Nvidia’s Export Crunch: Between Chips and Trade Wars

Nvidia is at the center of the U.S.-China tech standoff—balancing chip exports, trade tensions, and domestic manufacturing ambitions amidst a turbulent geopolitical landscape.

In a dramatic turn of events, Nvidia, the dominant force in AI hardware, finds itself in the crosshairs of an intensifying U.S.-China tech standoff. Just a day after unveiling plans to produce $500 billion worth of AI supercomputers domestically, the company was hit by a sweeping U.S. export restriction that could erase more than $5 billion from its books. The tension between geopolitical strategy and economic ambition is now playing out in silicon.

$5.5 Billion Blow to Nvidia

On April 9, 2025, the U.S. government imposed new licensing requirements for Nvidia's H20 chips—its most advanced AI hardware allowed for sale to China under earlier controls. The chips, engineered to comply with previous export rules, are now restricted indefinitely due to concerns they could be used in Chinese supercomputers.

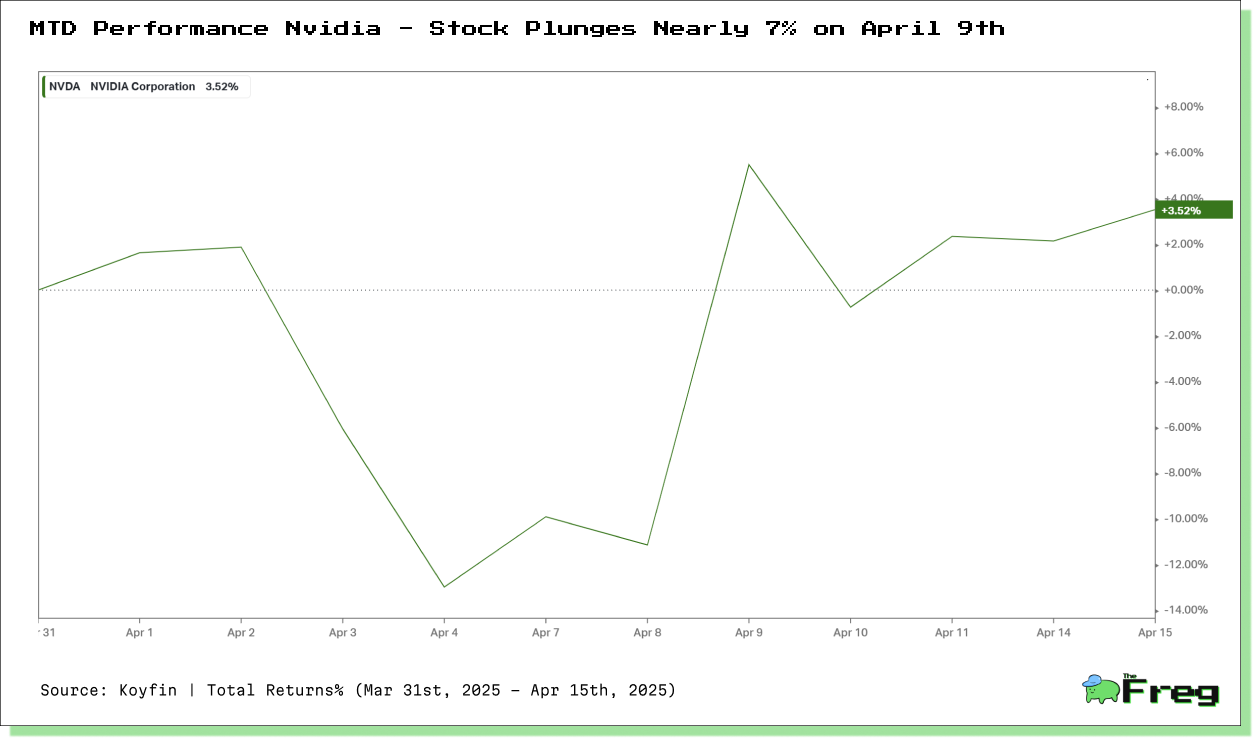

Caught off guard, major Chinese clients had expected shipments of H20s by year-end. Instead, Nvidia now anticipates a $5.5 billion charge in its fiscal Q1 2026, stemming from inventory, purchase commitments, and reserves for unsellable products. The market response was swift: Nvidia's stock tumbled nearly 7% in after-hours trading, with broader tech losses wiping out $180 billion in market value across the semiconductor sector.

