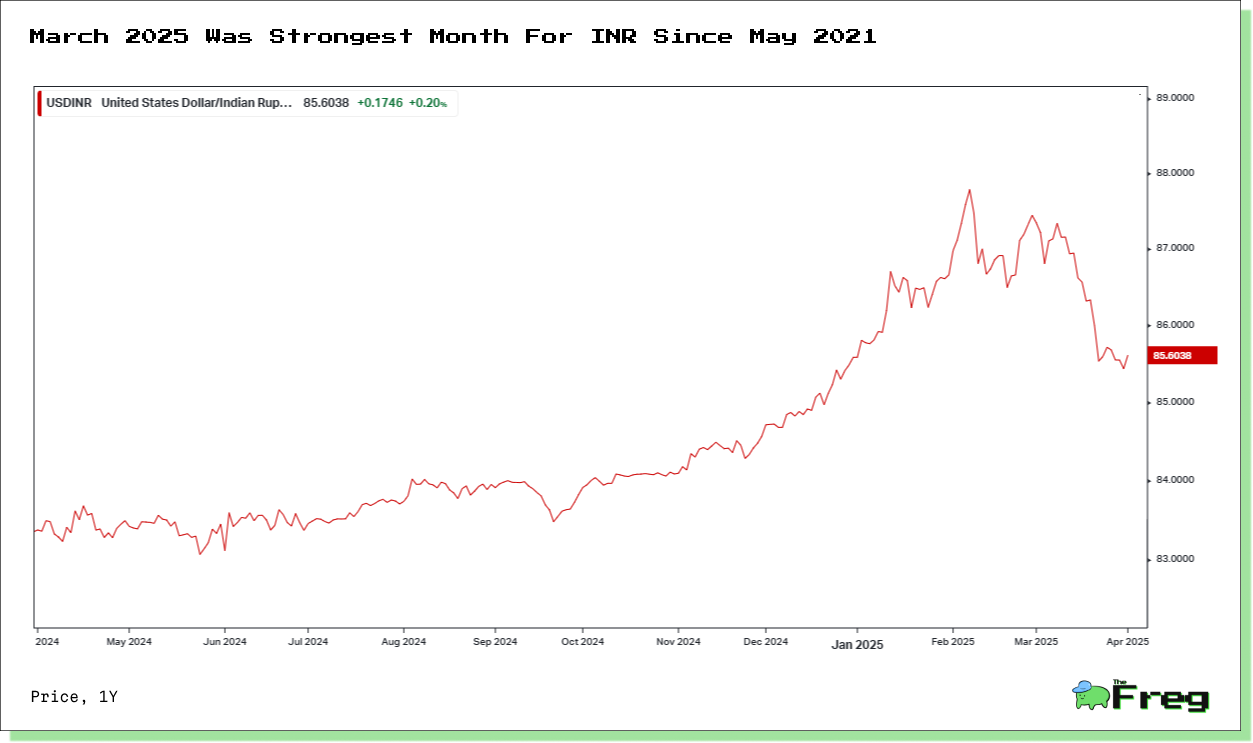

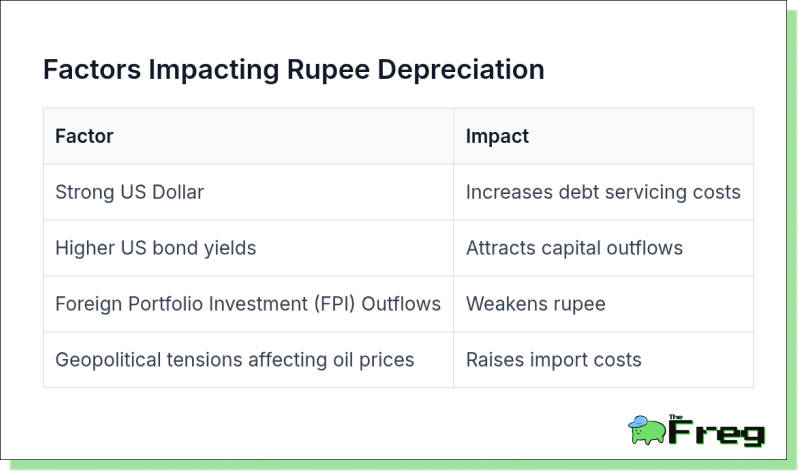

The Indian Rupee has been caught in a storm of external pressures, sliding to an all-time low of 86.63 per US dollar by January 2025.

This depreciation is fueled by a combination of a strong US dollar, higher US bond yields attracting investors away from emerging markets, and foreign portfolio outflows from India. Add to this the ever-volatile global oil prices and geopolitical tensions, and the rupee faces persistent downward pressure. The Reserve Bank of India (RBI) has intervened to curb volatility, but these measures have tightened banking liquidity and driven up short-term interest rates. A controlled depreciation strategy may prove essential to balance economic growth with currency stability.

Forex Reserves: A Robust but Tested Shield

With foreign exchange reserves standing at $652.9 billion as of mid-2024, India has built a solid buffer against external shocks. The reserves currently cover 90% of external debt and provide an import cover of 10.9 months—well above the IMF’s recommended threshold for emerging economies. However, the rising current account deficit and increasing short-term debt pose ongoing risks. The impending inclusion of Indian bonds in global indices could provide a fresh influx of reserves, yet it also heightens external debt exposure. Maintaining an optimal reserve level will require balancing debt obligations with capital inflows.

Debt Sustainability: Where Does India Stand?

A critical indicator of India’s debt health is its debt service ratio, which rose slightly to 6.5% in 2024 from 5.3% the previous year. This remains relatively low compared to global benchmarks, reinforcing India’s ability to meet repayment obligations. Moreover, the external debt-to-GDP ratio stood at 18.7%, a comfortable level by international standards. However, rising borrowing costs, rupee depreciation, and potential capital outflows present lurking threats. Continued prudence in debt management and forex reserve accumulation will be key to preserving stability.

Policy Responses: Strengthening India’s Financial Fortitude

India has proactively implemented strategies to manage its external debt and stabilize the rupee. Key initiatives include:

- Simplifying external borrowing norms to attract more diverse funding sources, including rupee-denominated bonds.

- Diversifying export markets to reduce trade dependency on a few key economies.

- Streamlining regulations to encourage foreign direct investment and boost economic resilience.

- Incentivizing export-oriented industries to enhance foreign exchange earnings.

- Allowing a measured rupee depreciation rather than excessive interventions that drain forex reserves.

- Ensuring sustainable government borrowing focused on long-term investments rather than short-term consumption.

Future Outlook: Navigating Uncharted Waters

India’s external debt remains within manageable levels, supported by strong economic fundamentals. However, global uncertainties demand ongoing vigilance. Key metrics to monitor include:

- GDP growth rate

- Fiscal deficit containment

- Forex reserves to debt ratio, ensuring it remains robust amid rising obligations

- Export growth and trade balance, vital for foreign exchange generation

By maintaining fiscal discipline, fostering economic resilience, and carefully managing external debt exposure, India can steer through these financial crosscurrents. The road ahead may be fraught with challenges, but with sound policy decisions and strategic planning, India is well-positioned to uphold its financial stability in a turbulent global economy.