India's Industrial Output Faces a Six-Month Slump: Dissecting the February 2025 Slowdown

India's industrial output slowed to 2.9% YoY in February 2025, hit by a high base effect and sector-specific challenges. Consumer demand remains weak, and experts foresee a modest recovery amid ongoing challenges.

India's industrial output growth slumped to a six-month low of 2.9% year-on-year in February 2025 marking a notable deceleration from January’s 5.2%. This sharp dip in the Index of Industrial Production (IIP)—a composite measure tracking the volume of production across manufacturing, mining, and electricity—underscores growing concerns around the sustainability of industrial momentum amid persistent sector-specific and macroeconomic headwinds.

The High Base Effect and the Statistical Mirage

A significant contributor to the subdued IIP figure was the high base effect. February 2024 had recorded an impressive 5.6% growth, bolstered in part by the leap year advantage of an extra day of production. This added roughly a 3.6% statistical boost to the previous year's production base, exaggerating the extent of the current year’s slowdown and complicating year-on-year comparisons.

Sectoral Breakdown: Manufacturing and Mining Weigh Down Output

The manufacturing sector—accounting for over three-quarters of the IIP—saw growth halve to 2.9% in February from 5.8% in January. A range of challenges affected the sector, from weak order books and cost pressures to sluggish demand. Key subsectors like chemicals and petroleum refineries contracted, while others such as basic metals and transport equipment reported modest expansions. Notably, food and beverage production remained a rare area of resilience.

Mining output also faltered significantly, registering a year-on-year growth of just 1.6%, down from 4.4% in January. This steep decline is attributed to reduced demand for critical minerals, inefficiencies, and ongoing global commodity market disruptions. Structural hurdles like high taxation and regulatory constraints further exacerbated the sector’s slowdown.