"The rules changed, leading to a $5 billion loss," said Jay Hatfield, CEO of Infrastructure Capital Advisors, echoing Nvidia’s frustration.

A Strategic Rebuild on U.S. Soil

In a stark contrast to its export woes, Nvidia announced plans to manufacture its AI supercomputers domestically for the first time. The $500 billion infrastructure project will span four years, with Blackwell chips produced at TSMC’s Phoenix facility and supercomputers assembled in Houston and Dallas through partnerships with Foxconn and Wistron.

"Adding American manufacturing helps us better meet the incredible and growing demand for AI chips, strengthens our supply chain and boosts our resiliency," said CEO Jensen Huang.

This reshoring aligns with broader trends toward supply chain de-risking and techno-nationalism. The initiative could create hundreds of thousands of jobs, reduce shipping expenses, and help bypass Asian tariffs that currently range from 25% to 50%.

The Cost of Building in America

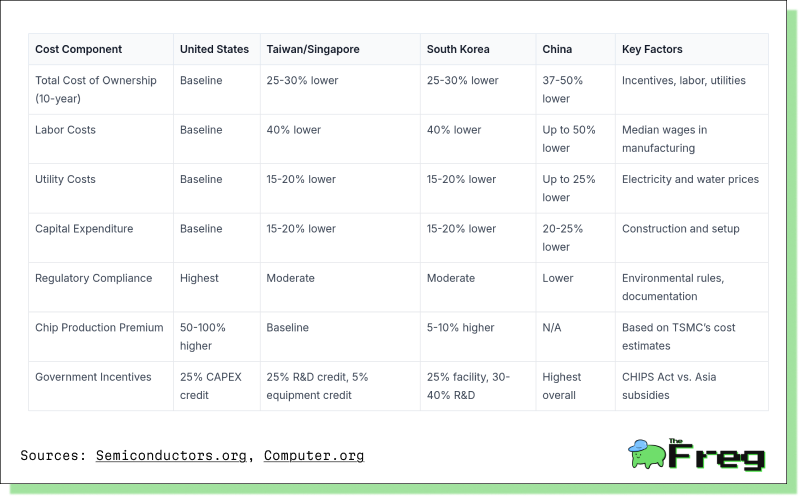

Despite its political appeal, U.S.-based semiconductor manufacturing is expensive. Facilities in the U.S. cost about 30% more to build and operate than in Taiwan, South Korea, or Singapore—and up to 50% more than in China. Labor, utilities, and regulatory compliance drive the cost differential.

Even with CHIPS Act subsidies—which provide a 25% tax credit on capital expenditures—the U.S. cost advantage remains elusive. For example, TSMC reportedly spent $35 million just on regulatory prep for its Arizona fab, which has taken twice as long to build as its Taiwanese counterparts.

The Labor Equation and Utility Burden

Labor cost gaps are especially stark. A semiconductor engineer in Phoenix earns $117,299 annually, compared to $32,500 in Taiwan and as low as $25,000 in parts of China. Southeast Asia offers even more dramatic savings, with labor costs in Indonesia up to 86% lower than Taiwan’s.

Meanwhile, semiconductor fabs are voracious water consumers. A facility processing 40,000 wafers a month can use 4.8 million gallons of water per day—about as much as a city of 60,000. That’s a sustainability red flag, especially in drought-prone Arizona.

A Geopolitical Chessboard

The export restrictions on H20 chips are part of a broader U.S. strategy to maintain dominance in AI and military tech. Since 2022, Washington has widened controls to include not just hardware, but also design and manufacturing tools.

