India’s Stock Market Valuations Face Rigorous Test

India's economic growth story remains compelling, even as the market takes a breather to catch up with fundamentals.

As of January 2025, Indian stock market valuations are under scrutiny, with concerns over frothy conditions in mid- and small-cap segments, elevated price-to-earnings ratios in the Nifty 50, and India's premium valuation compared to global markets raising the risk of potential corrections, according to analysts and recent market trends.

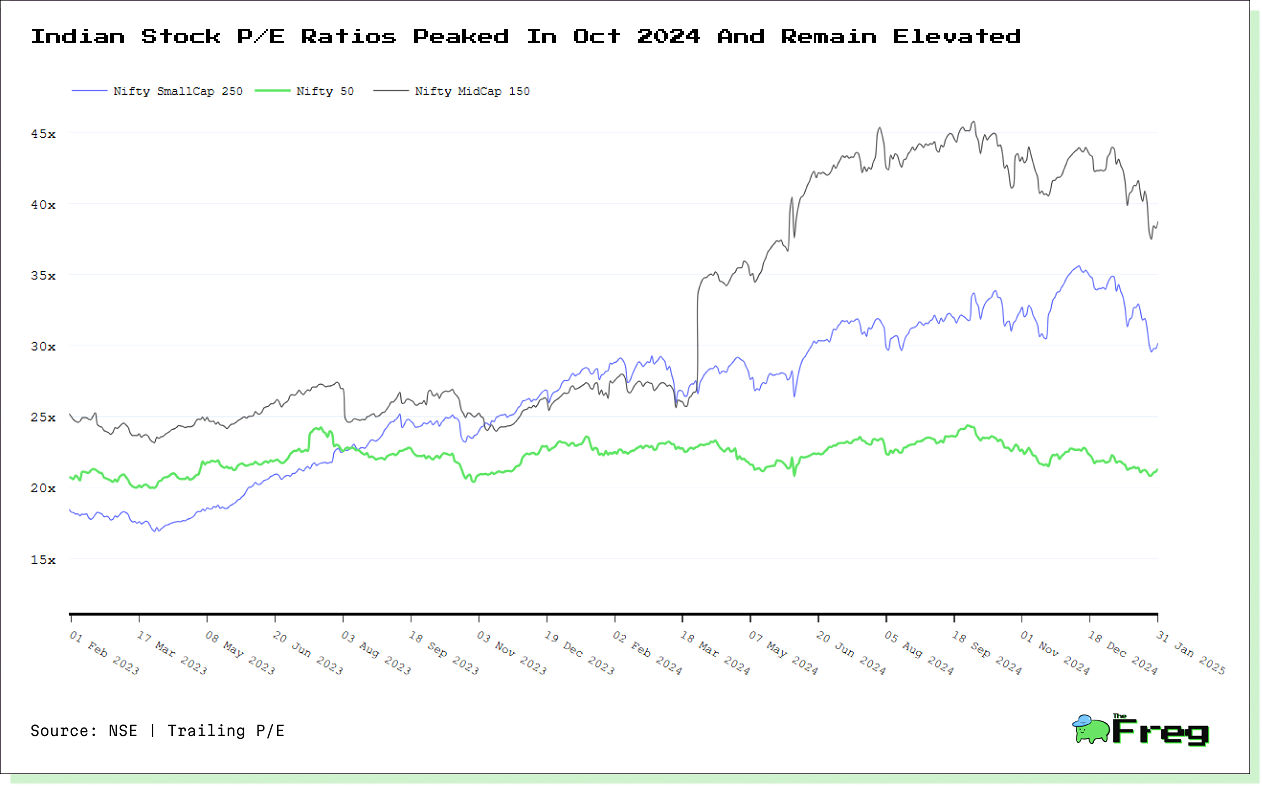

Mid- and Small-Cap Froth

The mid- and small-cap segments of the Indian stock market have experienced significant volatility and correction in early 2025, indicating potential froth in these sectors. The Nifty Midcap 150 index has lost around 6% and the Nifty Smallcap 250 index has slipped 9% in calendar year 2025, underperforming the benchmark Nifty50. This correction has been attributed to several factors:

- Sustained selling by Foreign Institutional Investors (FIIs).

- A trend towards quality stocks, with large-caps showing resilience while the broader market weakens.

- Historically high Price to Earnings ratios, with the Mid Cap to Large Cap ratio reaching near 2x (oct 2024), close to 2008 peak levels.

- Increased retail investor interest, as evidenced by significant inflows into small-cap funds and numerous new small-cap fund launches despite high valuations.

These factors suggest that caution is warranted in the mid- and small-cap space, with analysts warning that further correction may be necessary before value buying opportunities emerge.

Nifty 50's Elevated P/E Ratio

The Nifty 50 index has been trading at elevated Price-to-Earnings (P/E) ratios in early 2025, raising concerns about potential overvaluation in the Indian stock market. As of January 2025, the Nifty 50's Trailing P/E ratio stood at approximately 21.3, near its one-month high. This elevated level suggests that investors are paying a premium for stocks relative to their earnings, potentially indicating optimistic growth expectations or overvaluation.

However, analysts caution that such high valuations may increase market vulnerability to corrections, especially if earnings growth fails to meet expectations or macroeconomic conditions deteriorate. Investors are advised to carefully assess individual stock fundamentals and maintain a diversified portfolio to mitigate risks associated with potentially overvalued market segments.

