India’s Quiet Strength vs. America’s Noisy Markets

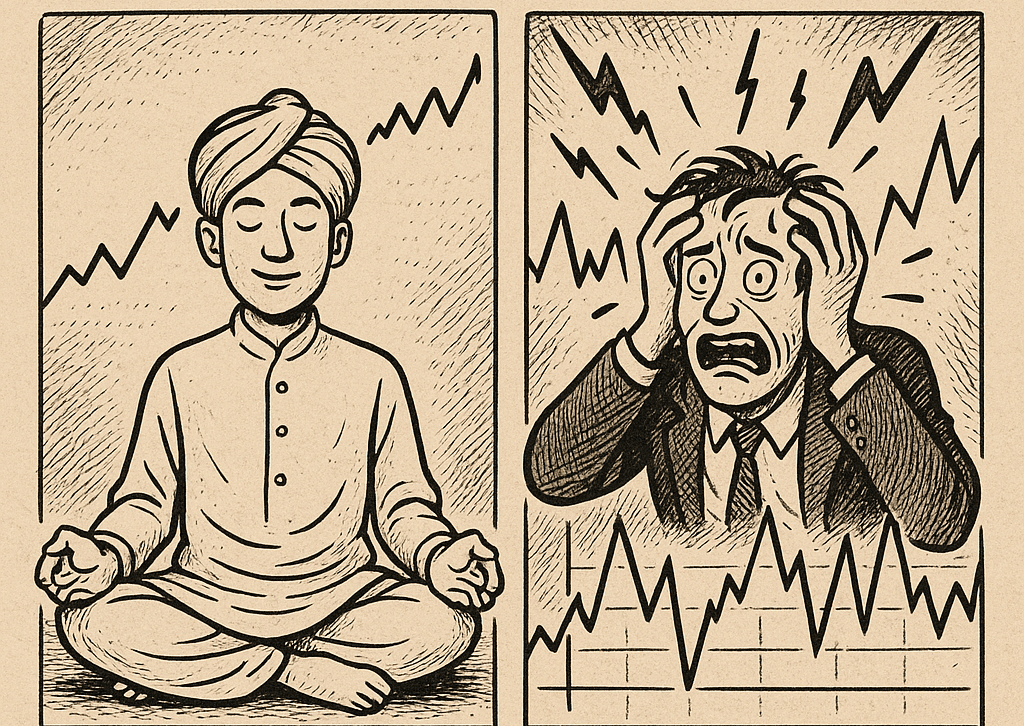

In 2025, Indian markets have become less volatile than the U.S., driven by structural strength and retail flows, while the U.S. grapples with cyclical shocks.

In a reversal few could have predicted a decade ago, Indian equities have emerged as a relative safe haven in 2025, with volatility levels falling below those of the traditionally more stable US market. This shift, captured by volatility indices and validated by macroeconomic trends, underscores a broader recalibration in global investor sentiment amid rising geopolitical and economic uncertainty. Something which we had pointed here.