Sector-wise YoY Growth for Jan and Feb 2025

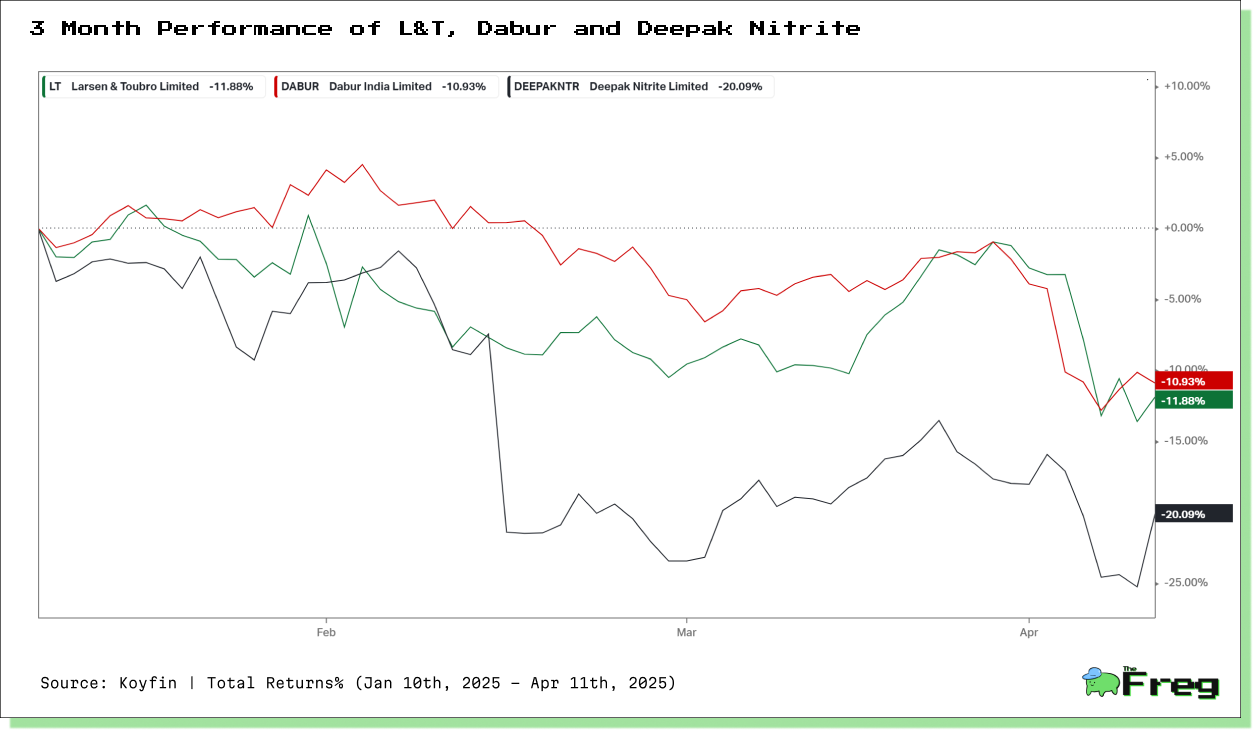

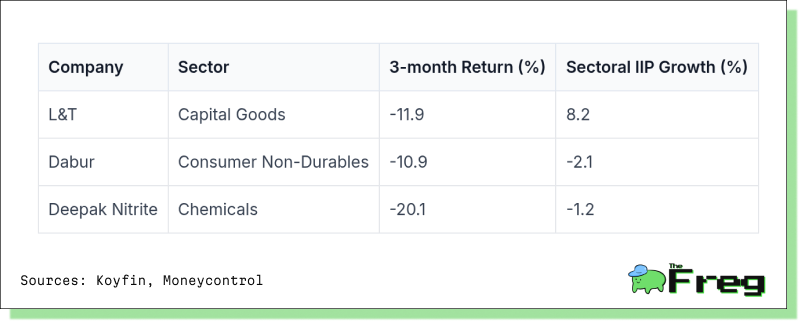

Stock Performance: Notable Mentions

The recent IIP data has had varying impacts on different sectors and companies:

Capital Goods: Larsen & Toubro (L&T) has shown resilience, gaining 1.12% recently despite the overall sector decline. L&T's strong performance aligns with the robust 8.2% growth in capital goods production, benefiting from ongoing infrastructure projects and private sector capex. Siemens India saw a 15–20% earnings upgrade, with strong commentary on long-term growth drivers from domestic manufacturing and exports.

Consumer Non-Durables: Dabur reported flat consolidated revenue growth in Q4, citing delayed winter, urban slowdown, and weakness in general trade. This aligns with the 2.1% contraction in consumer non-durables production. However, Dabur and other FMCG majors like ITC, Godrej, and Emami have reported robust sales in rural areas, potentially offsetting some urban weakness.

Chemicals: Deepak Nitrite has shown strong profitability with higher margins due to its diversified product portfolio, while Aarti Industries benefits from long-term contracts and global demand for specialty chemicals. However, the overall chemicals sector saw a contraction in the IIP data.

Electricity Generation: A Modest Bright Spot

The electricity sector emerged as the relative outperformer in February, with output rising 3.6% year-on-year—an improvement over January’s 2.4%. While its weight in the IIP is limited, the sector’s uptick reflects increased energy demand and a degree of underlying economic activity.

Diverging Use-Based Demand Trends

An analysis of the use-based classification reveals stark contrasts across segments:

- Capital goods surged by 10.3%, suggesting strong investment momentum possibly driven by public infrastructure spending and business optimism. This category includes machinery, tools, and construction equipment—critical inputs for future production.

- Intermediate goods grew by 5.9%, indicating sustained demand from industrial producers.

- Consumer durables expanded by 8.3%, but this was a marked slowdown from 14.1% growth in November 2024, hinting at softening consumer enthusiasm.

- Consumer non-durables, a proxy for everyday household consumption, contracted by 7.6%, reflecting deepening stress in rural demand and household budgets.

- Infrastructure/construction goods decelerated to 6.3% growth from earlier highs, likely due to a pullback in construction activity.

This divergence between investment-driven and consumption-driven sectors paints a picture of an economy where business confidence holds, but household spending remains fragile.

Temporary and Structural Drags

Beyond base effects, February’s industrial performance was also marred by supply chain disruptions and geopolitical volatility. Manufacturers reported delays due to raw material shortages and increased delivery times. Commodity prices remained volatile—energy prices saw mixed trends, with a notable rise in natural gas costs and a decline in broader energy prices over the February-March period. These dynamics strained profit margins and disrupted production schedules.

Meanwhile, recently introduced tariff policies led to input cost spikes and order placement backlogs. Though temporary in nature, these factors interacted with underlying structural weaknesses—particularly in consumer segments—to weigh heavily on output.

Expert Outlook: A Temporary Dip or a Warning Sign?

Industry watchers remain split on the implications of the February slowdown. Aditi Nayar, Chief Economist at ICRA, attributes the dip largely to the base effect and expects a modest rebound in March. She points to green shoots in high-frequency indicators like transport activity and electricity generation.

However, other experts caution that the persistent contraction in consumer non-durables signals deeper economic malaise. RBI surveys suggest continued weakening in manufacturing output and order books, implying that the slowdown may extend into the coming quarters.

Brokerage houses have adjusted GDP forecasts slightly downward, though most maintain a cautiously optimistic outlook for 2025. The resilience in capital goods is seen as a positive sign, but the weakness in household consumption remains a key risk.

Policy Implications: The Balancing Act Ahead

Policymakers face a challenging balancing act. Monetary easing by the RBI may be considered to spur demand, while fiscal measures targeted at rural consumption and supply chain support in manufacturing could also be on the table.

The disparity between capital investment and consumer sentiment suggests that while industries continue to build capacity, production may not ramp up unless consumer demand rebounds. Addressing this divergence will be critical to ensuring balanced and sustainable industrial growth.

In summary, February’s industrial output data is as much a reflection of statistical quirks as it is of real economic stress. With the base effect set to moderate in coming months, the onus will be on both policymakers and industry to catalyze a more broad-based recovery.