India’s Tightrope Walk in a Turbulent Trade War World

As U.S.-China tensions reshape global trade, India emerges as both a manufacturing hub and strategic wildcard.

As the United States and China spiral deeper into a tariff-fueled economic confrontation, a third player is stepping into the spotlight—India. Not by strategic design, but by the vacuum left behind in a rapidly reconfiguring global supply chain. With cumulative U.S. tariffs on Chinese goods now at a staggering 245%, the decoupling of the world’s two largest economies is no longer theoretical—it’s happening in real time.

In this turbulent realignment, India stands at a critical inflection point.

Apple’s Manufacturing Pivot

One of the signs of India’s manufacturing ascent is Apple’s strategic shift. In the year ending March 2025, Apple produced $22 billion worth of iPhones in India—a 60% increase over the previous year. Today, one in five iPhones globally rolls out of factories in Tamil Nadu and Karnataka.

It’s a shift, catalyzed first by pandemic disruptions and now supercharged by tariffs. With Chinese electronics facing tightening U.S. trade restrictions, Apple’s recalibration is both practical and symbolic. India is not just a production site—it’s an export engine, having shipped $17.4 billion worth of iPhones abroad this past year.

The Rare Earths Gamble

India’s rise isn’t just about tech hardware—it’s also about the critical materials that power it. China’s recent decision to restrict exports of rare earths, essential for everything from EVs to defense systems, jolted global markets. With 90% of global refining capacity under Chinese control, Washington turned to New Delhi.

The result: the Strategic Mineral Recovery partnership, launched during Prime Minister Modi’s visit to the U.S., accompanied by the lifting of longstanding sanctions on Indian Rare Earths Ltd. It’s a significant diplomatic win, but not yet a strategic one. India may have reserves, but it still imports 60% of its rare earths from China due to limited processing capabilities.

Unlocking this potential won’t be quick. It requires a long-term commitment to refining infrastructure, investment, and tech transfer.

The China Conundrum: Dependency in the Shadows

Ironically, even as India steps in to replace China for the West, its own trade dependency on Beijing is deepening. In FY 2024-25, India’s trade deficit with China surged to a record $99.2 billion. Chinese imports—especially electronics and green tech components—continue to flood the Indian market.

There’s a bitter irony here: India is trying to build resilience in its supply chains while absorbing Chinese goods possibly displaced from U.S. markets. The danger isn’t hypothetical. India could become a dumping ground for redirected Chinese inventory—eroding its own domestic manufacturing just as it gains momentum.

Beijing’s Soft Power Play

As tariffs fly between Washington and Beijing, China is extending a quieter hand to India. In just the first quarter of 2025, it issued over 85,000 visas to Indian nationals under relaxed norms. It’s a calculated gesture, intended to counter U.S. isolationism with Chinese inclusivity.

Delhi, however, is playing its cards close. Post-BRICS summit dialogues have warmed relations, but India continues to strike a diplomatic balance. It won’t be swayed by gestures alone—especially when long-term strategic goals align more closely with the West.