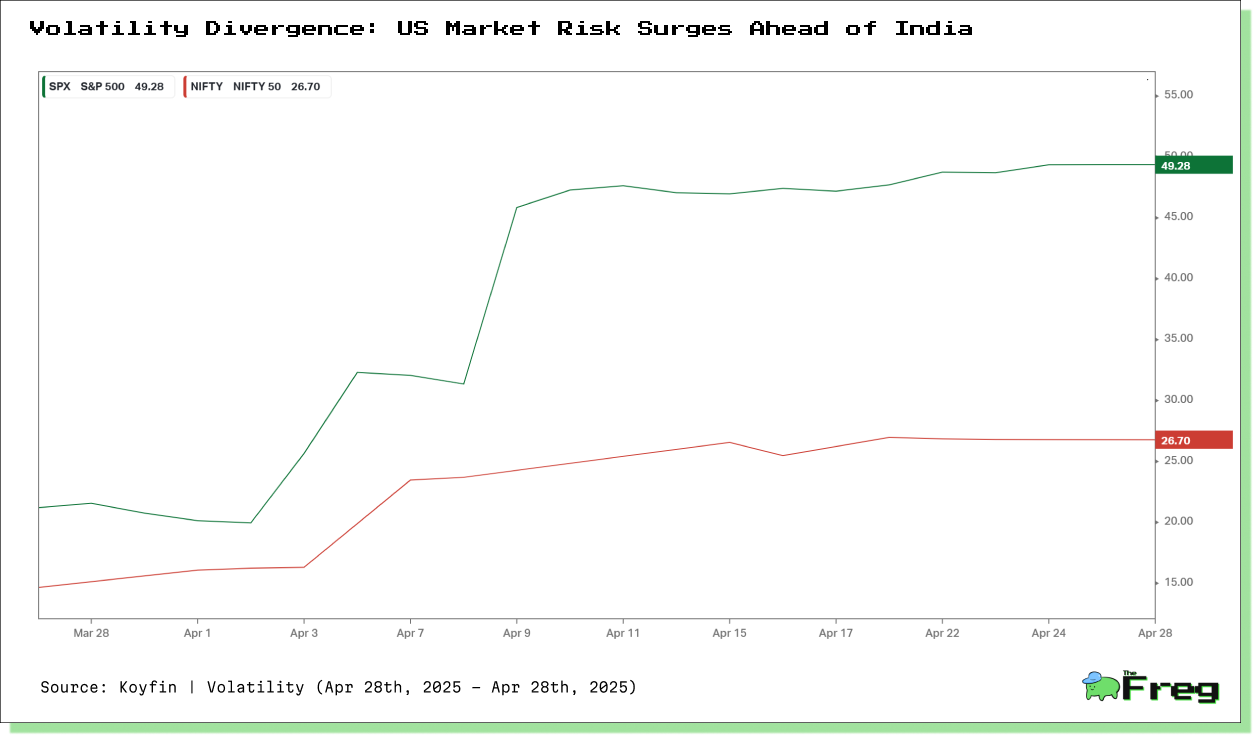

The VIX Gap: India Beats the US at Calm

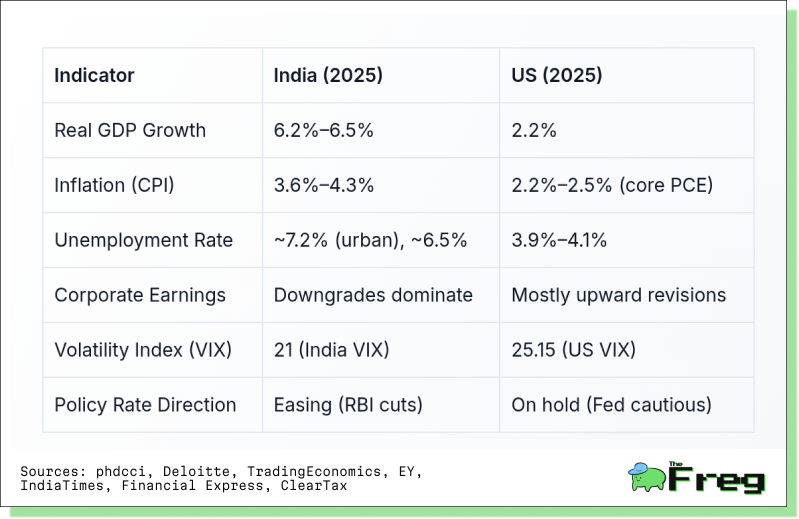

As of late April 2025, the US VIX—the market’s famed “fear index”—sits at approximately 25.15, up 67% from a year ago and well above its long-term average. Meanwhile, India VIX hovers near 21, even after a recent spike, signaling that investors expect more turbulence in the US than in Indian markets.

