Markets' Worst Quarter Since 2022

Wall Street's worst quarter since 2022 unfolds as Trump's tariff threats loom large. The S&P 500 and Nasdaq plummet, erasing trillions in market value.

U.S. stock markets have just wrapped up their worst quarter since 2022, with the S&P 500 and Nasdaq Composite posting significant declines amid growing uncertainty surrounding President Trump's economic policies and looming tariff announcements.

Trump Tariffs Shake Market Confidence

The Trump administration’s aggressive tariff strategy has sent shockwaves through the financial world, eroding market confidence and rattling investors. Wall Street strategists have slashed their year-end forecasts for the S&P 500, with Goldman Sachs now projecting a 35% chance of recession within the next year due to escalating trade tensions. The uncertainty surrounding these tariffs—targeting countries like Canada, Mexico, and China—has left businesses and consumers grappling with higher costs and diminished confidence.

The fallout has been severe: the S&P 500 has dropped from its February peak, wiping out $4 trillion in market value in less than a month. Technology stocks, once market darlings, bore the brunt of the selloff, with Tesla and Nvidia plunging 35% and 19%, respectively, in Q1. Meanwhile, safe-haven assets like gold surged to record highs as investors sought refuge from the chaos. The ripple effects of these tariffs have not only shaken U.S. markets but also triggered declines across Europe and Asia, underscoring the global scale of the economic uncertainty.

Tech Giants' $2 Trillion Wipeout

The tech sector’s meteoric rise came to a screeching halt as over $2 trillion in market value evaporated in just three weeks, marking one of the most dramatic corrections since 1982. This plunge, driven by a mix of overblown AI hype and investor disillusionment, saw heavyweights like Nvidia, Tesla, Microsoft, and Amazon suffer double-digit losses. Nvidia and Tesla, in particular, entered bear-market territory with declines exceeding 20%, while Microsoft and Amazon shed over 10% each.

The selloff was exacerbated by growing skepticism about the immediate returns on massive AI investments. Companies like Amazon faced backlash for heavy spending plans, while Intel saw a staggering drop following grim forecasts. Meanwhile, Meta managed to avoid similar punishment by demonstrating how its AI tools were already boosting ad revenue. As the sector grapples with the fallout, tech leaders are urging patience, emphasizing that AI-driven growth will take years to materialize.

Nasdaq's Plunge Explained

The Nasdaq Composite’s 10% plunge from its December highs has officially dragged it into correction territory, marking a stark reversal for the tech-heavy index that had been a market leader in prior years. The downturn was fueled by a toxic mix of escalating trade tensions, disappointing earnings from semiconductor companies, and investor anxiety over the Trump administration's unpredictable tariff policies. The tariffs—targeting imports from Canada, Mexico, and China—sparked retaliatory measures that rattled global markets and hit tech stocks particularly hard.

Adding to the chaos, major players like Nvidia and Tesla saw sharp declines, as investors fled high-growth names. Semiconductor stocks were especially battered after Marvell Technology’s dismal earnings report raised concerns about the sector's valuation. Meanwhile, conflicting signals on U.S. trade policy only deepened market confusion, with analysts warning that the Nasdaq’s correction could extend further if economic conditions deteriorate.

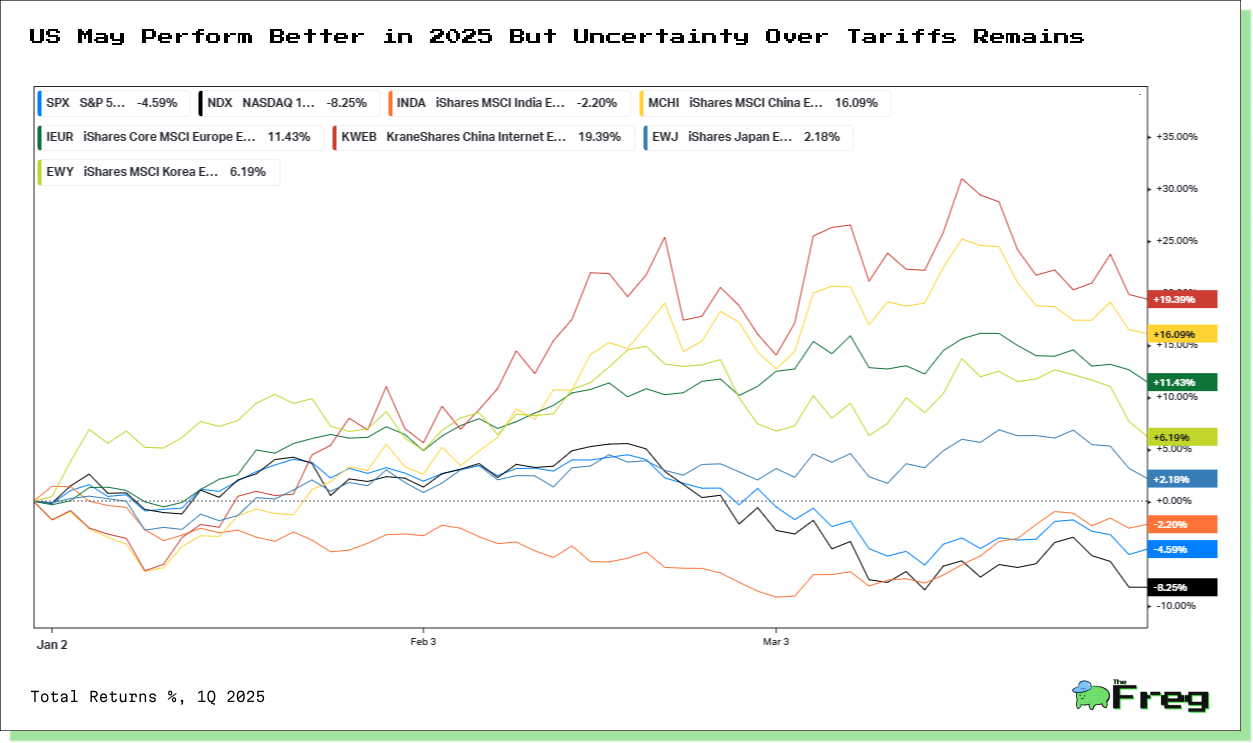

Global Markets Q1 Performance

In Q1 2025, European ETFs demonstrated strong performance, with the iShares Core MSCI Europe ETF (IEUR) gaining 11.43% year-to-date. This growth was driven by robust economic indicators and supportive monetary policies across the continent. Chinese internet-focused ETFs also saw significant gains, with the KraneShares CSI China Internet ETF (KWEB) surging nearly 20% year-to-date, buoyed by regulatory support and advancements in AI technology.

Indian ETFs faced challenges, with the iShares MSCI India ETF (INDA) declining 2.20% in the first quarter. Japan's ETFs showed modest growth, with the iShares Japan ETF (EWJ) rising 2.18%. South Korean ETFs experienced a decent growth, with the iShares MSCI Korea ETF gaining 6.19% over the same period. These varied performances reflect the diverse economic conditions and market dynamics across Asia's major economies in early 2025.