Powergrid Revolution Underway

As nations scramble to power up for the EV revolution and AI's insatiable appetite for electrons, it's like watching a global game of "Extreme Makeover: Power Grid Edition."

The global electricity supercycle, driven by the electrification of transportation, AI data centers, and the integration of renewable energy sources, is reshaping energy systems worldwide. This transformation necessitates significant investments in EV charging infrastructure, advanced grid technologies, and renewable energy integration to enhance grid stability, optimize energy flow, and accelerate the shift toward a sustainable, low-carbon future.

Global Power Infrastructure Surge

Global investment in power infrastructure is experiencing a significant surge, driven by the need to modernize aging grids, integrate renewable energy sources, and meet growing electricity demand. Worldwide infrastructure spending is projected to grow from $4 trillion per year in 2012 to more than $9 trillion per year by 2025, with a substantial portion dedicated to power systems. This trend is particularly pronounced in the power grid sector, where investments are expected to reach $374 billion in 2024, with China accounting for about 30% of the total. Key factors contributing to this surge include:

- Renewable energy integration: The rapid buildout of renewable capacity necessitates substantial grid upgrades and expansions.

- Government initiatives: Programs like the US Infrastructure Investment and Jobs Act, which allocates $65 billion for power infrastructure, and the European Commission's Action Plan for Grids, calling for €584 billion in investment between 2020 and 2030, are driving significant spending.

- Electrification of transportation: The growing adoption of electric vehicles is spurring investment in charging infrastructure and grid reinforcement.

This surge in power infrastructure spending is expected to continue, with global investment potentially reaching $1 trillion annually by the 2040s, reflecting the critical role of modernized grids in supporting the energy transition.

How Is US Tackling Powergrid Upgrades?

The United States is undertaking significant investments to upgrade its power grid infrastructure, aiming to enhance resilience, reliability, and capacity to support the growing demand for electricity.

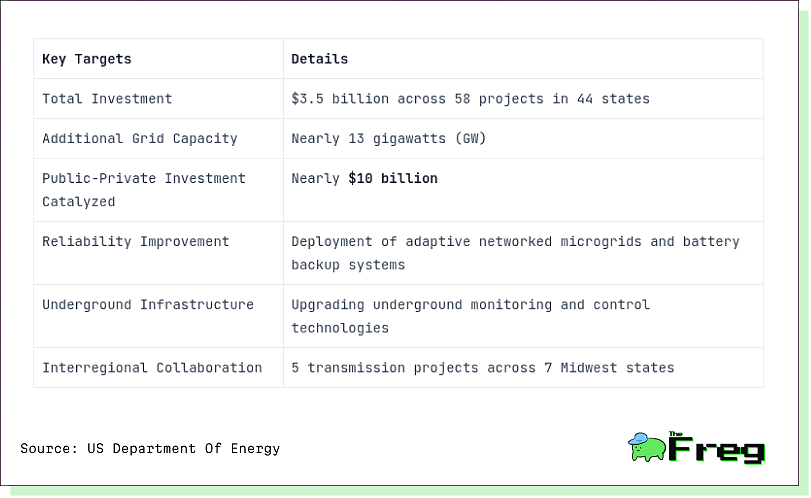

The Grid Resilience and Innovation Partnerships (GRIP) Program is designed to enhance grid flexibility and resilience. This program is expected to create thousands of jobs and support the ongoing manufacturing boom in the United States.

Historical Supercycle Parallels

The current energy supercycle shares similarities with past cycles but also exhibits unique characteristics. Like previous supercycles, it is driven by strong demand for raw materials and energy sources. However, this cycle is distinct in its focus on clean energy and decarbonization. Key differences from past cycles include:

- Selective commodity demand: Unlike previous supercycles where all commodities were in favor, this cycle shows preference for specific materials like lithium and nickel for batteries.

- Green technology focus: The current cycle is heavily influenced by the transition to renewable energy and electric vehicles.

- Supply chain resilience: There is increased emphasis on diversifying supply chains, particularly for critical minerals.

While echoing elements of past cycles, such as the post-World War II reconstruction era or China's rapid industrialization in the early 2000s, the current energy supercycle is uniquely characterized by its alignment with global efforts to combat climate change and transition to sustainable energy sources.

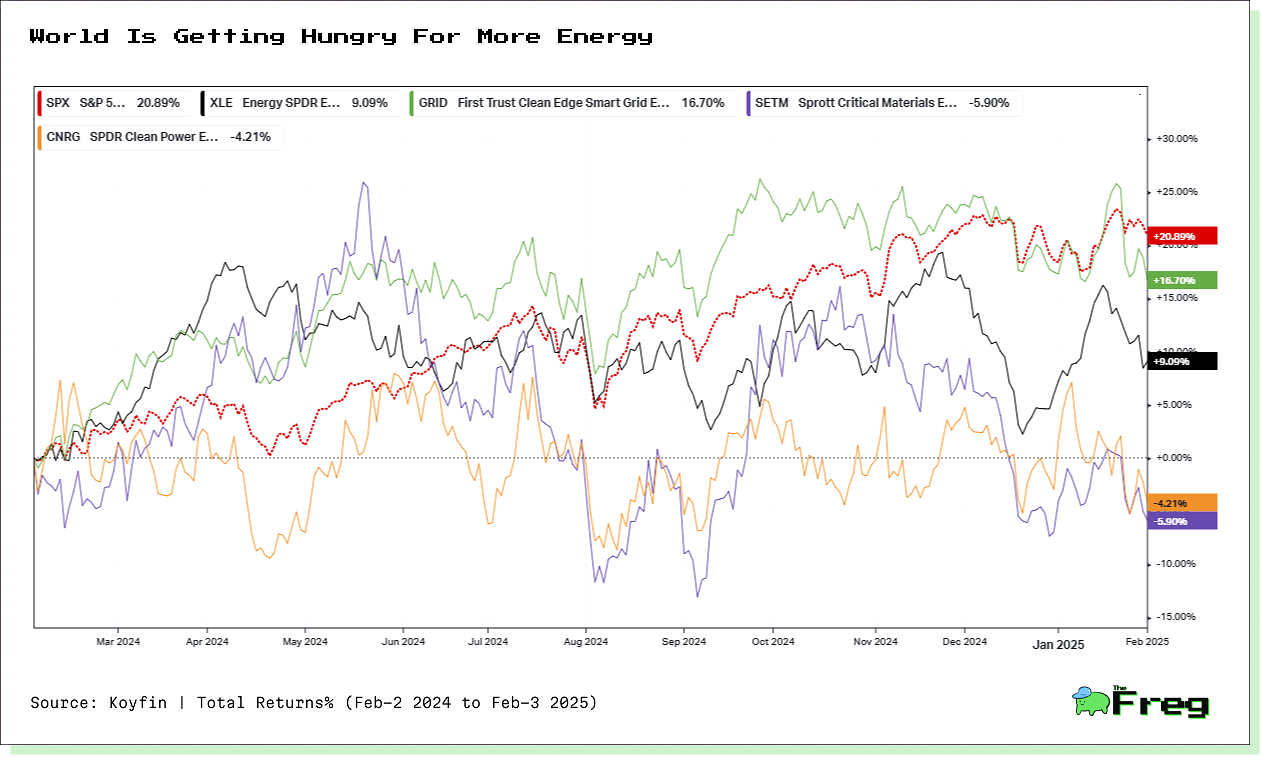

These ETFs are well-positioned to benefit from the ongoing grid infrastructure upgrade cycle, driven by the need for modernization, renewable energy integration, and increased electricity demand.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.