Japan's Semiconductor Revival Push

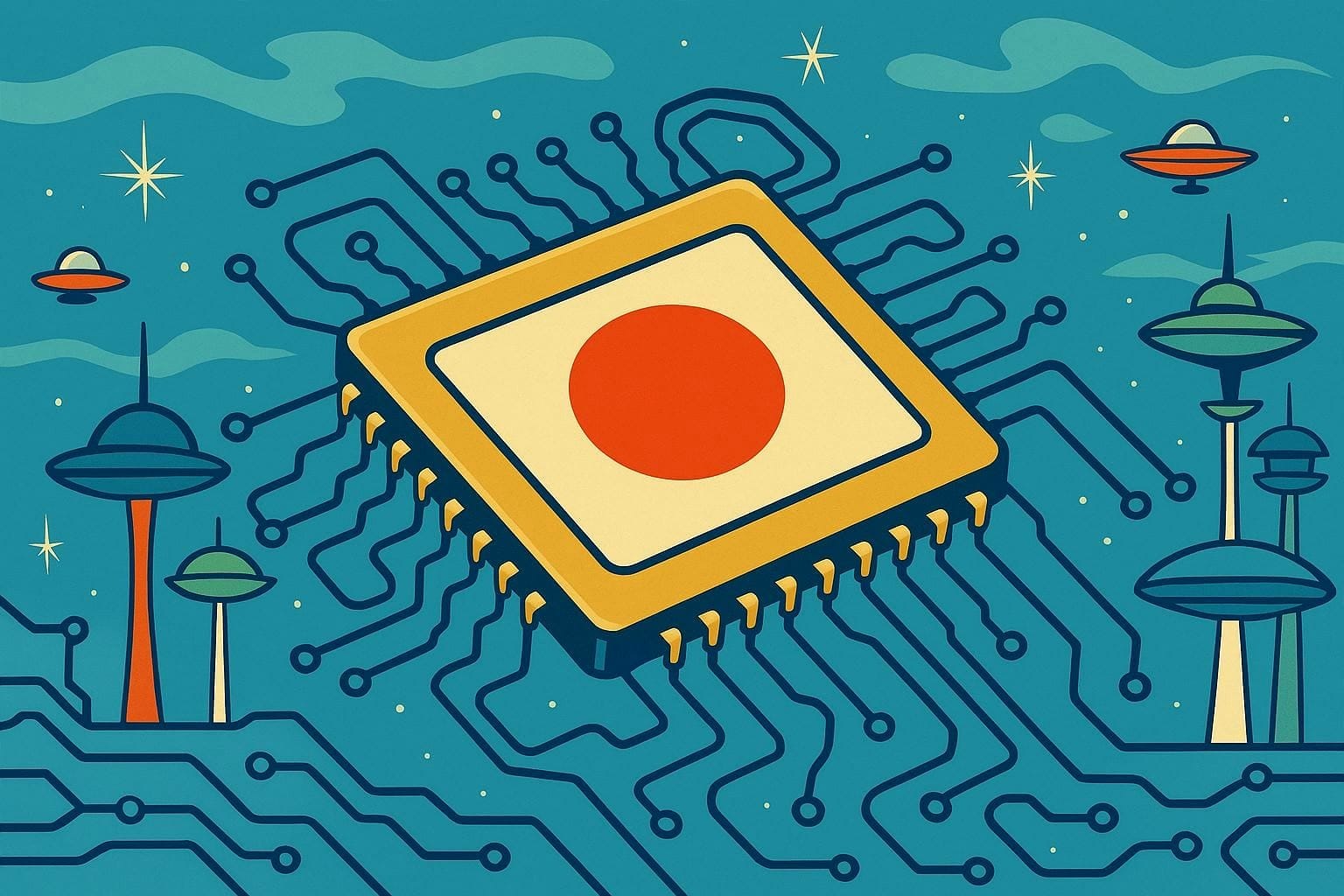

Japan's semiconductor revival strategy, spearheaded by Rapidus, aims to challenge global leaders like TSMC in advanced chip manufacturing.

