Private Equity and the EBITDA Tax Debate

Private equity firms are pushing to restore EBITDA-based interest deductibility, arguing it would lower financing costs, boost investment, and create jobs.

The private equity (PE) industry is lobbying for a significant tax change that could allow companies to include depreciation and amortization in their earnings calculations for tax deductions—potentially saving billions in taxes.

Under the first Trump administration’s tax reform, businesses were initially allowed to deduct debt payments of up to 30% of EBITDA. However, this rule changed three years ago, shifting the formula back to EBIT (Earnings Before Interest and Taxes), reducing the amount of deductible interest.

The proposed tax change would restore EBITDA as the basis for interest deductibility, allowing companies to deduct more interest expenses and lower their tax burden.

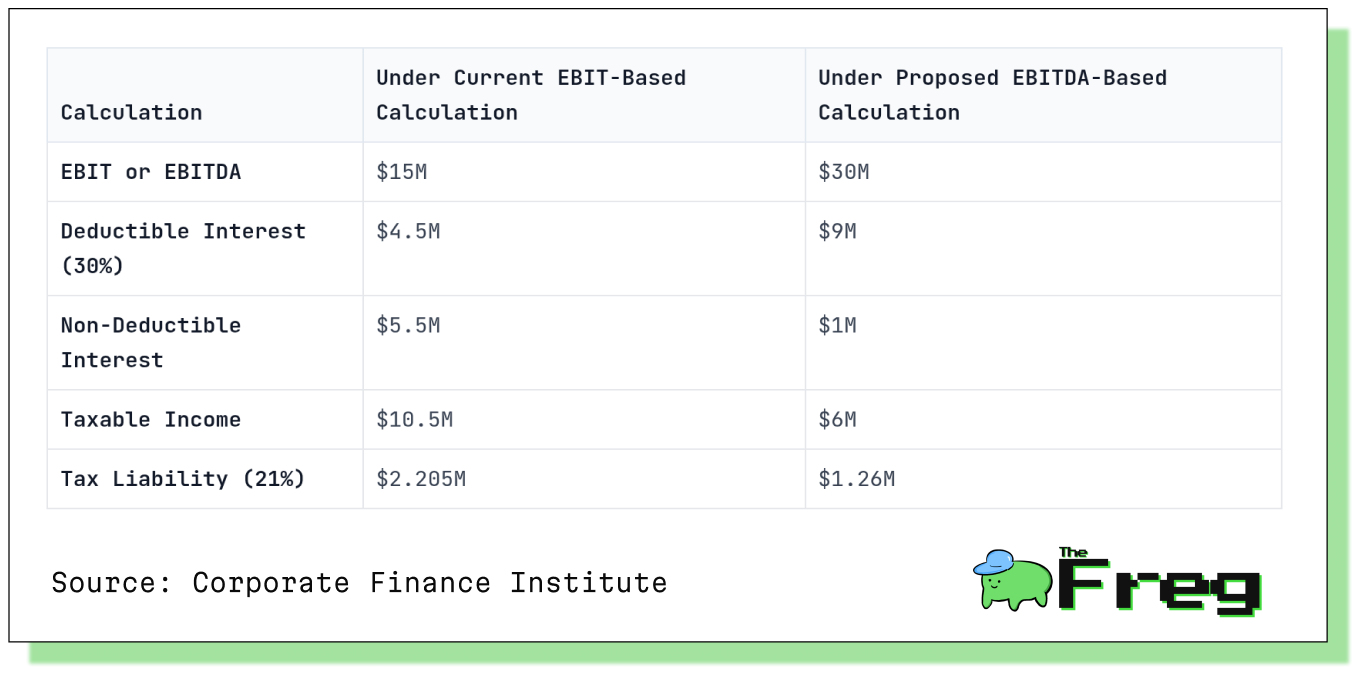

Impact of the Proposed Tax Change: A Hypothetical Example

To illustrate how the shift from EBIT to EBITDA would affect tax liability, consider the following hypothetical PE-owned company:

- Revenue: $100 million

- Operating Expenses: $70 million

- Depreciation & Amortization: $15 million

- Interest Expense: $10 million

- Tax Rate: 21%

This shift would significantly lower the company's tax liability by allowing for greater interest deductions.

Why There is Support for the Change

PE firms, along with manufacturers and equipment lenders, are advocating for this change, arguing that restoring EBITDA-based deductibility would:

- Lower the cost of capital – Making debt financing more attractive.

- Encourage investment – Enabling firms to reinvest in acquisitions and growth.

- Create U.S. jobs – By making capital-intensive industries more competitive.

For PE firms specifically, the change could have several major implications:

- Increased borrowing capacity: Higher deductible interest expenses would allow PE firms to take on more debt for acquisitions.

- Enhanced after-tax returns: Lower tax liabilities could boost overall investment returns.

- Improved cash flow: More deductible expenses mean more cash available for operations or debt servicing.

- Potential for higher valuations: The ability to take on more leverage could drive up acquisition multiples.

Asset-heavy industries such as manufacturing and real estate, which have significant depreciation and amortization expenses, would benefit the most.

Rising interest rates would further increase the value of the proposed tax change by making interest deductions even more valuable.

Risks of Increased Leverage

While the proposed tax change could benefit PE firms, it also introduces financial risks, including:

- Loss of Tax Revenue - The government could lose $179 billion in tax revenue over a decade if the EBITDA rule is reinstated.

- Greater vulnerability to economic downturns – More leverage means companies could struggle during recessions.

- Higher risk of defaults – Increased borrowing could lead to financial distress for overleveraged firms.

These concerns raise regulatory questions about whether encouraging more debt is a sustainable long-term policy.

Carried Interest and the Broader PE Tax Landscape

The EBITDA tax debate is unfolding alongside proposed changes to carried interest taxation, adding another layer of complexity for PE firms.

Carried interest refers to the profit earned by private fund managers on investors' capital. This income is currently taxed at the lower capital gains rate of 20% if held for more than three years.

However, recent proposals aim to:

- Increase the tax rate to 32% by 2025.

- Reclassify carried interest as ordinary income (up to 45%) from 2026.

If implemented, these changes could offset some of the tax savings from the EBITDA-based interest deduction, complicating PE firms' tax strategies.

As policymakers weigh the trade-offs, the outcome of this debate could reshape capital structures, investment strategies, and private equity’s financial landscape for years to come