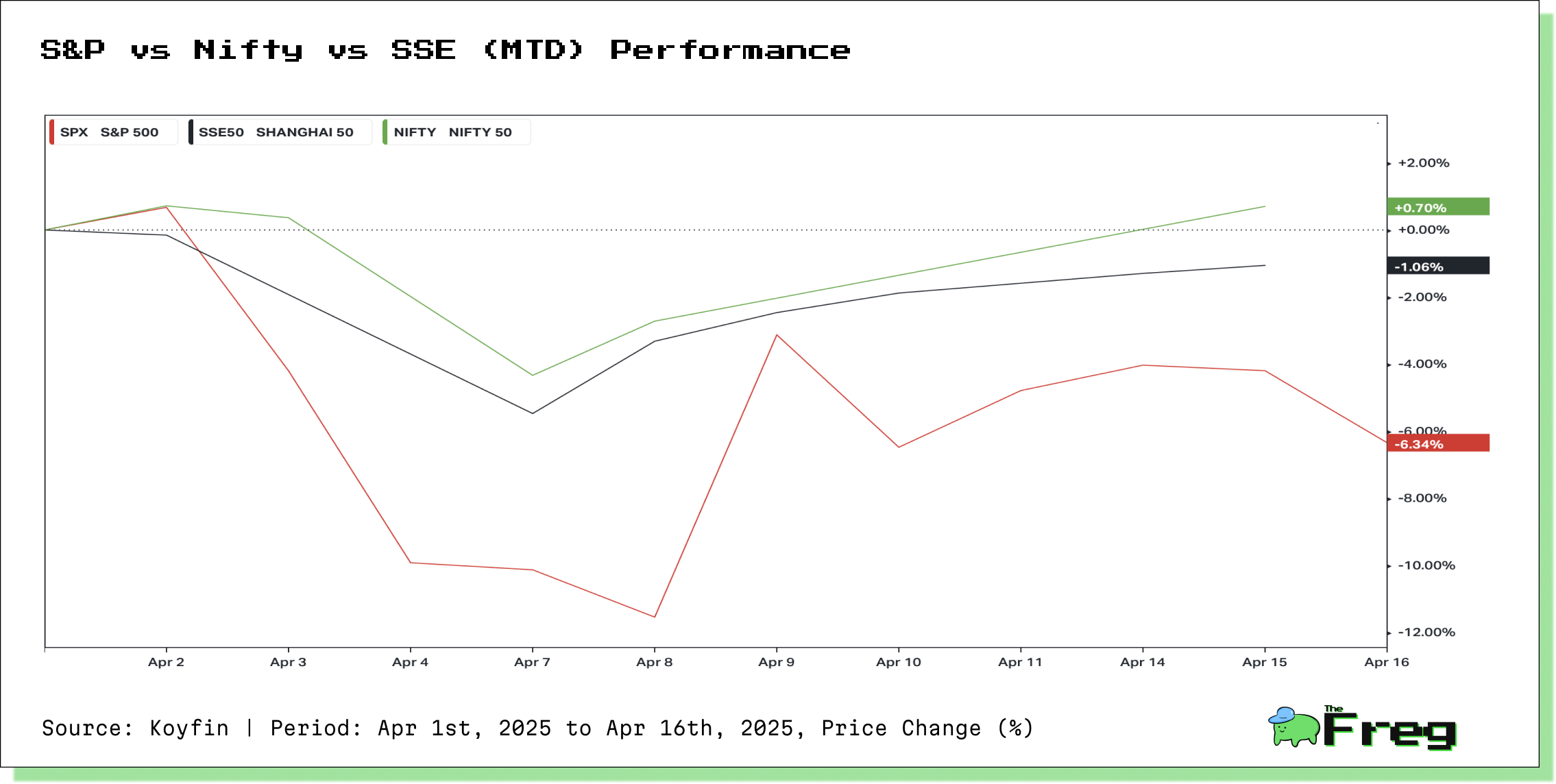

Investor Anxiety Meets Economic Resilience

Despite foreign portfolio investors pulling Rs 31,575 crore from Indian equities in April, a cautious optimism remains. India’s markets rebounded mid-month, with the Nifty 50 climbing 2.4%, reflecting relative stability in a jittery global environment.

India’s secret weapon? A consumption-driven domestic economy less reliant on exports than its East Asian peers .

- India’s exposure to US trade - just 2.7% of American imports compared to 14% for China

In a world where both U.S. and Chinese growth are under pressure, India might just offer the kind of grounded, demand-led stability global investors crave.

The Clock Is Ticking

India is no longer an outsider in the global trade game. It has a window—possibly brief—to transform into a credible manufacturing and strategic alternative. But time is not on its side. Infrastructure bottlenecks, regulatory hurdles, and a persistent skills gap remain stubborn roadblocks.