Oil's Perfect Storm: Tariffs and Oversupply

Oil prices plunged over 6% as new tariffs and a surprise OPEC+ supply hike fueled fears of oversupply and slowdown

Oil prices suffered their steepest single-day drop in three years on Thursday, falling more than 6% after U.S. President Donald Trump announced sweeping new tariffs and OPEC+ surprised markets by accelerating oil production increases.

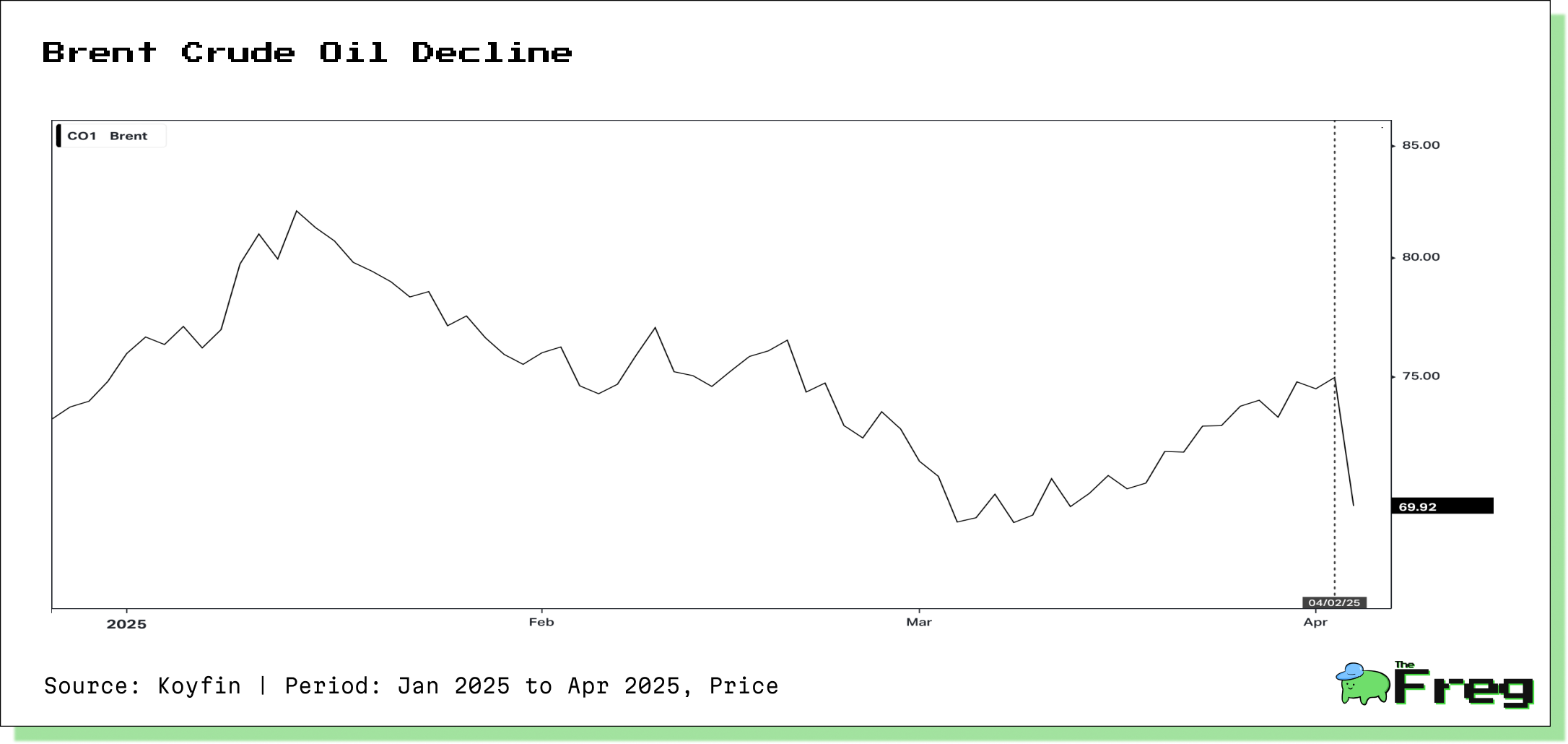

Brent Crude Slumps After Tariff Announcement

Brent crude, the global oil benchmark, dropped 5.78% to settle at

$69.92 per barrel. This steep decline followed Trump’s announcement of new tariffs, which raised fears of a global economic slowdown and weakened energy demand.

The situation was further compounded by OPEC+’s unexpected move to increase output by 411,000 barrels per day in May—more than triple the previously planned increase.

Market analysts warned that the combination of expanded oil supply and trade tensions could push Brent prices to multi-year lows, wiping out gains made during recent periods of geopolitical uncertainty. U.S. West Texas Intermediate (WTI) crude also fell sharply, dropping below $67 per barrel.

OPEC+ Adds to Market Pressures

Eight OPEC+ nations agreed to fast-track production hikes to address internal compliance concerns and potential supply disruptions. However, this move inadvertently deepened bearish sentiment in the market.

The increased output, coupled with deteriorating trade conditions, created a perfect storm for oil markets already on edge. Fears of oversupply are growing, with prices now reflecting expectations of sluggish demand driven by potential economic fallout from the tariffs. Brent and WTI futures are on track for their worst weekly performance in months.

Trade War Threatens Global Oil Demand

The escalating trade war, triggered by Trump’s tariffs, has raised alarms about a global economic slowdown that could hurt oil consumption. China, the world’s second-largest oil consumer with a daily demand of 11.5 million barrels, is particularly vulnerable.

Brent is heading for its largest weekly percentage loss since October, and WTI is set for its biggest drop since January. Analysts say prolonged trade conflicts could force oil producers to prioritize cost efficiency and productivity as demand weakens.

Tariffs Reshape Global Shipping and Supply Chains

Beyond oil, tariffs are also disrupting global shipping and logistics.

Operational disruptions, new compliance requirements, and rerouted shipping lanes have added to costs and delays. Freight forwarders are adapting by diversifying sourcing, optimizing logistics, and using financial hedging to manage volatility.

Oil and Tariffs: A Complex Relationship

Tariffs and oil prices are deeply interconnected. Tariffs can:

- Cause economic slowdowns, reducing energy demand

- Trigger currency volatility, impacting the affordability of oil

- Disrupt global trade flows, affecting oil supply chains

For instance, India’s Reliance Industries stopped importing Venezuelan crude in response to U.S. sanctions—an example of how policy can reshape oil trade.

The recent decline in the U.S. dollar has briefly cushioned falling oil prices.

The dollar index hit a four-month low, making oil cheaper for international buyers.

A weaker dollar also reduces yields on dollar-denominated assets, pushing investors toward commodities like oil. Still, this temporary support is unlikely to overcome the more powerful downward pressures from oversupply and trade concerns.

Geopolitical Tensions Complicate Recovery

Global supply chains are further strained by geopolitical conflicts, including the Russia-Ukraine war, South China Sea tensions, and the Israel-Hamas conflict. These events have:

- Caused energy supply disruptions

- Increased shipping costs

- Affected semiconductor and raw materials supply chains

In response, companies are investing in resilient supply chain strategies, including supplier diversification, risk management tools, and blockchain-based solutions. Despite these efforts, ongoing geopolitical instability continues to pose significant risks to global trade and energy markets.