Jerome Powell’s Warning Shot to Wall Street

Powell ends the era of easy support, prioritizing inflation control over market calm—forcing investors to confront rising risks alone.

Federal Reserve Chair Jerome Powell delivered a bracing message in his April 16 remarks at the Economic Club of Chicago, signaling a “wait-and-see” approach to monetary policy and rejecting the notion of a "Fed put"—the idea that the central bank would step in to support falling markets.

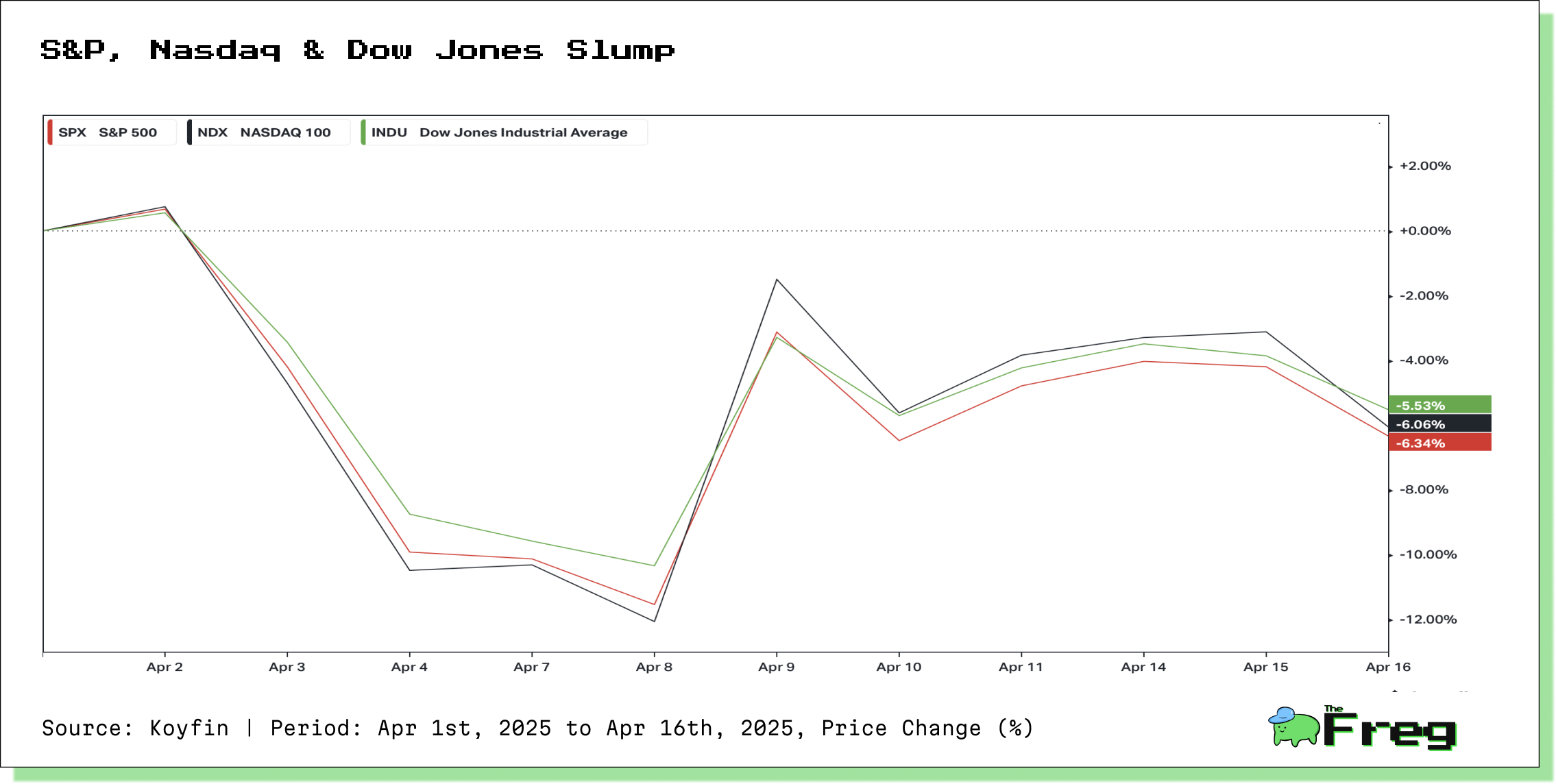

Markets responded with a swift and sharp selloff. Investors who had grown accustomed to Fed cushioning over the past decade reacted with caution as Powell made it clear: the Fed is not in the business of rescuing markets amid every bout of volatility. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all slumped in the wake of his remarks, as Wall Street recalibrated expectations.

No Sudden Moves: Powell’s Message to Markets

Powell struck a resolute tone: the Fed will not adjust rates unless the economic data warrant it. “We are well-positioned to wait for greater clarity before considering any adjustments to our policy stance,” he said, highlighting the central bank's growing concern over mixed signals in the economy.

