Japan Grows Slowly, Rates Rise

The economy is projected to grow at a pace above its potential growth rate, supported by moderately growing overseas economies and a virtuous cycle from income to spending.

Japan's economy is experiencing a slow yet steady recovery, with rising wages outpacing inflation and consumer spending showing signs of stabilization. The Bank of Japan's recent shift from negative interest rates to a 0.5% rate in January 2025—the highest in 17 years—reflects cautious optimism about the country's economic trajectory, despite ongoing challenges such as an aging population and substantial public debt.

Impact of Wage Growth on Inflation

Wage growth outpacing inflation in Japan is a positive economic indicator, but it's important to understand its potential impact on future inflation. As workers earn more, they have increased purchasing power, which can lead to higher consumer spending. This increased demand for goods and services may cause prices to rise, potentially fueling inflation. However, the relationship between wage growth and inflation is not always straightforward. In Japan's case, the projected wage increases are seen as a necessary step to break out of decades of economic stagnation.

While there are concerns about wage-push inflation, where higher wages lead to higher prices in a cyclical manner, economists at Daiwa Institute of Research anticipate that the underlying inflation rate will stabilize around 2%. This balanced outlook suggests that Japan's economy may be moving towards a healthier state of moderate inflation and sustained wage growth, potentially ending the long period of deflation and economic stagnation that has plagued the country for nearly 30 years.

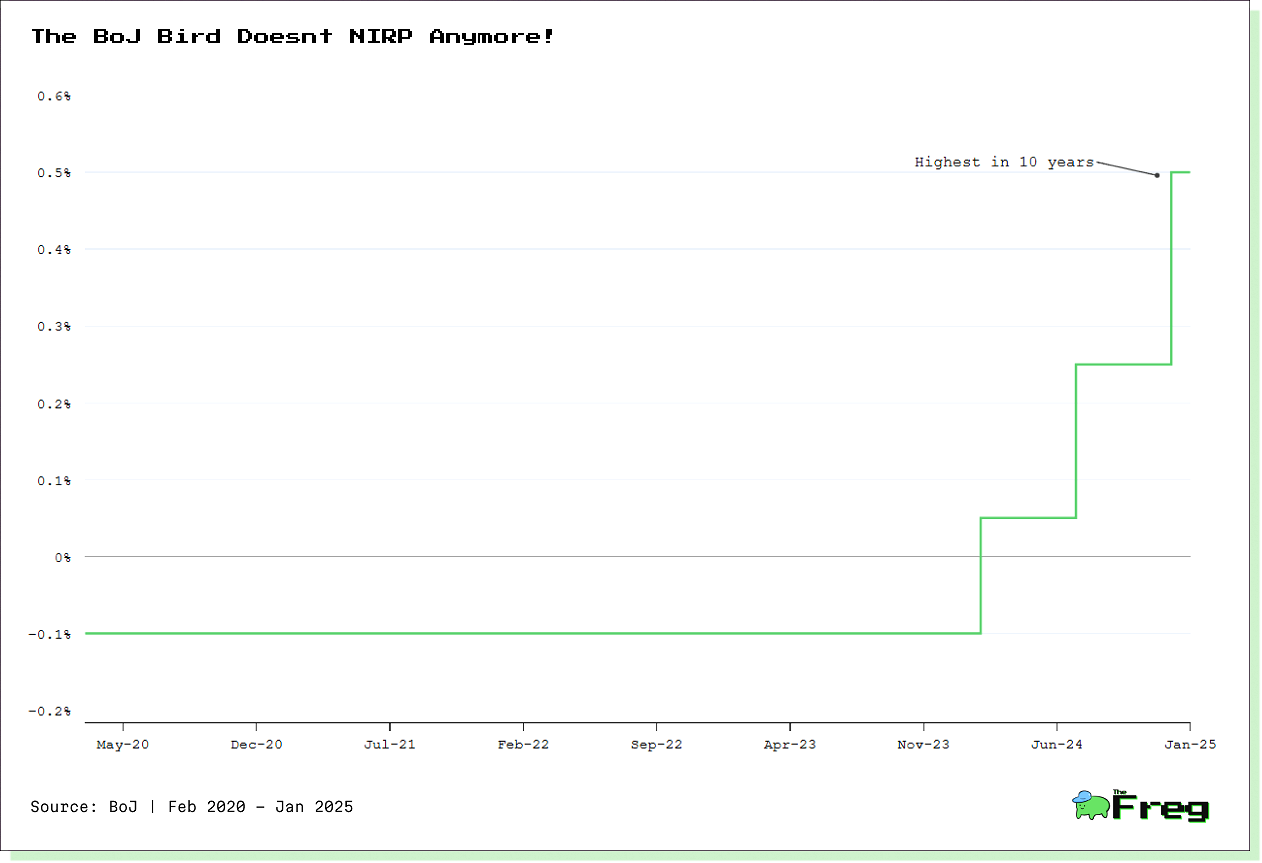

Shift from Negative Interest Rates

Japan's historic shift away from negative interest rates marks a significant turning point in its monetary policy. In March 2024, the Bank of Japan (BoJ) ended its negative interest rate policy (NIRP) and raised rates to a range of 0.0%–0.1%, signaling the beginning of a new era in Japan's economic strategy. This move was followed by a further increase to 0.5% in January 2025, bringing rates to their highest level in 17 years.

The shift reflects growing confidence in Japan's economic recovery and persistent inflationary pressures. The BoJ's decision to abandon yield curve control and allow long-term interest rates to rise has renewed investor interest, making Japan a more attractive investment destination3. However, the central bank remains cautious, maintaining a relatively loose monetary policy to support the country's fragile economic recovery while carefully monitoring the impact on Japan's substantial public debt.