China, for its part, is retaliating by stockpiling critical minerals like gallium and germanium and fast-tracking domestic chip innovation. The fallout is global. Following Nvidia's announcement, major indices took a dive: the Dow dropped 1.7%, S&P 500 fell 2.2%, and the Nasdaq slumped 3.1%. The WTO has warned that these tit-for-tat policies are choking global trade and injecting uncertainty into markets that rely on stability.

Building Supply Chain Resilience

Nvidia’s U.S. shift reduces exposure to geopolitical risk, shipping delays, and manufacturing defects. Making Blackwell chips in Arizona and assembling systems in Texas gives Nvidia more control over quality, faster turnaround, and better IP protection. Building domestically also solves supply chain bottlenecks in packaging technologies. With AI-powered tools, Nvidia can detect defects early and reduce rework.

Proximity between design and manufacturing teams speeds up prototyping and helps protect sensitive IP—crucial for AI advancement.

Talent and Infrastructure Gaps

But domestic production faces challenges. The U.S. could fall short by up to 146,000 skilled semiconductor workers by 2029. Only 1,500 engineers enter the chip industry each year—just 3% of graduates—against a need for 88,000.

Fabs require cleanrooms with high energy demands and sensitive contamination controls. Key tools like packaging, testing, and raw material systems are still dominated by Asia.

Innovation Acceleration

Building in the U.S. means tighter R&D integration. Nvidia can cut prototyping time by 60% and use AI to simulate manufacturing scenarios faster than traditional methods. Its cuLitho platform, which speeds up chip design with GPU acceleration, exemplifies this advantage: what once took weeks now takes hours. The result is a feedback loop—better chips lead to better tools that power even better chips. This matters as Nvidia races ahead with 3nm-4nm technology while China lags at 14nm.

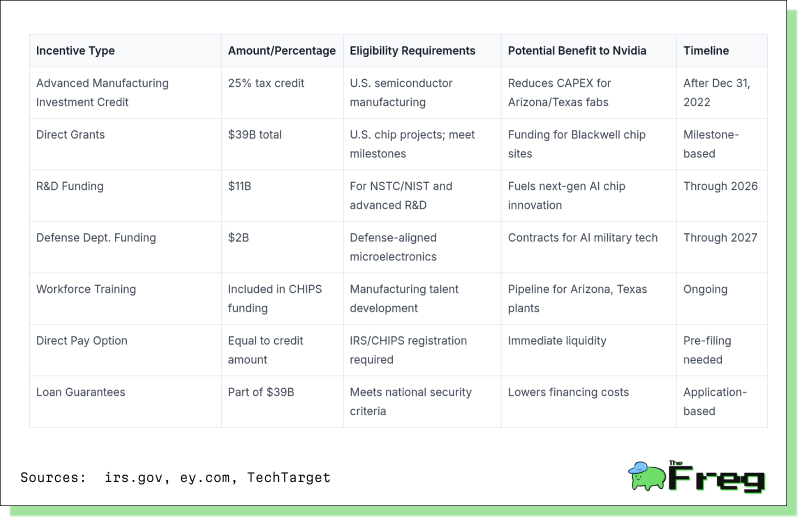

CHIPS Act Incentives

The CHIPS and Science Act gives Nvidia a financial cushion for U.S. expansion: $39 billion in grants, a 25% tax credit on manufacturing investments, and funding for R&D, defense, and workforce training. The 25% credit is especially powerful, reducing Nvidia’s capital costs for Arizona and Texas facilities with no cap. Restrictions on expanding Chinese production further align with Nvidia’s pivot.

The Commerce Department awards CHIPS funds based on milestones. Nvidia will receive funding as it hits key build-out goals. Over 460 applications have been submitted; $33 billion has already been allocated.

Balancing Geopolitical and Economic Pressures

Nvidia is wagering that the benefits of reshoring—resilience, IP security, innovation speed—justify the 30–50% higher costs. The move is both a geopolitical hedge and a long-term investment in U.S. tech independence. Whether this bet reshapes global chip supply or proves a costly detour remains to be seen. But with CHIPS Act backing and escalating tensions, Nvidia’s strategy may be more necessity than choice.