The performance of benchmark indices echoes this divergence. The S&P 500, despite logging a modest 6.8% annual gain, experienced multiple double-digit drawdowns. India’s Nifty 50, in contrast, gained 5.34% with much less drama.

Why the US is More Volatile

Multiple catalysts have contributed to the US market’s rollercoaster ride this year:

- Tariff Turbulence: April’s sweeping trade tariffs sparked a 10% plunge in the S&P 500 over two days. Even rumors of a 90-day pause created wild swings—a 9.5% rebound followed by renewed declines.

- Fiscal Deficit Woes: The growing US fiscal deficit has pushed Treasury yields higher, increasing borrowing costs and unsettling equity markets.

- Interest Rate Uncertainty: With the Fed on hold, investors are left guessing about future moves, making every inflation print a potential market mover.

- Tech Sector Fragility: The so-called "Magnificent Seven" have taken hits—Apple alone lost $174 billion in market cap, and Tesla’s stock has halved.

- Political Noise: Election-year drama in Washington has injected unpredictable policy risk across tax, trade, and regulatory fronts.

India’s Calm Amid the Storm

While US investors have been whipsawed by every headline, Indian markets have quietly demonstrated resilience. The Reserve Bank of India (RBI) has cut the repo rate twice in 2025, bringing it down to 6% and reinforcing its accommodative stance.

More than just central bank support, India’s macroeconomic landscape is supportive:

- Strong Domestic Demand: Despite a trimmed GDP outlook (6.5% for FY26), consumer and infrastructure spending remains robust.

- Retail Investor Inflows: Monthly SIP contributions to mutual funds crossed ₹25,000 crore, reflecting a maturing investor base.

- Reform Momentum: Policy steps like the PLI expansion and GST rationalization continue to stabilize the economic foundation.

- Political Stability: With no major elections or disruptive reforms this year, policy continuity has further anchored sentiment.

India’s Decoupling: Temporary or Structural?

India’s recent run of low volatility and relative market calm has been impressive, but the question is whether this decoupling from global risk is built to last—or is just a fleeting phase. The answer, as always, is a mix of structural strengths and lurking vulnerabilities.

Domestic Flows vs. Global Outflows: The surge in systematic investment plans (SIPs) and retail mutual fund inflows has helped cushion Indian equities against the persistent exodus of foreign capital. In 2025, domestic investors have pumped in nearly as much as foreign institutional investors (FIIs) have pulled out, keeping the market afloat even as global funds chase bargains in China, Europe, and elsewhere. However, if global shocks intensify or domestic sentiment sours, this balancing act could be tested.

China+1 and EM Darling Status: India’s appeal as a “China+1” manufacturing hub is more than just a narrative—it’s backed by rising exports (notably in mobile phones), competitive wages, and government incentives like the PLI scheme. These factors support a structural case for India’s outperformance among emerging markets. Yet, as global investors rotate allocations based on valuations and relative performance, India’s premium pricing could become a double-edged sword if corporate earnings disappoint or reforms stall.

Risks to Watch: The low India VIX is not immune to sudden spikes. Key risk triggers include:

- Election Surprises: Political uncertainty, especially around major elections, has historically sent India VIX soaring, as markets price in the risk of policy shifts or instability.

- Oil Price Shocks: With India’s heavy reliance on imported crude, any sharp rise in oil prices can hit both the rupee and inflation, feeding into market volatility.

- Currency Weakness: A sudden INR depreciation, especially if triggered by global risk aversion or a Fed surprise, could amplify outflows and rattle equities.

In short, India’s decoupling is underpinned by real progress, but it’s not bulletproof. Structural strengths can keep volatility contained—until the next global or domestic curveball arrives. Stay nimble, and don’t ignore the warning lights.