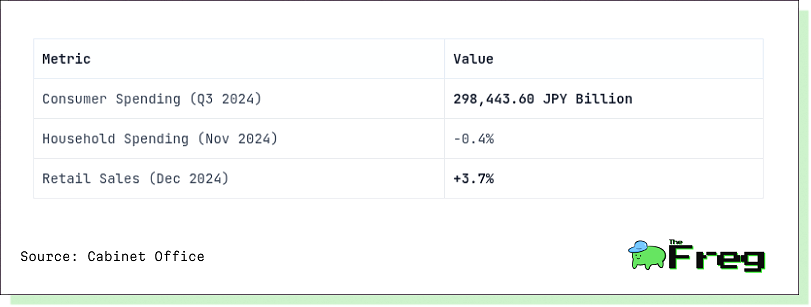

Consumer Spending Recovery Trends

Japan's consumer spending has shown signs of recovery in 2024 and early 2025, albeit with some fluctuations. The Cabinet Office reported a gradual economic recovery despite areas of stagnation, with mixed trends in consumer spending observed. While persistent food price increases have driven cost-saving behaviors, recovery in automobile sales has contributed to an improved outlook. Consumer spending in Japan increased to 298,443.60 JPY Billion in the third quarter of 2024, up from 296,483.50 JPY Billion in the second quarter. This growth trend is expected to continue, with projections indicating consumer spending will reach 302,336.00 JPY Billion in 2026 and 304,452.00 JPY Billion in 2027.

However, the recovery remains fragile, as evidenced by the year-on-year decline in household spending in late 2024.

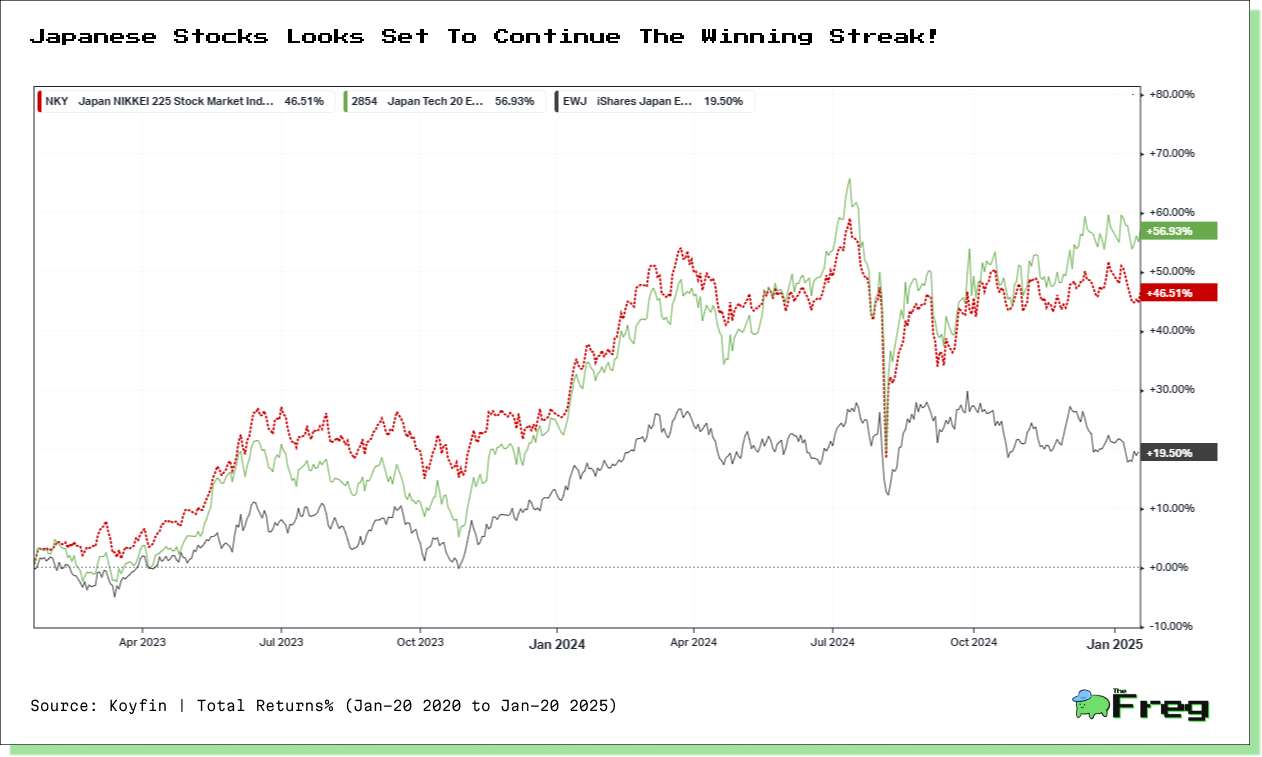

What Does This Mean For Japanese Stocks In 2025?

Japan's economy in 2025 presents a mixed picture of cautious optimism and ongoing challenges. The country is experiencing moderate growth, with GDP expected to expand by 1.2% in 2025, driven by increasing domestic demand and wage gains outpacing inflation. This economic recovery is supported by the Bank of Japan's gradual shift away from ultra-loose monetary policy, with interest rates rising to 0.5% in January 2025. For Japanese stocks, this economic landscape offers potential opportunities:

- Corporate profits are likely to benefit from the improving domestic consumption and steady wage growth.

- The end of deflation and the continuation of a virtuous cycle between wages and prices could boost investor confidence.

- Sectors tied to domestic consumption may see increased interest as household spending shows signs of recovery.

Overall, while Japanese stocks may see positive momentum in 2025, success will likely depend on companies' ability to navigate the evolving economic landscape and capitalize on domestic growth opportunities.