Notably, Powell pointed to elevated uncertainty from shifting trade policies, including steep new tariffs, which he said are both pushing inflation higher and likely to slow growth. This creates a policy bind where the Fed faces risks of both rising unemployment and persistent inflation.

When asked whether the Fed would intervene to calm financial markets—a hallmark of the "Fed put" era—Powell’s answer was unequivocal: “No.” Recent volatility, he explained, is an understandable response to economic uncertainty—not a reason for central bank intervention. Markets, he added, remain “orderly and functioning,” even amid increased turbulence.

Markets React: Stocks Slide, Volatility Surges

Investors had hoped Powell might offer dovish reassurances. Instead, his remarks triggered a broad market selloff:

Losses deepened after Powell spoke, as his refusal to hint at policy easing sparked further selling. The VIX index—Wall Street’s “fear gauge”—spiked to its highest level in months.

Safe-haven assets surged:

- Gold jumped 3.5% to a record high

- 10-year Treasury yields fell ~6 basis points to 4.28%

A tentative calm returned in early Asian trading on April 17, but the message was clear: the Fed is prioritizing inflation control over market stability.

Wall Street Reacts: No Rescue Coming

Analysts widely interpreted Powell’s tone as hawkish. “I think people were expecting Powell to be neutral—and he wasn’t,” said Jim Carroll of Ballast Rock Wealth. Gina Bolvin of Bolvin Wealth Management added that 2025 may be a “more difficult year for investors” compared to the “cake walks” of recent years.

Volatility is now expected to remain high as markets digest worsening trade tensions. New tariffs have already sparked panic buying and complicated the economic outlook.

Comerica’s chief economist warned that a temporary spike in consumer spending in March likely masked underlying weakness, noting a decline in demand is likely in the months ahead. The prevailing investor mood has soured, with consumer confidence now near three-year lows and inflation expectations hitting their highest level since 1981.

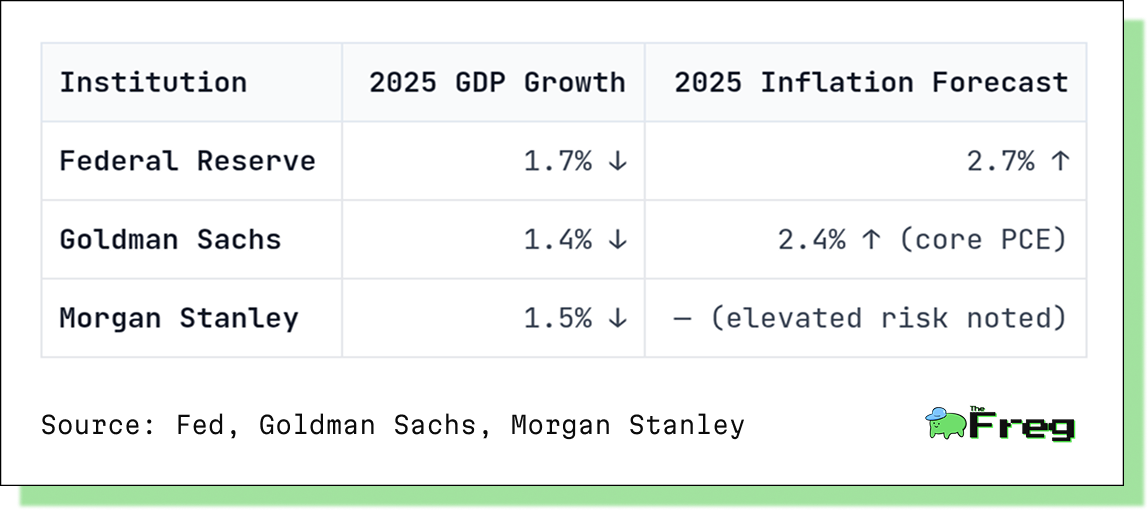

Growth Slows, Inflation Sticks

Recent economic data paints a mixed picture. While the labor market remains solid, March retail sales surged 1.4% largely due to consumers trying to beat price hikes from tariffs. This preemptive demand may have artificially buoyed Q1 GDP, which is now estimated to have grown less than 0.5% annualized.

Powell acknowledged that tariffs are "highly likely" to drive inflation up, and emphasized that the Fed would not cut rates unless inflation convincingly subsides and the economy clearly needs support.

A Market Without a Safety Net

With the Fed stepping back from its market-backstop role, investors are entering a new paradigm. Powell’s speech underlines a stark shift: the Fed will respond to economic data, not market swings. In the coming weeks, expect heightened sensitivity to:

- Inflation readings

- Consumer spending trends

- Labor market strength

- Corporate earnings impacted by tariffs

Until inflation is under control, the Fed is unlikely to intervene. As one strategist put it: “If you’re waiting for a Fed put, you should probably set your sights on a lower strike price.”

Powell’s realism has marked the end—at least for now—of the easy Fed put era. For investors, that means navigating a landscape shaped more by economic fundamentals than by central bank support. In the short term, volatility may persist. But if inflation begins to retreat or the trade war eases, policy flexibility could return.

Until then, markets are largely on their own. Jerome Powell is standing firm—and Wall Street is taking notice.