Mexico ETFs Defy Tariffs

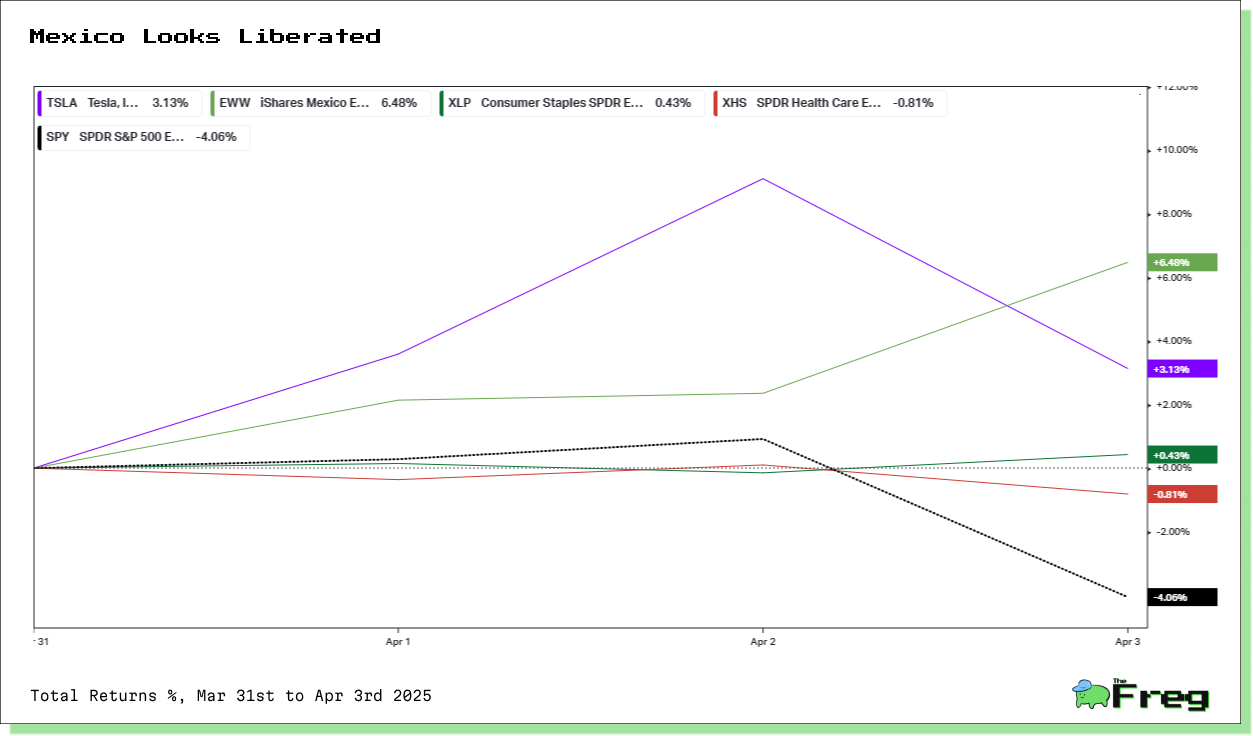

As trade tensions escalate, Mexico focused and consumer staples ETFs have shown resilience, outperforming broader market indices when majority crashed on Apr 2nd.

As President Trump's tariff tango continues to rattle global markets, an unexpected twist has emerged: Mexico-focused ETFs are surging, alongside healthcare and consumer staples, while Tesla and defense manufacturers might find a silver lining in the trade war clouds. According to reports from Bloomberg, this peculiar market behavior is keeping investors on their toes as they navigate the choppy waters of international trade tensions.

Surprise Surge in Mexico Focused ETF

Despite the imposition of 25% tariffs on Mexican imports by the Trump administration, Mexico-focused ETFs have shown surprising resilience and even growth. The iShares MSCI Mexico ETF (EWW) has surged 6.4% month-to-date, defying expectations of economic downturn. This unexpected performance can be attributed to several factors:

- Mexico's proactive approach to trade negotiations, including the deployment of 10,000 National Guard troops to its northern border to combat fentanyl trafficking.

- The country's strategic "Plan Mexico" initiative to promote investment and nearshoring.

- Investors' optimism following the one-month pause on tariffs agreed upon by the U.S. and Mexico.

However, analysts warn that prolonged tariffs could still have significant negative impacts, potentially reducing Mexico's GDP by 1.7% over five years and increasing inflation by up to 2.3%. As trade tensions continue to evolve, investors should remain vigilant of the potential volatility in Mexico-focused ETFs and the broader implications for North American trade relations.

Tesla's Tariff Resilience Strategy

Tesla's domestic manufacturing focus may shield it from the worst impacts of President Trump's new 25% auto tariffs, but the company still faces challenges. While Tesla produces all its U.S.-sold vehicles in California and Texas plants, CEO Elon Musk emphasized that the tariff impact remains "significant" due to imported components. To mitigate these effects, Tesla is likely to pursue several strategies:

- Expanding U.S.-based production to reduce reliance on imported parts.

- Adjusting pricing strategies to maintain competitiveness despite rising costs.

- Leveraging its vertical integration and battery manufacturing capabilities.

- Potentially benefiting from disruptions to competitors who rely more heavily on imports.

Despite these challenges, analysts suggest Tesla may fare better than other major automakers, potentially gaining a competitive edge in the evolving electric vehicle market. However, the company must navigate carefully to balance increased production costs with maintaining its market position and profitability.

Defensive ETFs Have Modest Gains

Healthcare and consumer staples ETFs have shown remarkable resilience in the face of recent tariff announcements, outperforming broader market indices. The Consumer Staples Select Sector SPDR Fund (XLP) rose modestly

0.43% month-to-date, while the Consumer Discretionary Select Sector SPDR Fund (XLY) fell 3.26% over the same period. This defensive sector's strength is attributed to the consistent demand for essential products like household goods, food, and beverages, even during economic uncertainty.

Healthcare ETFs are also demonstrating stability amid market volatility. Funds like the iShares Global Healthcare ETF (IXJ) and SPDR Health Care ETF (XHS) are benefiting from increased healthcare spending driven by an aging population and technological advancements. These sectors' resilience is further evidenced by the consumer staples sector being the only segment in the S&P 500 to experience an increase of 0.7% on a day when the overall index dropped 4.8%. Investors are gravitating towards these ETFs due to their minimal tariff exposure and perceived safety in the face of potential broader economic slowdowns.