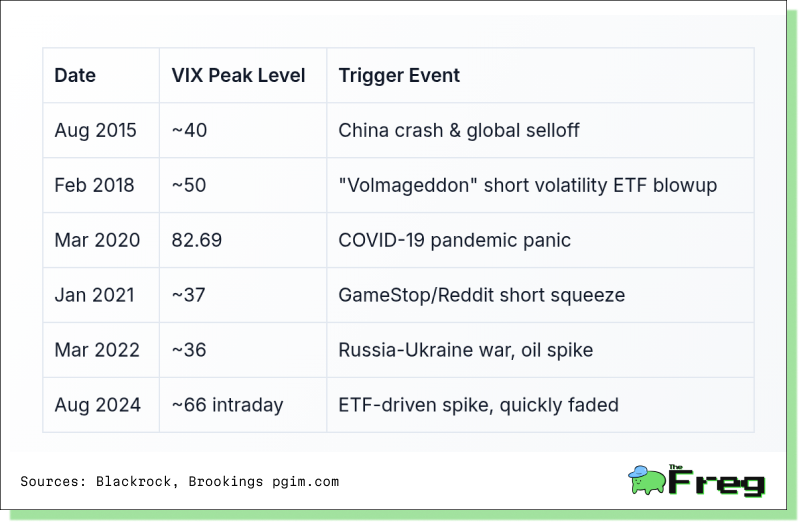

A Decade of US Volatility Spikes

The past ten years show how fast US market calm can turn to chaos:

These spikes highlight how external shocks—from pandemics to policy shifts—can suddenly jolt even the most developed markets.

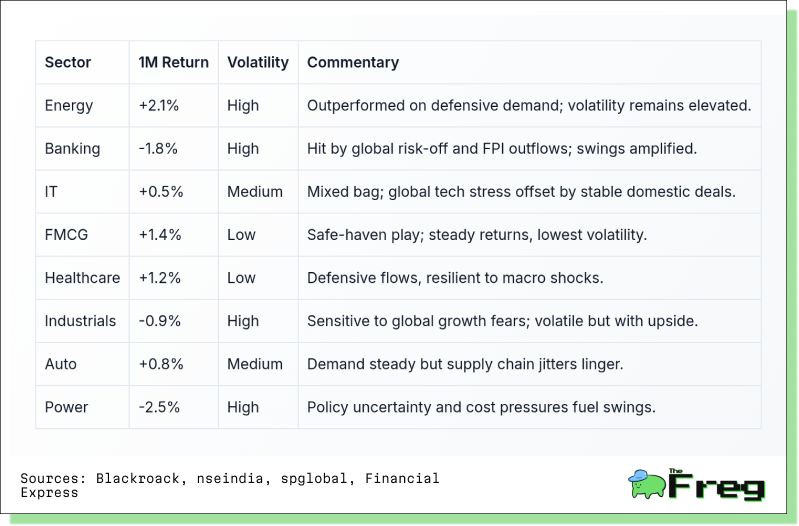

Sector Performance Snapshot

While headline indices grab attention, the real story of market risk often plays out at the sector level. Here’s a snapshot of how key Indian sectors have fared recently, highlighting the divergence between calm and chaos beneath the surface.

Performance and Volatility of Key sectors in India

Energy and FMCG have stood out for their resilience, while Banking and Industrials have been whipsawed by global jitters. Defensive sectors like FMCG and Healthcare remain oases of calm, underscoring the importance of sector selection in volatile markets.

Structural Calm vs. Cyclical Chaos

The current risk reversal is part structural, part cyclical. US volatility is largely cyclical, driven by tariffs, election noise, and inflation worries. India’s relative calm, on the other hand, is structural—rooted in long-term policy, reforms, and growing domestic participation.

But neither trend is permanent. If the US reaches a trade détente or clarity returns post-election, its markets could regain stability. Conversely, India remains vulnerable to global shocks like oil price spikes or export downturns.

The Takeaway for Investors

This flip in volatility doesn’t crown a new global safe haven overnight. But it’s a reminder that risk is dynamic. Investors should avoid chasing temporary calm or fleeing temporary chaos. Instead, stick to disciplined strategies, monitor structural shifts, and stay prepared for the next macro twist.