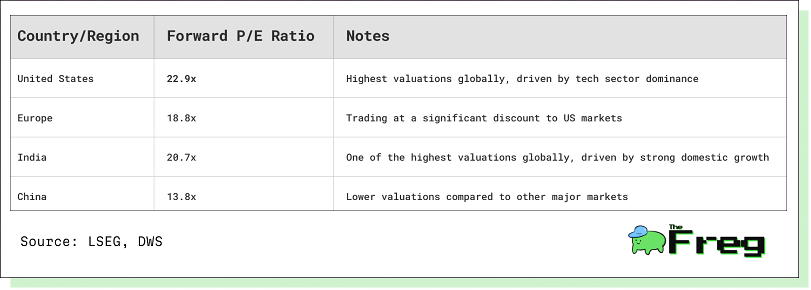

Global Comparison of Valuations

A snapshot of global stock market valuations as of January 2025, highlighting the significant disparities between major markets. The United States continues to trade at premium multiples, with a forward P/E ratio of 22.87, reflecting the ongoing dominance of its tech sector. In contrast, European markets offer relative value.

India's valuation stands out among Asian markets, with a forward P/E ratio of 20.7, underscoring its position as one of the most expensive markets globally. This premium valuation is attributed to India's strong domestic fundamentals and rising capital expenditure growth.

On the other hand, China's relatively low P/E ratio of 13.84 suggests potential value opportunities, albeit with considerations for geopolitical and regulatory risks. These valuation disparities reflect varying economic conditions, growth prospects, and investor sentiment across global markets. They also underscore the potential benefits of geographical diversification in investment portfolios as we move through 2025.

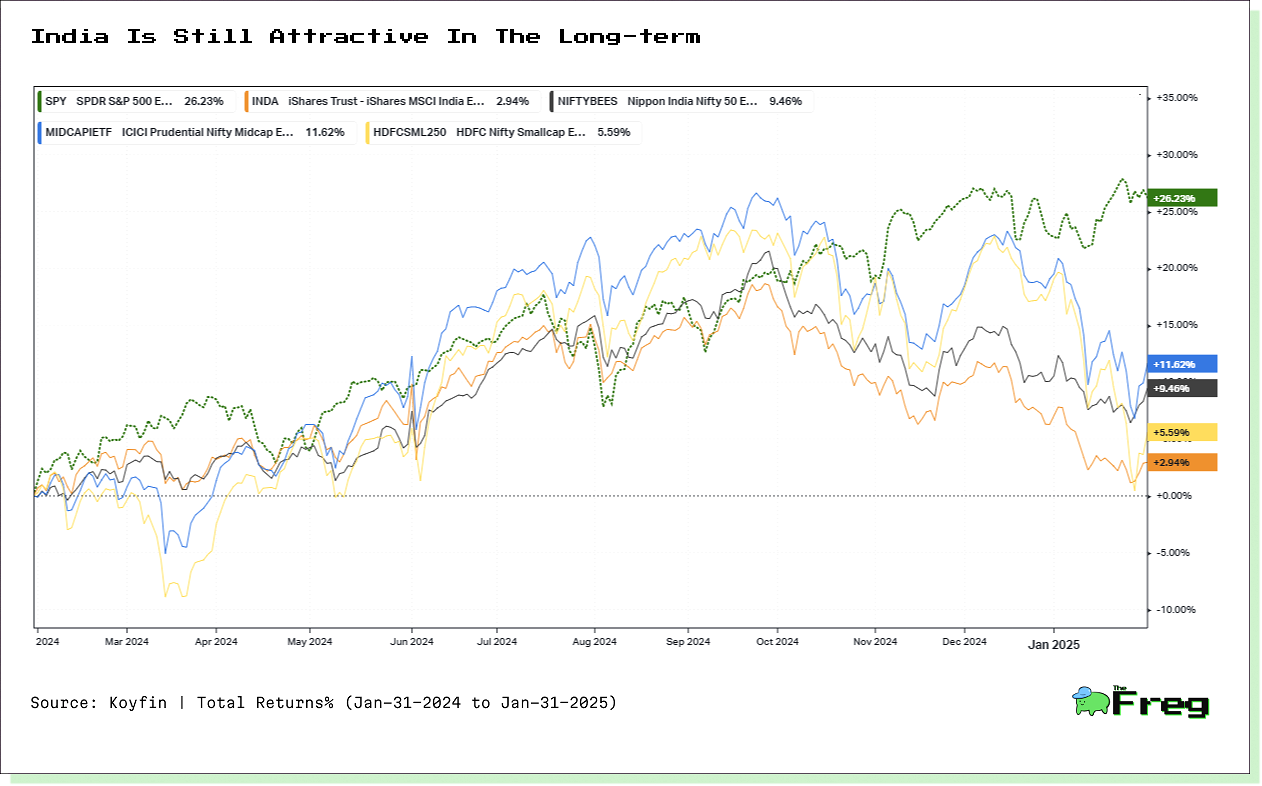

Market Timing Dilemma

While the Indian stock market presents attractive long-term growth potential, current valuations and market conditions suggest a cautious approach for new investors in early 2025. The Nifty 50's elevated P/E ratio and concerns over froth in mid- and small-cap segments indicate potential overvaluation. However, strong domestic economic fundamentals and projected earnings growth continue to support India's premium valuation.

Ultimately, while short-term volatility may persist, India's structural growth story remains intact, making it an attractive market for disciplined, long-term investors.