Japan is injecting an additional 802.5 billion yen ($5.4 billion) into semiconductor venture Rapidus, bringing total government support to 1.7 trillion yen, as the country aims to revitalize its domestic chip industry and secure a position in advanced semiconductor manufacturing by 2027.

Rapidus and 2nm Chip Ambitions

Rapidus, Japan's state-backed chip venture, is making significant strides towards producing cutting-edge 2nm semiconductors. The company aims to begin trial production of 2nm chips in April 2025, with plans to deliver prototypes to Broadcom by June of the same year. This ambitious timeline positions Rapidus to potentially mass-produce these advanced chips by 2027, competing with industry leaders like TSMC and Samsung.

To achieve this goal, Rapidus is deploying 10 advanced extreme ultraviolet (EUV) lithography systems across its production sites. The company's IIM-1 plant could potentially process between 17,000 and 20,000 wafers monthly at full capacity. Rapidus is also collaborating with IBM on research and development, and has formed partnerships with AI companies like Preferred Networks and Sakura Internet to create domestically produced AI infrastructure. These efforts are crucial for Japan's semiconductor revival, as the country aims to triple sales of domestically produced chips to 15 trillion yen (~USD 100 billion) annually by 2030.

Hokkaido's Role in Semiconductor Revival

Hokkaido is emerging as a key player in Japan's semiconductor revival, with Rapidus constructing a state-of-the-art 2nm chip manufacturing plant in Chitose city. The region offers ideal conditions for semiconductor production, including abundant water resources, extensive industrial land, and a cool climate. Hokkaido's leadership in renewable energy potential further enhances its attractiveness to investors.

The semiconductor ecosystem in Hokkaido is expanding rapidly, attracting international companies and research institutions. ASML, Applied Materials, and Lam Research have already established bases in the region, while Belgian R&D institute imec is planning to open a facility. This influx of global players is transforming Hokkaido into a comprehensive hub for semiconductor production, research, and human resource development. The Hokkaido Government is actively promoting this growth through its Hokkaido Semiconductor and Digital Industry Promotion Vision, aiming to share the benefits across the entire prefecture.

Government-Industry Collaboration for Rapidus

Rapidus Corporation, founded in 2022, represents a significant public-private partnership in Japan's semiconductor strategy. The company has received substantial support from both the government and major Japanese corporations:

- The Japanese government has allocated 920 billion yen ($6.1 billion) to Rapidus for its Hokkaido factory, with plans to provide up to 10 trillion yen ($65.9 billion) in funding by fiscal 2030 for AI and semiconductor-related facilities.

- Major Japanese companies, including Toyota Motor Corporation and Sony Group, have jointly invested approximately 73 billion yen ($482 million) in Rapidus.

This collaboration aims to develop and mass-produce advanced 2nm semiconductors by 2027, positioning Japan as a key player in the global semiconductor industry. The partnership extends beyond domestic borders, with Rapidus forming strategic alliances with international entities such as IBM for joint development and Quest Global for design and manufacturing solutions.

Global Semiconductor Foundry Market Share

//Table//

The dominance of Taiwan Semiconductor Manufacturing Company (TSMC) in the global semiconductor foundry market, with a commanding 67% share.

Samsung Foundry follows as a distant second with 11% of the market. The remaining market is split between United Microelectronics Corporation (UMC), Semiconductor Manufacturing International Corporation (SMIC), and GlobalFoundries, each holding a 5% share. Other smaller foundries collectively account for the remaining 8% of the market.

It's worth noting that TSMC's market share has been steadily increasing, growing from 62% in Q1 2024 to 67% by Q4 2024, demonstrating its strengthening position in the industry.

Rapidus' Market Share Challenge

Rapidus faces a monumental task in gaining market share from established semiconductor giants. As a newcomer in the advanced chip manufacturing space, Rapidus is competing against industry leaders like TSMC. To carve out its niche, Rapidus is focusing on specialized chips for AI and supercomputing applications, aiming to differentiate itself from TSMC's broad market coverage. The company's strategy involves leveraging automation and AI in production processes, potentially reducing the required engineering workforce by half compared to traditional methods. Despite these innovative approaches, Rapidus will need to overcome significant technical and financial hurdles to establish itself as a viable alternative in the highly competitive global semiconductor market.